Comparing the effects of sales taxes and tobacco (excise) taxes with real policy examples.

Cigarette (Tobacco) Taxes

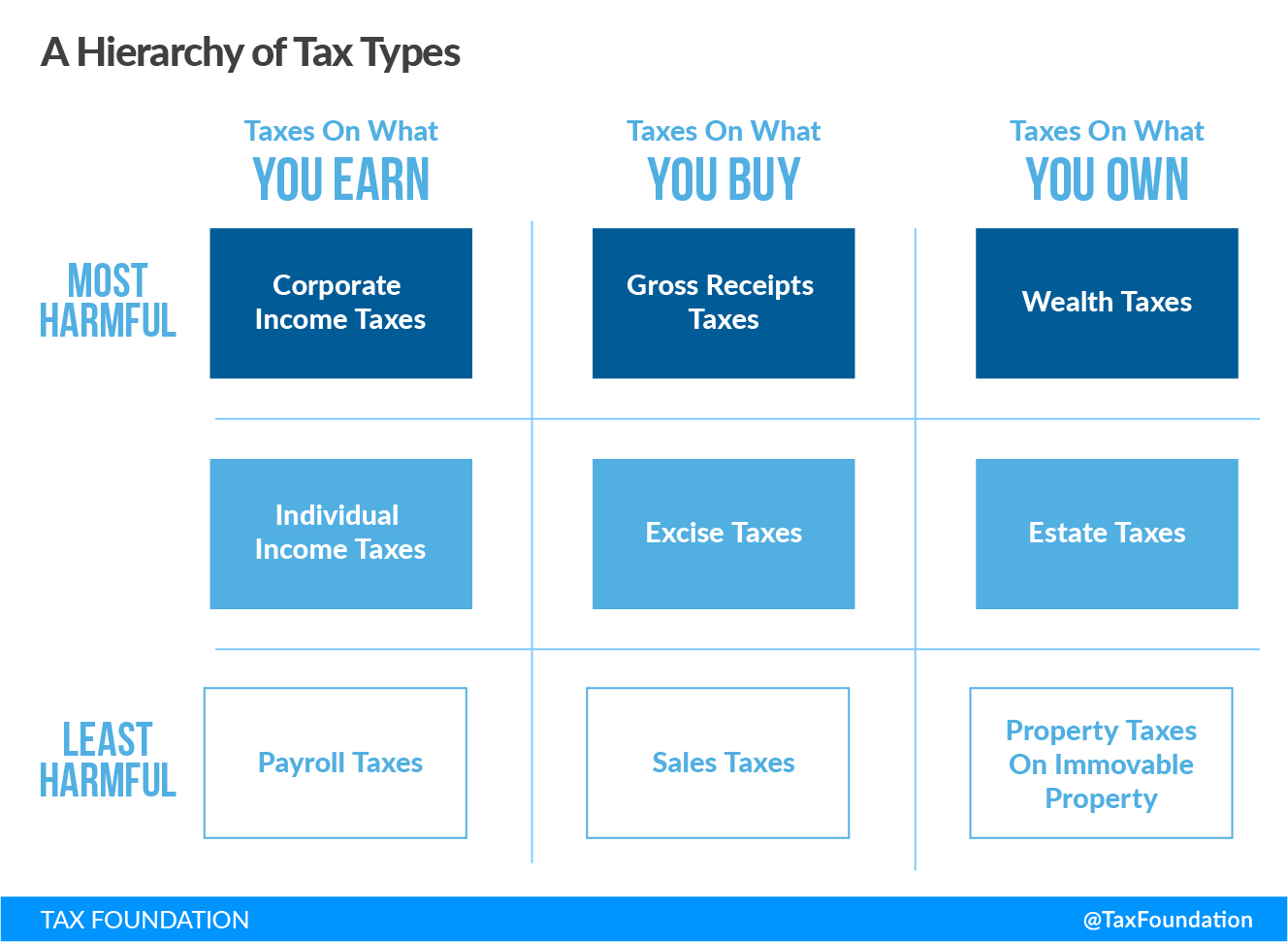

Excise taxes are imposed on a specific good or activity, such as cigarettes, alcohol, and fuel. Because of their narrow base (applying a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. to a small selection of goods or services), excise taxes distort production and consumption choices. Sometimes this distortion is by design.

For example, a tax on cigarettes to discourage smoking causes a distortion—smokers consume less or buy cigarettes elsewhere, which can result in the tax being an unreliable long-term revenue source—as the tax increases, revenue tends to decrease after a brief burst initially. For excise taxes, the tax should target the activity or component that causes the most harm or highest societal cost—what economists refer to as a “negative externalityAn externality, in economics terms, is a side effect or consequence of an activity that is not reflected in the cost of that activity, and not primarily borne by those directly involved in said activity. Externalities can be caused by either production or consumption of a good or service and can be positive or negative. .” Examples are the amount of tobacco or alcohol consumed, which can lead to increased health-care costs and burdens and more.

Other excise taxes levied in direct connection with the consumption of public goods, like gas taxes paying for road usage, respect the benefit principle and constitute a user feeA user fee is a charge imposed by the government for the primary purpose of covering the cost of providing a service, directly raising funds from the people who benefit from the particular public good or service being provided. A user fee is not a tax, though some taxes may be labeled as user fees or closely resemble them. system. For user fees, the tax should target the best available proxy for use. Because there is a pretty clear connection between the amount of gasoline consumed and road usage, the gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. is a good funding mechanism for the highways.

As excise taxes often target a specific product or industry, they sometimes pose a smaller risk to the overall economy than increases to broader taxes like the personal income tax or corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. . As a result, they are often tempting to lawmakers looking for new revenue. However, lawmakers should exercise caution. Because they can be very narrow, excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. hikes:

- Can be detrimental to specific industries and certain types of consumers and, in the case of tobacco taxes, encourage black market activity

- Are unsustainable revenue tools by design

- Can be regressive, disproportionately burdening low-income taxpayers, as in the case of tobacco taxes

By itself, the fact that some excise taxes have regressive effects is no argument against levying them, but the effect does illustrate one trade-off of relying too heavily on excise taxes for revenue generation.

Sales Taxes

General tax revenues should come from more stable, broad-based consumption taxes like the general sales tax, imposed at the state-level on the retail sales of goods and services in the U.S. Ideally, sales taxes are imposed on all final sales of goods and services, but not on intermediate business-to-business transactions in the production chain, as in the case of gross receipts taxes (GRT).

Sales taxes are less distortive than capital and income taxes because they do not affect decisions to work or invest, and when appropriately structured, they do not lead to tax pyramiding. States rightly tend to rely on general sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. revenues to a much larger degree than on revenue from excise taxes.

Principles of Sound Tax Policy

| Cigarette Taxes | Sales Taxes | |

|---|---|---|

| Stability | ❌ | ✔️ |

| Neutrality | ❌ | ✔️ |

| Transparency | ✔️ | ✔️ |

| Simplicity | ✔️ | ✔️ |

Stability

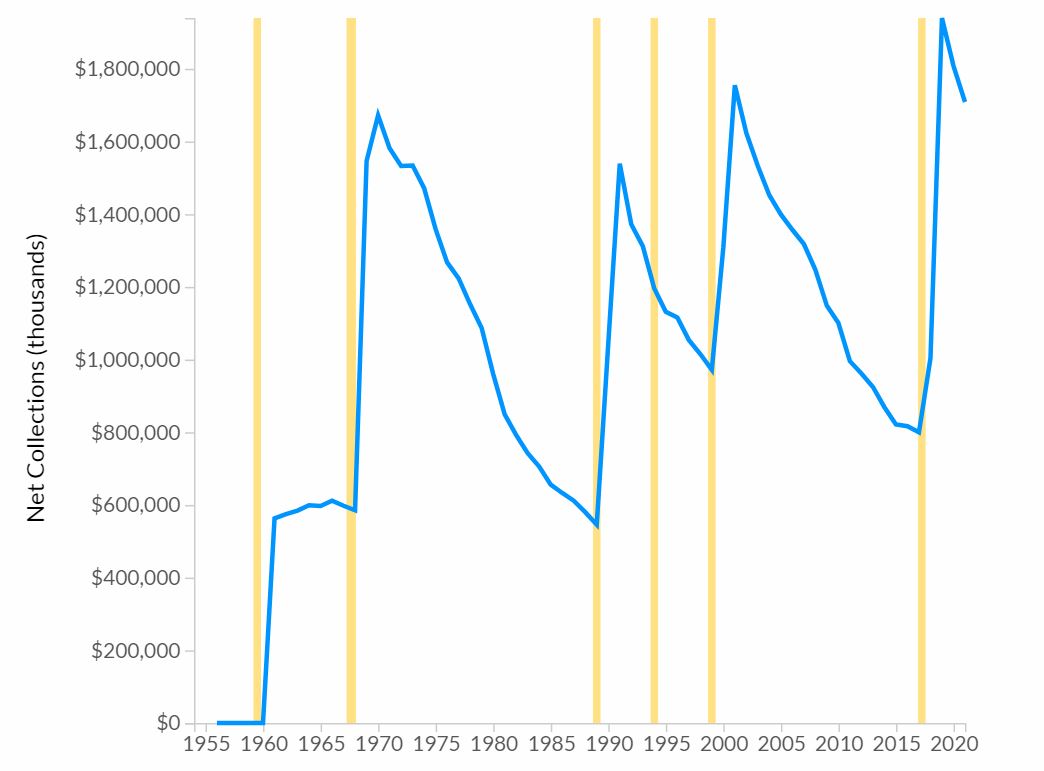

All tax revenue is subject to economic cycles and changing taxpayer behavior, but broad-based consumption taxes experience considerably less volatility than excise taxes that change depending on consumer preference, technological development, or regulatory intervention. In most states, cigarette tax hikes are met with a momentary bump in revenue, followed by a drop-off in future years. Conversely, one of the advantages of a broad-based consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or an income tax where all savings is tax-deductible. is its stability.

