A regressive tax is one where the average tax burden decreases with income. Low-income taxpayers pay a disproportionate share of the tax burden, while middle- and high-income taxpayers shoulder a relatively small tax burden.

What Are Some Examples of a Regressive Tax?

The burden of a tax results from both the design of a tax and the true economic burden of a tax. A regressive tax is often flat in nature, meaning that the same rate of tax applies (generally) regardless of income. These taxes include most sales taxes, payroll taxes, excise taxes, and property taxes.

Because the same rate of tax applies regardless of one’s income, a lower-income individual may face a higher tax burden than a higher-income individual with the same amount of consumption.

For example, if two individuals who make $20,000 and $40,000 spend $100 on clothing with a 5 percent sales tax rate, the lower-earner will be paying more taxes as a share of their income than the higher-earner. The same can be true of two neighbors with similar property values and property tax burdens. They will pay the same level of property taxes regardless of their income.

How Regressive Are Excise Taxes and Tariffs?

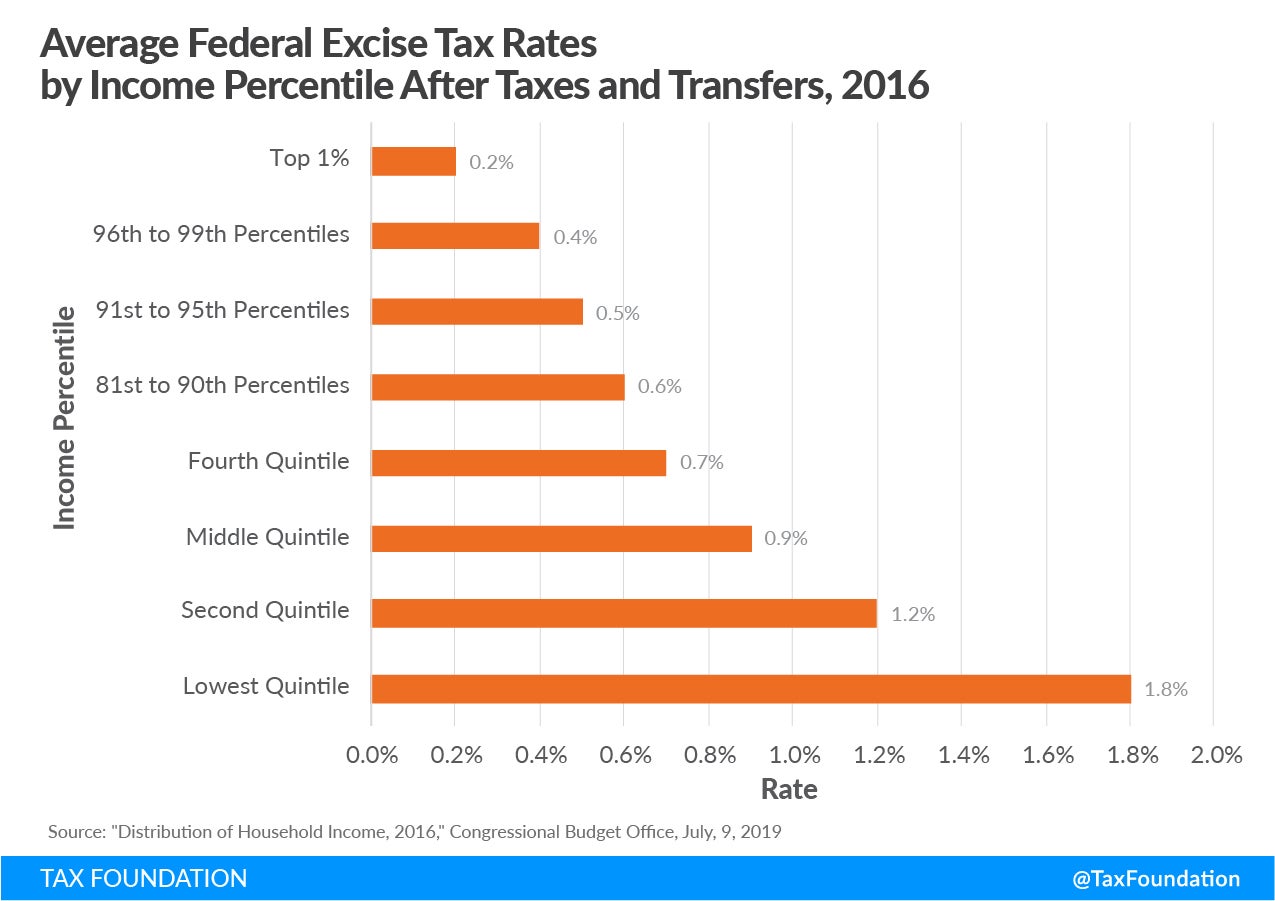

Excise taxes are particularly regressive. Households in the lowest one-fifth by income faced an average federal excise tax rate that is nine times greater than the average excise tax rate faced by the top 1 percent of households.

The distributional effects of a tariff (the economic burden it places on households across income levels) tend to be regressive, burdening lower-income households more than higher-income households. Tariffs ultimately fall on the factors of production and reduce taxpayer labor and capital income. This occurs either by raising prices or reducing wage and capital income.

Analysis of imposed and threatened U.S. tariffs under the Trump administration (as of December 2018) shows that lower- and middle-income households experience relatively larger drops in after-tax income.

| Income Percentile | Change in After-Tax Income |

|---|---|

| Lowest Quintile (0% to 20%) | -1.37% |

| Second Quintile (20% to 40%) | -1.32% |

| Middle Quintile (40% to 60%) | -1.37% |

| Fourth Quintile (60% to 80%) | -1.31% |

| Top Quintile (80% to 100%) | -1.14% |

| All | -1.22% |

| Addendum: | |

| 80% to 90% | -1.25% |

| 90% to 95% | -1.24% |

| 95% to 99% | -1.18% |

| 99% to 100% | -0.95% |

| Source: Tax Foundation Taxes and Growth Model, April 2018 | |

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe