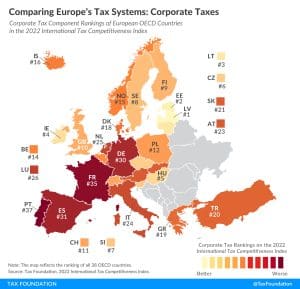

Comparing Europe’s Tax Systems: Corporate Taxes

According to the corporate tax component of the 2022 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min read

According to the corporate tax component of the 2022 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

3 min read

The business tax changes originally introduced in the TCJA are scheduled to increase tax burdens on businesses at a time when economic headwinds and broader uncertainty are higher than they have been in decades.

12 min read

Colombia should consider shifting its planned tax reforms from harmful corporate and individual taxes to less harmful consumption taxes.

5 min read

Every policy has trade-offs, but a well-designed carbon tax has the potential to protect the environment without harming consumers, jobs, or businesses.

The IRS recently released the new inflation adjusted 2023 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

4 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

41 min read

Federal tax collections are approaching the highest levels in U.S. history set during World War II and again during the dot-com bubble in 2000. Meanwhile, federal spending in FY 2022 was over 25 percent of GDP—a level only exceeded during the height of the pandemic in 2020 and 2021, and during World War II.

4 min read

President Biden proposed a 7-point hike in the corporate tax rate to 28 percent, a new minimum book tax on corporate profits, and higher taxes on international activity. We estimated these proposals would reduce the size of the economy (GDP) by 1.6 percent over the long run and eliminate 542,000 jobs.

6 min read

Some tax ballot initiatives will be straightforward, some will be complex, and—let’s be honest—some will be a drafting nightmare.

5 min read

The Inflation Reduction Act primarily uses carrots, not sticks, to incentivize reductions in carbon emissions. It creates or expands tax credits for various low- or no-emission technologies, rather than imposing a generalized penalty for emissions, such as a carbon tax.

5 min read

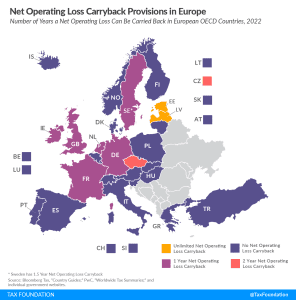

Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

4 min read

The Inflation Reduction Act created numerous tax subsidy programs intended to accelerate the transition to a greener economy.

8 min read

In an already-challenging economic environment, new UK Prime Minister Liz Truss must get tax rates correct to avoid over-burdening a population and business sector facing immense uncertainty. Focusing only on rates while ignoring the base misses an opportunity for real, pro-growth reform.

4 min read

The Inflation Reduction Act focused more on enforcement and hiring more auditors rather than programs that make it easier for taxpayers to comply with the code and the IRS to administer it.

6 min read

In a pattern that has become all too common in recent decades, the newly enacted Inflation Reduction Act (IRA) added yet another layer of complexity to an already complex and burdensome federal tax code.

9 min read

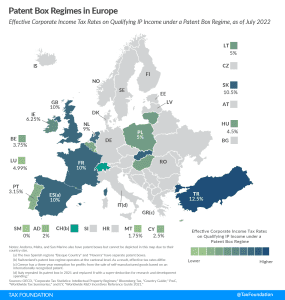

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP. Most commonly, eligible types of IP are patents and software copyrights. Currently, 13 of the 27 EU member states have a patent box regime.

4 min read

The Inflation Reduction Act increases the IRS’s budget by roughly $80 billion over 10 years. The money is broken into four main categories—enforcement, operations support, business system modernization, and taxpayer services—as well as a few other small items such as an exploratory study on the potential of a free-file system.

6 min read