Neutrality

Most excise taxes are, by definition, not neutral. Many are designed to impact specific industries and decisions made by consumers to increase costs and lower consumption.

Broad-based consumption taxes that apply to all final consumption, like a sales tax, are neutral because they have little effect on consumer behavior and apply to all business models the same. However, no such tax exists today, as many states would tax a good but not the services associated with that good.

Sales taxes that capture intermediate business activity are less neutral because the total tax burden multiplies throughout the production chain, disadvantaging certain industries, especially those with long supply chains.

Transparency

A sales tax may also lack transparency if it applies to business inputs. Products with longer production chains are taxed more, and the overall burden of the tax ends up hidden in the final price of goods.

That said, well-structured, broad-based state sales taxes are relatively transparent; consumers can clearly see their tax burden printed at the bottom of their receipts.

Excise taxes are generally less transparent as they are often levied early in the value chain and built into the price when the good moves through the chain. They are, however, specific when levied on quantity, making them fairly transparent. For example, the tax on 20 cigarettes is always the same (within the state).

Simplicity

Excise tax simplicity can vary depending on how the tax is applied. For example, tobacco taxes levied based on quantities tend to be simpler than those based on price.

State sales taxes are typically simple, as the same tax is levied across the purchase of most goods. Sales taxes become less simple with the addition of exemptions for certain goods like groceries and with sales tax holidays.

What Is Best?

The viability of either tax policy is dependent on the purpose of the tax, though sales taxes tend to be more stable tax policy and a better source of revenue.

Despite declining sales tax revenues over the past few decades, this is not a symptom of the tax type itself, but rather the fact that sales tax bases have historically been designed to exclude services. Sales tax revenues have fallen, even coupled with increased rates, as the economy has shifted from goods-based to service-based.

General sales taxes tend to be the better policy for both the taxpayer and the government. The sales tax provides a more stable source of revenue because the tax targets a wide tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . Conversely, cigarette taxes are aimed at a narrow base and are often designed to curb the use of tobacco products, creating an unstable revenue stream.

Sales Tax: Expanding the Base

Sales taxes account for almost one-third of all state tax revenue, second only to individual income taxes (36 percent) in their contribution to state receipts. Reliance on sales taxes, however, ranges from a low of less than 16 percent in Vermont (neglecting the five states which do not impose state-level sales taxes) to a high of nearly 68 percent in Texas.

Five states—Alaska, Delaware, Montana, New Hampshire, and Oregon—do not levy state-level sales taxes.

State reliance on sales tax depends on its mix of other taxes (Texas, for instance, forgoes income taxes, while Vermont has high-rate income taxes); its sales tax rate; and, importantly, the breadth of its sales tax base.

Expanding sales tax bases improves neutrality. Newly generated revenues can then be used to finance general fund programs or other tax reforms, including paying down reductions in the sales tax rate.

One option to broaden the base is to expand sales taxes beyond taxing goods into taxing services as well. While some states have attempted this expansion, many still focus the sales tax on the purchase of tangible goods. This could include services like lawn care, streaming services, or home repairs.

Cigarette (Tobacco) Tax: A Short Game

In almost any state you look at, cigarette excise tax increases result in a burst of revenue, followed by a steep decline as the tax does what it is intended to do: reduce cigarette purchases.

Governments should remain cautious when forecasting excise revenue. Revenue generation can be impacted by changes in technology, consumer preference, or total tax burden. The impact of the tax burden is most visible in the cigarette market, where a substantial black market offers untaxed or low-tax products—primarily in areas with high taxes. Moreover, cigarette consumption is a market in long-term decline.

Further Reading

Below are some resources regarding sales and tobacco taxes and their impact from Tax Foundation and other sources. Please conduct additional research on the case prior to discussion.

- How Stable is Cigarette Tax Revenue?

- Excise Tax Application and Trends

- The history and future of the retail sales tax (Brookings)

- Sales Tax Base Broadening: Right-Sizing a State Sales Tax

- Not All Taxes Are Created Equal

Reflect on the following questions:

- What are the main pros and cons of each policy?

- How do these policies meet (or not meet) the Principles of Sound Tax Policy?

- How can these policies be implemented in a sound manner?

- Who are the stakeholders in each and what are their interests?

- How has this been addressed in other cases?