Featured Articles

Historical U.S. Federal Corporate Income Tax Rates & Brackets, 1909-2020

How do current federal corporate tax rates and brackets compare historically?

8 min read

Historical U.S. Federal Individual Income Tax Rates & Brackets, 1862-2021

How do current federal individual income tax rates and brackets compare historically?

1 min read

All Related Articles

Placing Harris and Trump Tax Plans in Historical Context

Trump’s tariff hikes would rank as the the largest tax increase outside of wartime since 1940. Meanwhile, Harris’s tax plan would rank as the 6th largest tax increase outside of wartime since 1940.

5 min read

How World War II Reshaped US Taxation

World War II shaped many aspects of the modern world, including the US tax code. But the dramatic changes to our system that military mobilization required didn’t subside when the fighting finished; they’ve persisted to today.

4 min read

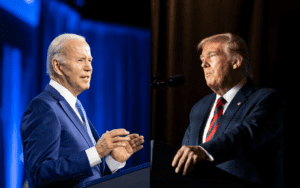

Placing Biden and Trump Tax Proposals in Historical Context

From President Biden calling the Tax Cuts and Jobs Act the “largest tax cut in American history,” to former President Trump claiming that Biden “wants to raise your taxes by four times,” the campaign rhetoric on taxes may be sparking some confusion.

5 min read

History of Taxes

Learn where and when taxes originated and how they resemble taxes we have today. Understand how the American tax code developed from the beginning of the colonies. Learn about some of the weirder taxes throughout history, designed not just to raise revenue, but influence behavior too.

Historical U.S. Federal Corporate Income Tax Rates & Brackets, 1909-2020

How do current federal corporate tax rates and brackets compare historically?

8 min read

Historical U.S. Federal Individual Income Tax Rates & Brackets, 1862-2021

How do current federal individual income tax rates and brackets compare historically?

1 min read

How Controlled Foreign Corporation Rules Look Around the World: United States of America

The United States was the first country to enact CFC rules, and it is probably the country with the most complex set of rules that will be presented in this blog series. The rules determine control using a combined ownership test: one for the corporation and the other at the shareholder level. The assessable income under the rules is generally passive income but the amount of foreign income subject to U.S. tax has expanded with the adoption of GILTI.

10 min read

The Tax Foundation’s 80th Anniversary

2 min read