Tax Cuts vs. Tax Reform

Tax cuts vs. tax reform: what’s the real difference, and why does it matter?

Tax cuts vs. tax reform: what’s the real difference, and why does it matter?

Taxing wealth has become a hot-button issue in today’s political discourse, promising to reshape economic equality. But what are the real-world implications of such policies?

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

19 min read

To make sound financial decisions and support better tax policy, taxpayers should understand the taxes they face. Unfortunately, most U.S. taxpayers do not know or are unsure of basic tax concepts.

6 min read

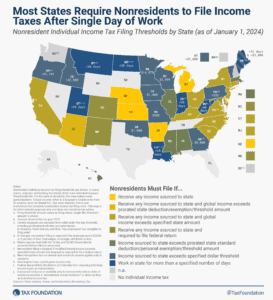

When Caitlin Clark and Angel Reese made their WNBA preseason debuts, basketball fans across the country tuned in. But there’s another audience that also follows along: state revenue officials, who will expect their piece of the pie each time these star athletes—and their teammates—come to town.

3 min read

One relatively easy but meaningful step policymakers can take to make future tax seasons less burdensome is to modernize their state’s nonresident income tax filing, withholding, and reciprocity laws.

7 min read

Despite taxes playing a significant role in personal finances and being levied on a sizable portion of the U.S. population, most Americans are not just unhappy with the current tax code but also do not understand it.

4 min read

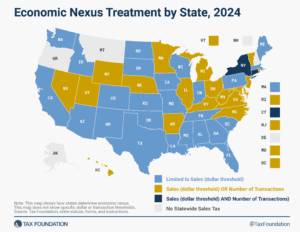

Reforming economic nexus thresholds would not only be better for businesses but for states as well. It is more cost-effective for states to focus on—and simplify—compliance for a reasonable number of sellers than to impose rules that have low compliance and are costly to administer.

4 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

3 min read

Don’t be fooled by tax myths and misconceptions this tax filing season.

3 min read

Working from home is great. The tax complications? Not so much.

4 min read

Sales taxes go beyond a few extra bucks at the register. It’s not just about what you pay, but who pays. What are the implications of state sales tax bases across the U.S.?

We’re exploring the intricacies of the latest congressional act stirring up Washington—The Tax Relief for American Families and Workers Act of 2024.

The House Ways and Means Committee has advanced a tax deal to the House floor that would temporarily—and retroactively—restore two major business deductions for cost recovery and expand the child tax credit through 2025.

10 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

Americans are saving less. While the U.S. saving rate has regularly lagged behind its peers, it has yet to return to pre-pandemic levels. Increasingly, people are turning to credit cards to fill the gaps in their budgets.

Explore the IRS inflation-adjusted 2024 tax brackets, for which taxpayers will file tax returns in early 2025.

4 min read

The current patchwork of state laws taxing marketplace facilitators is complex, burdensome, and inefficient. States should work to resolve these issues and standardize the otherwise disparate requirements—with or without an inducement from Congress or the courts.

29 min read

The latest tax gap report from the IRS has generated much media attention—and much misunderstanding.

6 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read