Portugal’s Personal Income Tax System: High Top Rate, Threshold, and Tax Credits

4 min readBy:Note: This post is part of a series on Portugal’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policy, examining how it compares internationally, providing an analysis of current policy, and discussing pathways toward reform. See here, here, and here. For a complete analysis of this and other tax reform options in Portugal, download our Portuguese-language primer.

Portugal ranks 29th out of 38 OECD countries in the individual tax category of the International Tax Competitiveness Index 2023. The main culprit for this unfavorable rating is the country’s high top income tax levied only on a narrow set of earnings, which raises revenue with a high efficiency cost. On top of this, the Portuguese income tax system features complex tax credits that undermine the income tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. while distorting economic behavior and increasing compliance costs, as well as a tax-relief scheme for returning tax residents that sets ambiguous incentives for emigration and return.

Portugal would do better to attract talent and improve earnings incentives by setting a ceiling for social contributions and reducing income tax rates more broadly, instead of granting special tax credits or returnee tax-relief. Closing the value-added tax (VAT) gap and eliminating special tax credits would allow room to either reduce the tax burden on labor or pursue alternative reforms that would increase labor productivity and real wages.

High Top Rate and Threshold

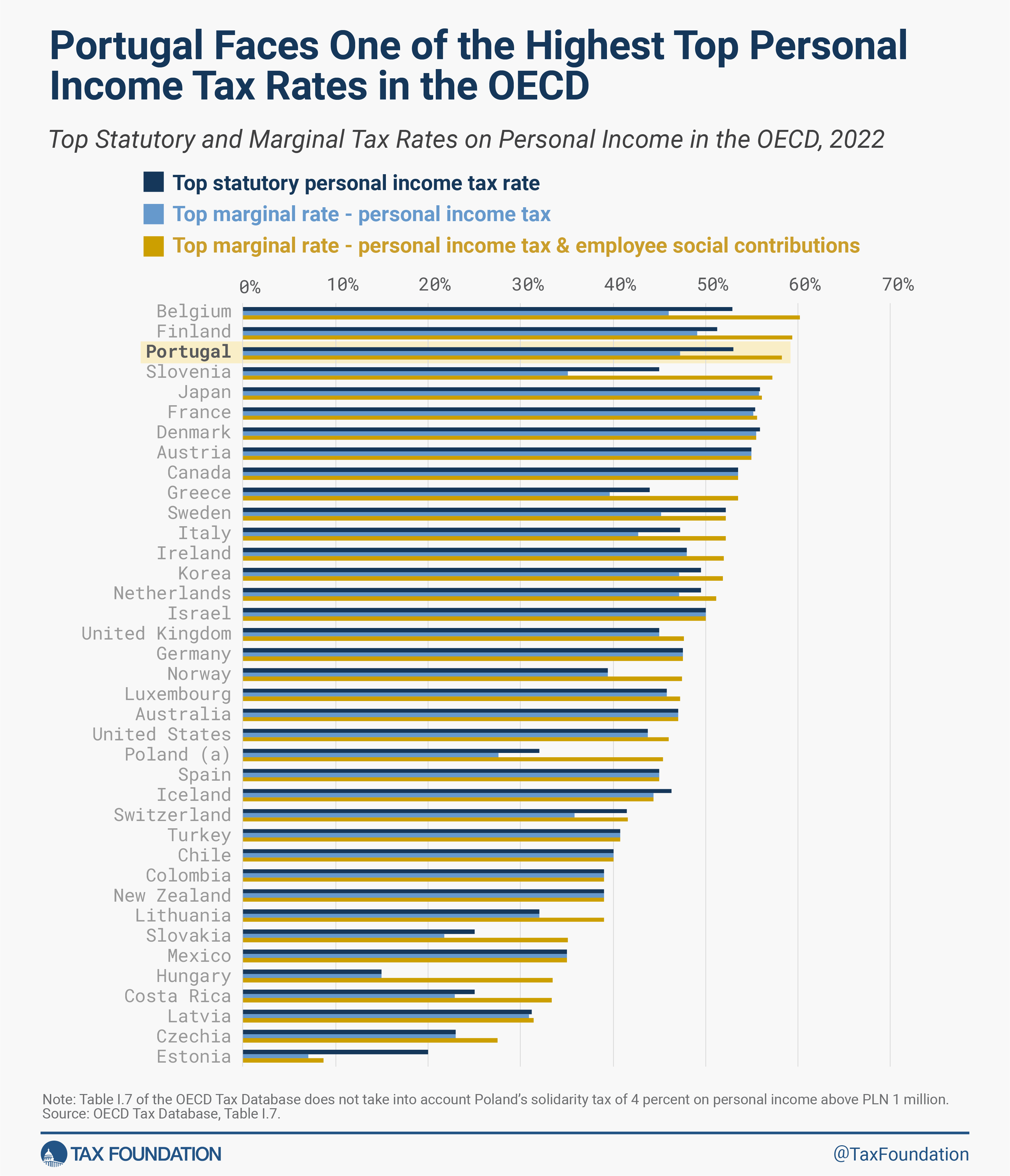

Portugal’s personal income tax system levies high tax rates on an unusually narrow set of high earners, striking a poor balance between earnings incentives and revenue contributions. Personal income is subject to 11 different tax brackets, including two brackets for added solidarity rates. The country’s top income tax rate is 53 percent (including the 5 percent solidarity tax rate).

Additionally, Portugal’s social system does not feature a general ceiling for social contributions, increasing the marginal tax wedgeA tax wedge is the difference between total labor costs to the employer and the corresponding net take-home pay of the employee. It is also an economic term that refers to the economic inefficiency resulting from taxes. for high-income workers above that of its European neighbors with similarly high top statutory rates. Portugal’s top income tax rate inclusive of employee social contributions is 58.2 percent, the third-highest in the OECD (behind only Belgium and Finland).

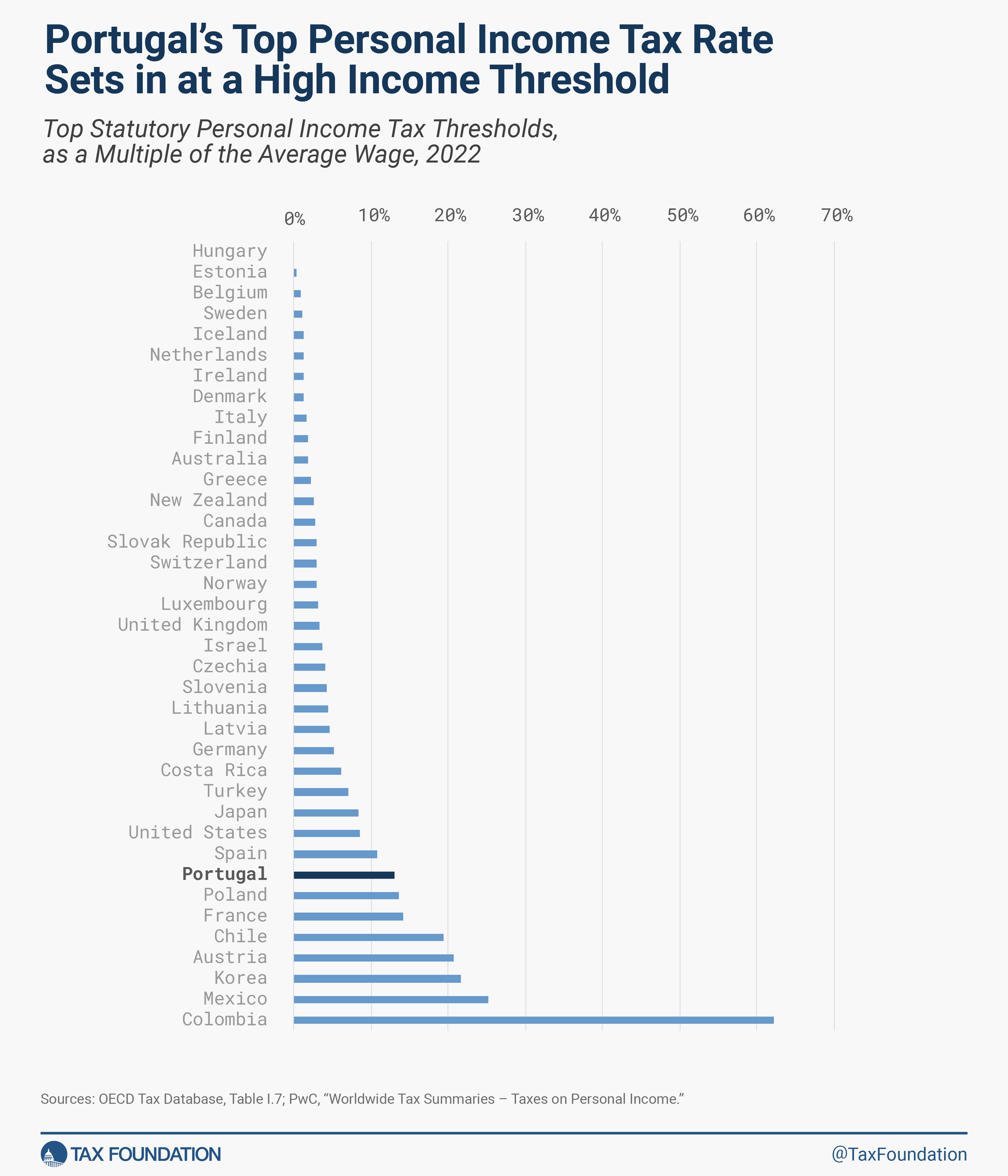

Furthermore, Portugal’s top income tax rate sets in at an unusually high threshold of EUR 250,000 in annual income, 13 times the average wage in 2022. In the OECD, the average threshold of the top rate is around half of this, with just seven other OECD countries applying top income tax thresholds higher than Portugal.

Imposing high top marginal tax rates at elevated earnings thresholds is an inefficient way to raise government revenue. Higher top rates incentivize people over that income threshold to earn less, while leaving the revenue raised from everyone else unchanged. By raising the rate of a lower bracket, however, revenue is raised from taxpayers in higher brackets without incentivizing them to reduce their earnings (only the earning incentives of individuals in that lower bracket are affected). High top rate thresholds reduce the number of taxpayers whose earning incentives are negatively affected by the top personal income tax rate but also the amount of revenue that can be raised by it.

Base Erosion from Distortive Tax Credits

One factor that erodes Portugal’s personal income tax base is its extensive system of tax credits. The tax credits apply to a large variety of consumption goods, leisure activities, and membership fees for trade unions, introducing distortions to consumption behavior and increasing compliance costs. Generally, personal tax deductions should be limited to investment costs that increase taxpayers’ taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. or prevent them from falling into the welfare net. To the extent that some of these credits are motivated by distributive concerns, direct transfers and rate cuts represent a more efficient and targeted way to provide support for low-income households.

Time-Inconsistent Emigrant Tax Relief

In recent years, the government pursued an emigrant tax relief policy that excludes 50 percent of employment income from income tax to Portuguese emigrants in the first five years after their return. The program creates an incentive for those already living and working abroad to return. However, it also builds expectations to gain from such schemes in the future that can fuel out-migration. This makes preferential tax relief programs a risky gamble if Portugal’s government is looking to retain young and skilled taxpayers.

In the longer term, policymakers can positively influence their residents’ locations by reducing government spending and the total tax burden on labor. Another option would be to boost labor productivity and gross wages in Portugal by attracting investment through corporate tax reform and making it easier for residents to relocate to better jobs.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe