2025 Tax Brackets

Explore the IRS inflation-adjusted 2025 tax brackets, for which taxpayers will file tax returns in early 2026.

4 min read

Explore the IRS inflation-adjusted 2025 tax brackets, for which taxpayers will file tax returns in early 2026.

4 min read

The 2024 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

7 min read

Exempting Social Security benefits from income tax would increase the budget deficit by about $1.6 trillion over 10 years, accelerate the insolvency of the Social Security and Medicare trust funds, and create a new hole in the income tax without a sound policy rationale.

6 min read

The European Union’s experience with high inflation highlights the critical need for adaptive fiscal policies. Best practices drawn from the academic literature recommend implementing automatic adjustment mechanisms with a certain periodicity and based on price increases.

31 min read

The TCJA improved the U.S. tax code, but the meandering voyage of its passing and the compromises made to get it into law show the challenges of the legislative process.

6 min read

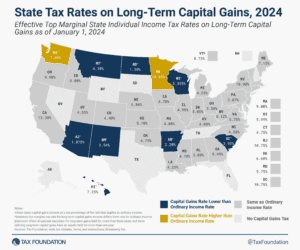

Savings and investment are critical activities, both for individuals’ and families’ financial security and for the health of the national economy as a whole. As such, policymakers should consider how they can help mitigate—rather than add to—tax codes’ biases against saving and investment.

5 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

In his FY 2025 budget, Illinois Gov. Pritzker outlined a number of proposed tax changes, including to individual and corporate income taxes, state sales taxes, and sports betting excise taxes.

7 min read

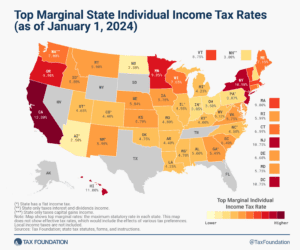

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

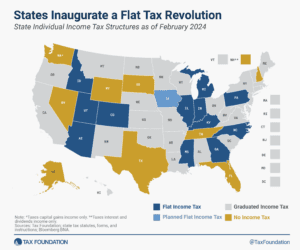

In 2021 and 2022 alone, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read

After years of strong revenue growth, Kansas has substantial cash reserves on hand, and policymakers on both sides of the aisle have expressed a desire to return some of the extra revenue to taxpayers.

5 min read

The House Ways and Means Committee has advanced a tax deal to the House floor that would temporarily—and retroactively—restore two major business deductions for cost recovery and expand the child tax credit through 2025.

10 min read

While some recommendations follow the principles of sound tax policy and may improve the District’s tax climate, some proposals make the tax code more complex and less neutral, potentially disincentivizing investment and business activity.

6 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

Explore the IRS inflation-adjusted 2024 tax brackets, for which taxpayers will file tax returns in early 2025.

4 min read

At the most recent Republican primary debate, former governor and United Nations ambassador Nikki Haley (R-SC) proposed eliminating the federal gas tax to lower fuel prices for consumers.

3 min read

The 2023 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

6 min read

In recent years, European countries have undertaken a series of tax reforms designed to maintain tax revenue levels while protecting households and businesses from high inflation.

8 min read

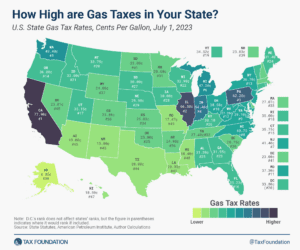

California pumps out the highest state gas tax rate of 77.9 cents per gallon (cpg), followed by Illinois (66.5 cpg) and Pennsylvania (62.2 cpg).

2 min read

As fiscal year 2023 draws to a close, North Carolina’s House and Senate have each passed their own versions of the biennial budget for fiscal years 2024-25. While legislative leaders have generally agreed to overall spending levels, negotiations remain ongoing to resolve different approaches to tax policy.

7 min read