European Union Member States are in the process of implementing the global minimum taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. in line with a directive unanimously agreed to at the end of 2022. This week, the Lithuanian Free Market Institute, along with several other think tanks based in Europe, released a report summarizing some of the minimum tax’s challenges and giving some recommendations.

The report notes that the minimum tax will put pressure on countries to rely more on subsidies for fiscal competition rather than the sort of tax competition that has been prevalent in recent decades. This is directly related to the “fatal flaw” of the minimum tax as recently described by Tax Foundation Senior Economist Alan Cole.

The report argues that subsidies can distort the market and lead to a misallocation of resources. At a time when public finances are under pressure, this new form of fiscal competition can be both expensive and potentially wasteful.

The rules clearly channel policy away from utilizing tax as a competitive factor, but the report notes that little has been done to clarify how policymakers can transition from existing preferential tax regimes. In some cases, these preferential regimes are contractual, and governments are wary about violating those contracts. Countries that might otherwise raise revenue through the minimum tax rules will be stuck watching other jurisdictions collect top-up tax revenue.

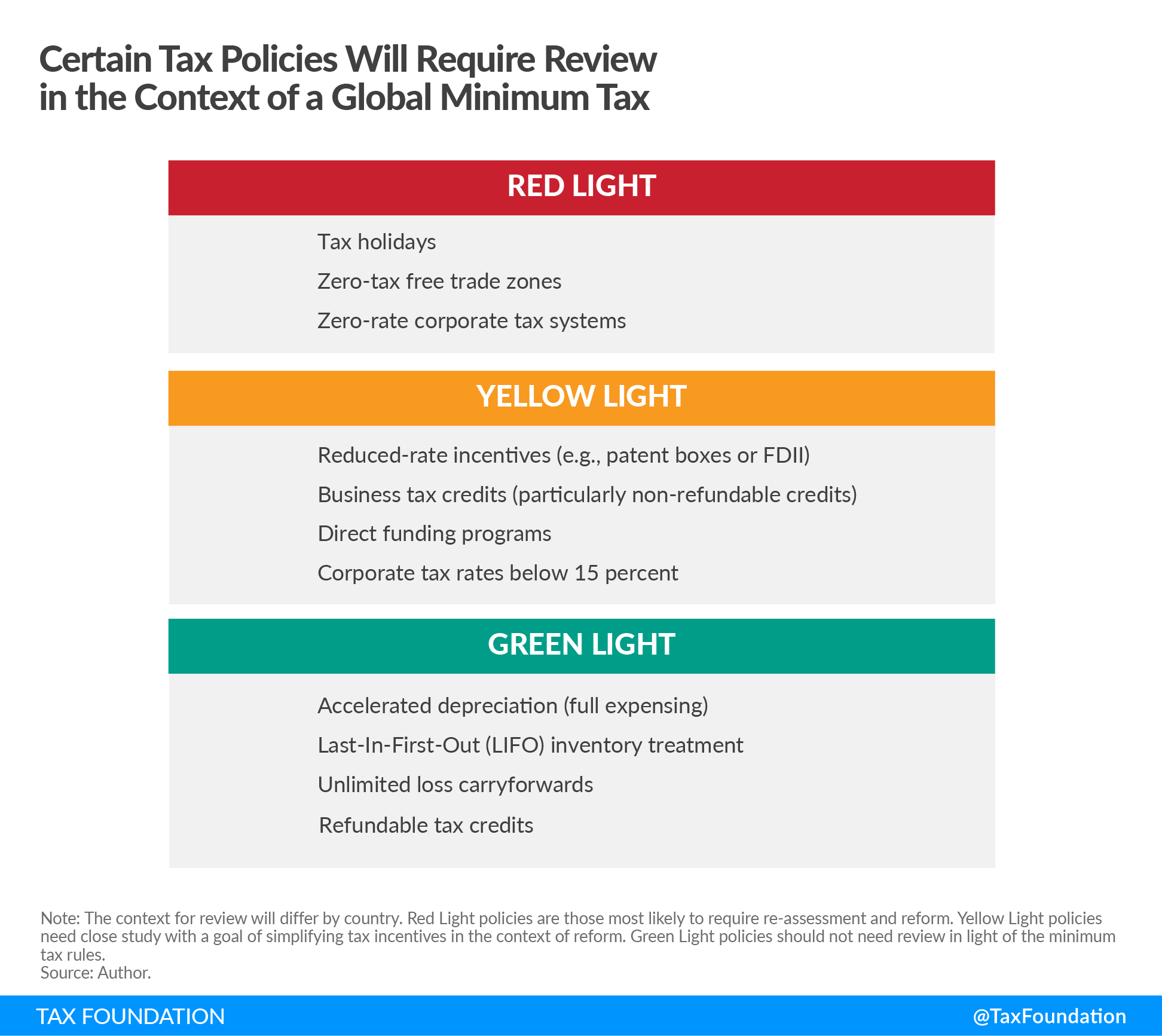

This is related to a challenge that I have described in the past (and shown in the nearby graphic): there are some tax preferences that will clearly create a risk of a top-up tax under the minimum tax proposal. However, as the report from the Lithuanian Free Market Institute argues, there is not a clear road map for jurisdictions to follow to redesign or transition from their current preferences while avoiding direct subsidies and maintaining fiscal competitiveness.

A third issue identified in the report is the lack of an inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. adjustment for the application threshold. The rules apply to businesses with annual revenue above €750 million and a branch in a given country with revenue of at least €10 million and profit of €1 million. The report points out that not indexing these thresholds to inflation will cause the scope of the policy to expand over time, creating more compliance burdens.

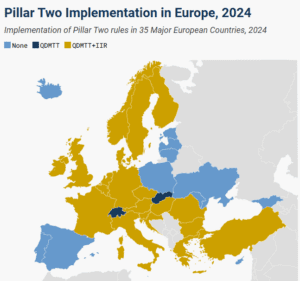

The report moves on to discuss legal uncertainty for companies, especially with the quick transition to implementation. The largely untested tax rules will require incredible efforts by businesses and governments to effectively comply with and administer the rules. Even so, the report notes six countries (Cyprus, Poland, Portugal, Latvia, Lithuania, and Spain) that have missed deadlines for adopting the minimum tax rules into their national laws, creating additional challenges for taxpayers who will be expected to comply with rules that apply retroactively to the beginning of 2024.

Finally, the report points to the need for an assessment of the minimum tax rules. The European Commission chose not to provide an impact assessment as part of the directive, but it can still evaluate the initial experience with the rules and adjust policy as necessary.

These recommendations are worthwhile for policymakers to consider, especially because the European elections this year will provide an opportunity for a new Commission to chart a course that minimizes the negative impacts of the minimum tax rules and aims for more certainty.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe