All Related Articles

Impact of Elections on French Tax Policy and EU Own Resources

The French election results are paralyzing for French pro-growth tax reforms, pessimistic for EU own resources, and dire for overall economic certainty.

5 min read

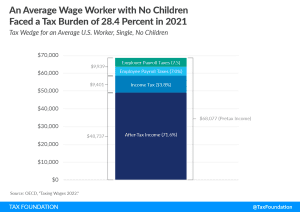

The U.S. Tax Burden on Labor, 2022

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay nearly 30 percent of their wages in taxes.

4 min read

Carbon Taxes and the Future of Green Tax Reform

Our new analysis reviews the basic structure of carbon taxes, how they compare to the existing set of climate policies, and how they could fit into various pro-growth tax reform packages.

26 min read

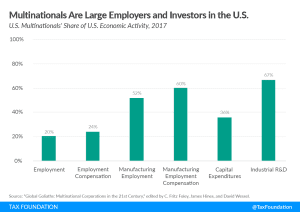

4 Things to Know About the Global Tax Debate

The Biden administration has been supportive of the negotiations, but the changes should be reviewed in the context of recent policy changes in the U.S. and elsewhere, the general landscape of business taxation in the U.S., and potential challenges and risks arising from the global tax deal.

3 min read

Why FDI Matters for U.S. Employment, Wages, and Productivity

Contrary to the Biden administration’s claims, raising taxes on cross-border investment would hurt U.S. economic growth and jobs. Research shows that FDI creates jobs in the U.S. and raises workers’ wages and productivity.

5 min read

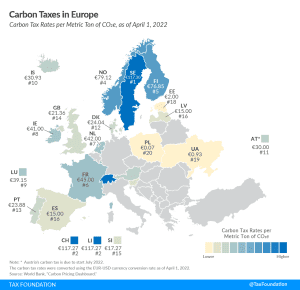

Carbon Taxes in Europe, 2022

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

3 min read

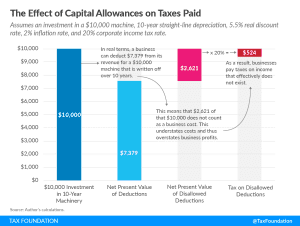

The Legacy of Harvard Economist Dale Jorgenson

Dr. Jorgenson’s work has been instrumental in convincing many in the tax policy community to take seriously the need to factor in the economic effects of taxation on capital formation, productivity, wages, and employment in forecasting the welfare and federal budget consequences of changes in tax policy.

4 min read

Pro-Growth Tax Reforms Throughout the Republican Study Committee’s FY 2023 Budget

The United States needs to grow its way out of inflation and set the economy up for continued growth—the tax code provides tools for policymakers to do just that.

3 min read

Biden’s FY 2023 Budget Would Result in $4 Trillion of Gross Revenue Increases

President Biden’s budget proposes several new tax increases on high-income individuals and businesses, which combined with the Build Back Better plan would give the U.S. the highest top tax rates on individual and corporate income in the developed world.

5 min read

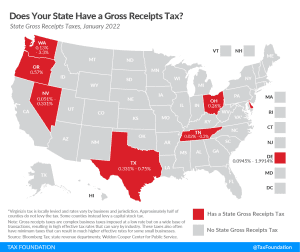

Gross Receipts Taxes by State, 2022

Eliminating state gross receipts taxes would be a pro-growth change to make the tax code better for businesses and consumers. How does your state compare?

4 min read

3 Takeaways from the New Congressional Budget Office Outlook

The CBO projections show policymakers’ top priority over the next five years will need to be cleaning up our country’s fiscal situation while maintaining a pro-growth and competitive tax code.

5 min read

Wisconsin Losing Ground to Tax-Friendly Peers

While Wisconsin has long been one of the highest-tax states in the nation, that distinction is increasingly detrimental as businesses and individuals enjoy increased economic and geographic mobility.

6 min read

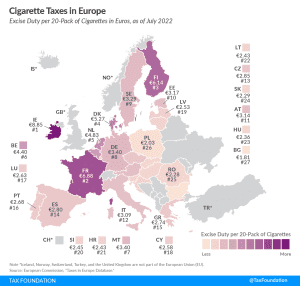

Cigarette Taxes in Europe, 2022

Ireland and France levy the highest excise duties on cigarettes in the EU, at €8.85 ($10.47) and €6.88 ($8.13) per 20-cigarette pack, respectively.

3 min read

Two Dozen States Show Why the Kansas Critique of Income Tax Cuts Is Mistaken

The Kansas experience is so infamous that “what about Kansas?” is almost guaranteed to be a question—sometimes as a retort, but often a genuine expression of concern—any time any state explores tax relief. But what about the other two dozen states that have cut their income taxes since then?

6 min read

Oklahoma Should Prioritize Pro-Growth Relief, Not Gimmicky Rebate Checks

If Sooner State policymakers want to use a portion of their higher revenues to make the economy work better for all Oklahomans, they should consider repealing the franchise tax, trimming the income tax, or both—paired, if desired, with targeted aid to those in the greatest need—not writing a single round of gimmicky checks.

5 min read