The U.S. Tax Burden on Labor, 2023

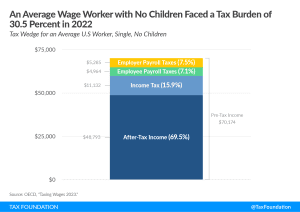

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay more than 30 percent of their wages in taxes.

4 min readAlex Mengden is a Policy Analyst at the Tax Foundation, where he focuses on international tax issues and tax policy in Europe. He holds a BA in philosophy and economics from the University of Bayreuth and an MSc in economics from the Ludwig Maximilian University of Munich.

Prior to joining the Tax Foundation, Alex tutored classes in public finance for undergraduate students at LMU Munich. He also worked on economic policy research for IREF Europe and previously interned at the Cato Institute, ifo Institute, and the Institute of Economic Affairs.

He currently lives in Munich, Germany, and spends his free time cooking, reading, and enjoying the outdoors.

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay more than 30 percent of their wages in taxes.

4 min read