With inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. continuing to skyrocket, especially for food, which reached 10.4 percent in June, it is worth examining how the ongoing U.S. trade war with China and U.S. tariff policy overall has impacted U.S. agriculture and food prices. The economic literature shows that the U.S. import tariffs and subsequent retaliatory tariffs imposed by China and other countries on U.S. agricultural exports have hurt the U.S. agricultural industry and could impact future production, further raising food prices.

Tariffs generally raise consumer prices, and while that’s true of export tariffs too, the mechanism operates a bit differently. Limitations on exports, whether through tariffs or explicit export bans, often produce an excess in goods. If firms are unable to sell their products to the world, they must sell more of them domestically. The surplus lowers prices in the short run. But when firms invest in producing food, a highly volatile commodity, they invest based on what return they think they will be likely to earn in the future. If their access to a foreign market is limited due to another country’s tariffTariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade barriers that raise prices, reduce available quantities of goods and services for US businesses and consumers, and create an economic burden on foreign exporters. policies, their profits will fall and they will invest less in future production, which would lead to higher prices in the long run.

In response to the U.S. imposition of tariffs by the Trump administration on Chinese imports, China responded with several waves of tariffs on U.S. exports to China, with tariff rates ranging from 2.5 percent to 25 percent. As China represents the U.S.’s largest agricultural export market, a large percentage of agricultural goods, including soybean and pork exports, faced tariffs. Other countries also retaliated against the U.S. for imposing Section 232 tariffs on steel and aluminum. Across all retaliatory tariffs, $30 billion in agricultural products were targeted, or about 22 percent of all retaliated goods.

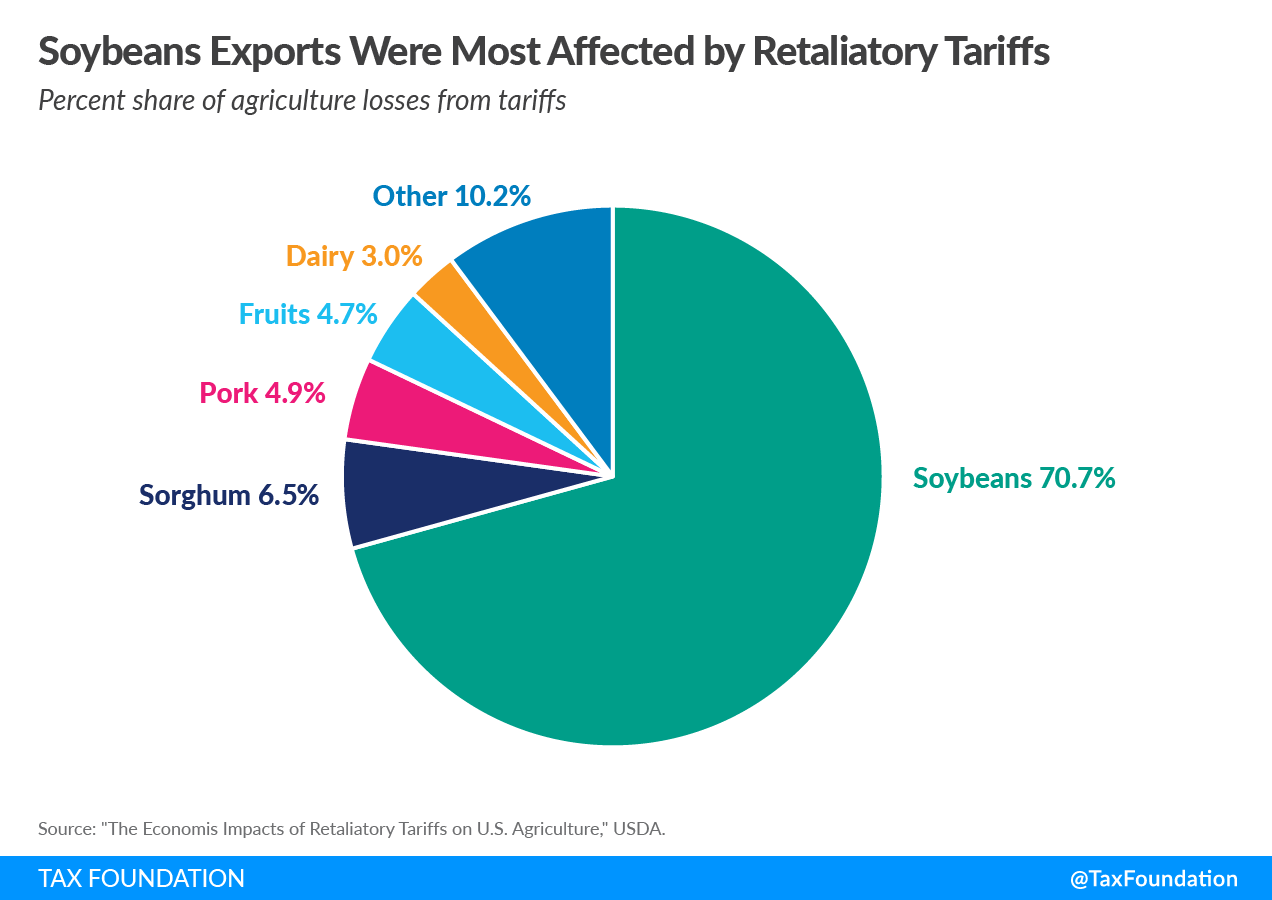

A U.S. Department of Agriculture study found the retaliatory tariffs reduced U.S. agricultural exports by $27 billion from mid-2018 when the tariffs were imposed to the end of 2019. Soybeans accounted for the majority of the decline, at 71 percent, followed by sorghum and pork at 7 percent and 5 percent respectively. The losses were primarily concentrated in states exporting the products, such as Iowa, Illinois, and Kansas. In these three states alone, GDP losses totaled $3.8 billion through 2019. Altogether, the U.S. lost nearly $16 billion in trade with retaliatory countries due to these tariffs.

The Trump administration’s tariffs on Chinese imports primarily targeted intermediate goods, or goods used in the production process of consumption goods, but some tariffs hit food directly. For example, the third tranche of tariffs enacted in September 2018, totaling $200 billion, hit a wide batch of goods including seafood. Most seafood imported from China is actually farmed in the U.S., but because it is packaged in China, this qualifies as a “substantial transformation” under U.S. trade law and gets labeled as a Chinese good. This has significantly impacted the fishing industry in Alaska, and led to increased imports of seafood from Russia at a time when U.S.-Russia relations are strained due to the ongoing Russia-Ukraine war.

The trade war has failed to generate benefits for U.S. industries. The Biden administration should help farmers by negotiating with China and other countries to lower or rescind the tariffs altogether and focusing on more constructive trade polices to promote U.S. economic growth.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe