Jared Walczak is Vice President of State Projects at the Tax Foundation. He is the lead researcher on the annual State Business Tax Climate Index and Location Matters, and has authored or coauthored tax reform guides on Alaska, Iowa, Kansas, Louisiana, Nevada, New York, Pennsylvania, South Carolina, West Virginia, and Wisconsin.

Jared’s work is regularly cited in The New York Times, The Wall Street Journal, The Washington Post, Los Angeles Times, Politico, AP, and many other prominent national and state outlets.

He previously served as legislative director to a member of the Senate of Virginia and as policy director for a statewide campaign, and consulted on research and policy development for a number of candidates and elected officials. In his free time, Jared enjoys hiking and has a goal of visiting all 63 national parks.

Latest Work

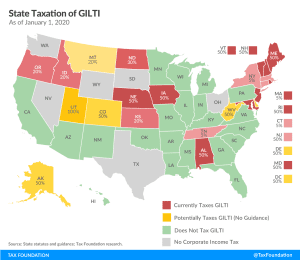

Kansas, Nebraska, and Utah Lawmakers Pursue “Not GILTI” Verdicts

Taxing GILTI puts states at a competitive disadvantage compared to their peers—all for a tax that makes very little sense at the state level, and which legislators never sought in the first place.

5 min read

Navigating Alaska’s Fiscal Crisis

4 min read

Tax Trends at the Dawn of 2020

From remote sales tax collection to taxes on marijuana and vaping products, we recap the top state tax trends from 2019 and break down which ones you should watch for in 2020.

38 min readGILTI and Other Conformity Issues Still Loom for States in 2020

Even two years after enactment of the federal Tax Cuts and Jobs Act (TCJA), many states have yet to issue guidance explaining how they conform to key provisions of the law, particularly those pertaining to international income.

27 min read

State Sales Taxes in the Post-Wayfair Era

Our new report explores the choices states have made regarding sales taxes following the South Dakota v. Wayfair Supreme Court online sales tax decision heading into calendar year 2020, outlines legal pitfalls states should seek to avoid, and offers up a few best practices for designing reliable, equitable, legally-sound remote sales tax regimes.

58 min read

Kansas Tax Modernization: A Framework for Stable, Fair, Pro-Growth Reform

Our new report outlines various policy recommendations for Kansas to consider in order to begin a robust and bipartisan conversation about modernizing the state’s tax code to suit a 21st century economy.

15 min read

Results of 2019 State and Local Tax Ballot Initiatives

Election Day 2019 will feature notable tax-related ballot measures in California, Colorado, New Mexico, Pennsylvania, Texas, and Washington. Once the polls close tonight, beginning with Pennsylvania and Texas at 8 PM EST, we will begin tracking the results as they come in.

4 min read

2020 State Business Tax Climate Index

Connecticut, California, New York, and New Jersey rank lowest in our 2020 State Business Tax Climate Index, which compares states on more than 120 tax policy variables to show how well they structure their tax systems and to provide a road map for improvement.

20 min read