Efforts to Improve Tax Treatment of Saving Gain Traction on Hill

The proposals share a common goal of improving incentives for households to save during a time when inflation is impacting their finances.

3 min read

The proposals share a common goal of improving incentives for households to save during a time when inflation is impacting their finances.

3 min read

As policymakers on both sides of the Atlantic debate the way forward on carbon border adjustment mechanisms, it is important to keep principles of good tax policy in mind.

7 min read

The United States needs to grow its way out of inflation and set the economy up for continued growth—the tax code provides tools for policymakers to do just that.

3 min read

Amidst soaring inflation, policymakers across the political spectrum proposed many ideas to soften the blow of higher prices–especially for low-income workers and families. One idea that caught on quickly: sales tax relief on groceries. The idea had its merits, but Tax Foundation research shows that it may have missed the mark.

Efforts to improve the taxpayer experience should focus on the IRS’s operations and include structural improvements to the tax code.

4 min read

As the deadline for tax filing nears, the IRS faces scrutiny for its backlog of returns, inaccessible taxpayer service, and delays in issuing certain refunds.

5 min read

Lawmakers can be proud of the steps that they have taken toward a better tax code but should consider revisiting the design of the bill’s tax triggers in order to better accomplish their goal of responsible improvement.

6 min read

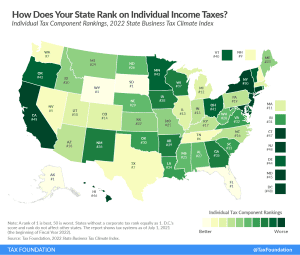

After a whirlwind of cuts and reforms in 2021, it looks like 2022 might be an even bigger year for state tax codes. Republican and Democratic governors alike used their annual State of the State addresses to call for tax reform, and there is already serious momentum from state lawmakers nationwide to get the job done.

3 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Even if 2022 sees many tax reforms, the scope of Iowa’s tax relief measures is likely to stand out. With the most recent reform package, Iowa lawmakers have made a significant investment in a more competitive tax climate for an increasingly competitive era.

6 min read

In a time of increased mobility and tax competition, a lower rate and simpler tax structure would help Georgia stand out among states. Lawmakers would be wise to consider reforming the state’s income tax to improve the state’s competitiveness.

3 min read

By reducing the tax code’s current barriers to investment and saving and simplifying its complex rules, lawmakers would greatly enhance the ability of Americans to pursue new ideas, create more opportunities, and build financial security for themselves and their families.

40 min read

The expanded Child Tax Credit from the American Rescue Plan was touted as a once-in-a-lifetime achievement toward reducing child poverty. But it was passed as a temporary tax measure. Temporary tax policy makes tax filing confusing, and the IRS has shown that it isn’t able to keep pace with being a social administrator and a tax collector. We discuss what taxpayers need to know about the ever-changing Child Tax Credit and how it may impact taxpayers this spring.

The 2022 tax filing season is about to begin. With expected delays, pandemic-related troubles, and a backlog of over 8 million unprocessed returns from the 2021 tax filing season, Garrett Watson joins Jesse Solis to discuss what all these troubles will mean for taxpayers in what is shaping up to be a chaotic spring.

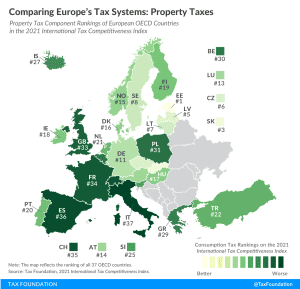

Recent discussions of a proposed wealth tax for the United States have included little information about trends in wealth taxation among other developed nations. However, those trends and the current state of wealth taxes in OECD countries can provide context for U.S. proposals.

3 min read

The National Taxpayer Advocate argued the IRS telephone service “was the worst it has ever been” in 2021, with an answer rate of about 11 percent.

4 min read

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read

In most states, you don’t have to visit for long before you start accruing tax liability.

5 min read