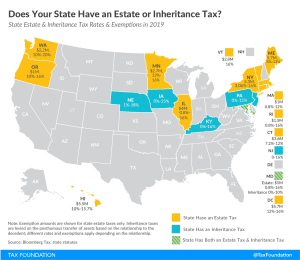

Estate and Inheritance Taxes by State, 2024

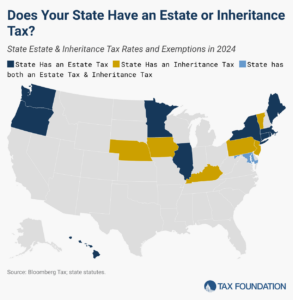

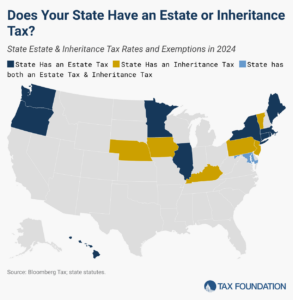

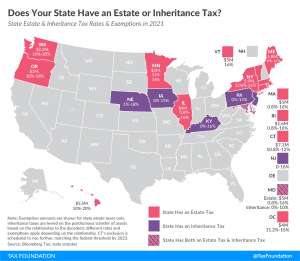

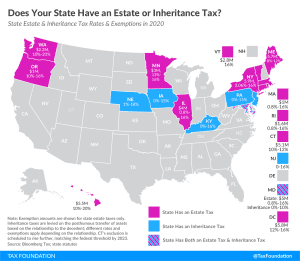

In addition to the federal estate tax, with a top rate of 40 percent, 12 states and DC impose additional estate taxes, while six states levy inheritance taxes.

7 min read

In addition to the federal estate tax, with a top rate of 40 percent, 12 states and DC impose additional estate taxes, while six states levy inheritance taxes.

7 min read

In addition to the federal estate tax, with a top rate of 40 percent, 12 states and DC impose additional estate taxes, while six states levy inheritance taxes.

7 min read

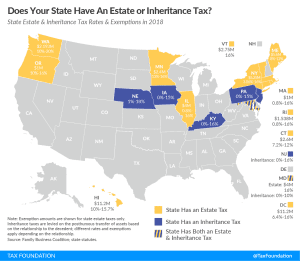

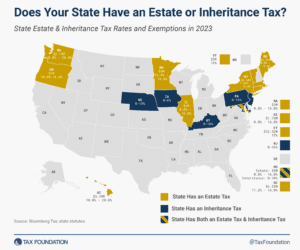

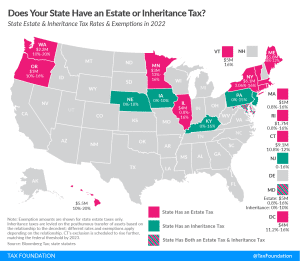

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

4 min read

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

4 min read

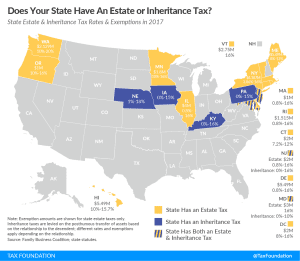

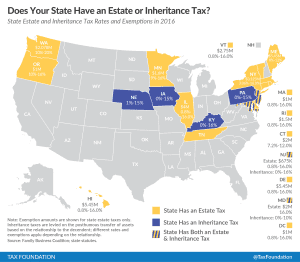

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax. Twelve states and Washington, D.C. impose estate taxes and six impose inheritance taxes. Maryland is the only state to impose both. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as estate taxes without the federal exemption hurt a state’s competitiveness.

3 min read

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.

3 min read