Spain’s Poorly Designed Tax Policy Hurts Its Competitiveness

Spain’s central government could learn some valuable lessons from its regional governments and other European countries about sound tax policy.

7 min read

Spain’s central government could learn some valuable lessons from its regional governments and other European countries about sound tax policy.

7 min read

While both President Biden and Vice President Harris aim their proposed tax hikes on businesses and high earners, key differences between their tax ideas in the past reveal where Harris may take her tax policy platform in the 2024 campaign.

6 min read

Many developed countries have repealed their wealth taxes in recent years for a variety of reasons. They raise little revenue, create high administrative costs, and induce an outflow of wealthy individuals and their money. Many policymakers have also recognized that high taxes on capital and wealth damage economic growth.

30 min read

The Spanish election results are moving the country away from pro-growth tax reforms while launching the government’s tax agenda, and the agenda of the Spanish presidency of the Council of the European Union, into uncertainty.

7 min read

The European Commission proposed a new source of revenue as part of its second basket of own resources: a “temporary statistical own resource based on company profits.” This is an attempt to bolster the EU’s budget as it repays its debt.

5 min read

With several states entertaining proposals to tax the financial transactions of savers and investors who don’t even live in their states, some members of Congress see an interstate commerce question worthy of a federal response.

6 min read

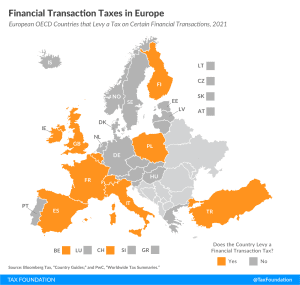

Belgium, Finland, France, Ireland, Italy, Poland, Spain, Switzerland, Turkey, and the United Kingdom currently levy a type of financial transaction tax

2 min read

Lawmakers looking to close budget shortfalls would be well-advised to consider other and more stable avenues for new revenue.

28 min read

While other countries in Europe are working towards introducing tax cuts and stimulating economic recovery by supporting business investment and employment, Spain is putting more fiscal pressure on households and businesses.

4 min read

Spain’s upper house passed two major tax bills today: the financial transaction tax (FTT) and the digital service tax (DST). Both taxes will go into effect in January 2021.

3 min read

As the NYSE prepares to conduct a test of their server capacity elsewhere, New Jersey lawmakers may be forced to rethink the viability of their financial transaction tax proposal.

4 min read

What tax policy ideas did Harris propose along the campaign trail, and how do they differ from Biden’s plan?

4 min read

Seeking new sources of funding, New York and New Jersey—two states at the heart of global financial markets—are considering financial transaction taxes.

5 min read

The European Council recently agreed on a new multiannual budget and a recovery program, which sets EU budget levels for 2021-2027 totals €1 trillion (US $1.2 trillion). The lack of details on the various tax proposals and the eventual need for revenue sources to finance new EU debt mean there is a lot of work left for policymakers in Brussels to do.

4 min read

Spain is planning to implement two major taxes during the next few months, a digital services tax and a financial transaction tax, which have the potential to negatively impact capital formation, growth, and economic recovery and start a harmful trade war.

5 min read

While much of Germany’s EU presidency agenda is focused on policies to ensure economic stability and recovery from the COVID-19 pandemic, there’s a pair of tax proposals that the country is planning to develop and move forward at the EU level: a financial transaction tax and a minimum effective tax.

5 min read

FTTs are unreliable sources of revenue and can increase risky financial activities. When looking to address income inequality and raise revenue, lawmakers should look to alternatives to this complicated and distortive tax.

5 min read

Policymakers should exercise caution in deciding whether to enact an FTT given the uncertainty regarding the FTT’s ability to raise revenue and the significant damage it could cause to the U.S. financial system

39 min read