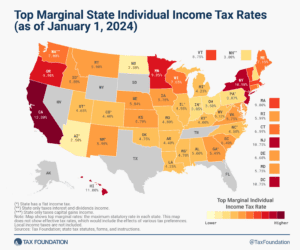

State Individual Income Tax Rates and Brackets, 2024

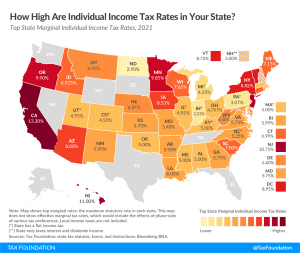

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min readProviding journalists, taxpayers and policymakers with basic data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission. We’ve found that one of the best, most engaging ways to do that is by visualizing tax data in the form of maps.

How does your state collect revenue? Every week, we release a new tax map that illustrates one important measure of state tax rates, collections, burdens and more. If you enjoy our weekly tax maps, help us continue this work and more by making a small contribution here.

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

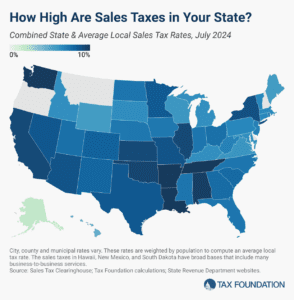

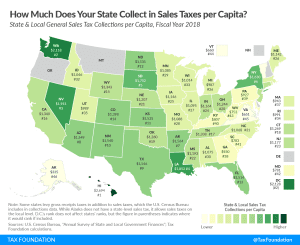

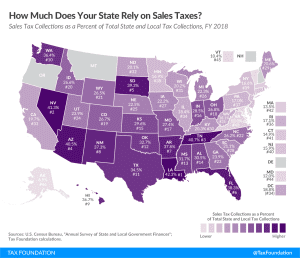

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections).

8 min read

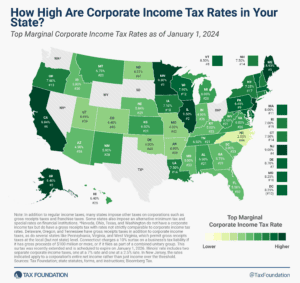

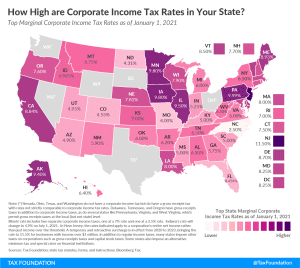

Graduated corporate rates are inequitable—that is, the size of a corporation bears no necessary relation to the income levels of the owners.

7 min read

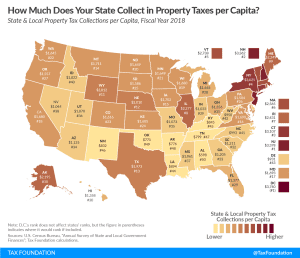

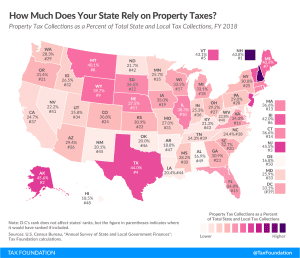

Property taxes are an important source of revenue for local and state governments. In FY 2018, property taxes generated over 30 percent of total U.S. state and local tax collections and over 70 percent of local tax collections.

2 min read

Rightsizing a state’s sales tax base can not only make the tax more equitable and better align it with the modern economy but also generate revenue that can be used to pay down the rates of more harmful taxes. That is why sales tax base broadening, which is favored by public finance scholars across the political spectrum, features in many tax reform plans.

3 min read

Location Matters is an account of tax complexity and the ways that tax structure affect competitiveness. For policymakers, it represents an opportunity to explore the seemingly more arcane tax provisions that can have a significant impact on business tax burdens, and to discover how their tax code—often completely by accident—picks winners and losers.

4 min read

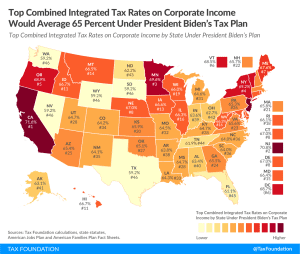

Under President Biden’s tax plan, the United States would tax corporate income at the highest top rate in the industrialized world, averaging 65.1 percent.

3 min read

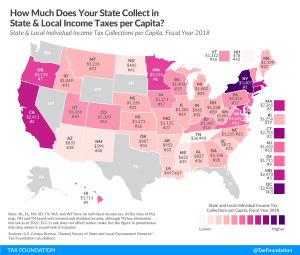

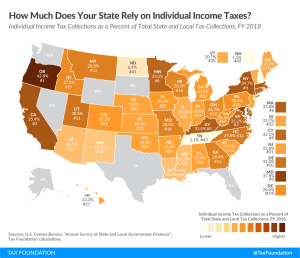

The individual income tax is one of the most significant sources of revenue for state and local governments, generating approximately 24 percent of state and local tax collections in FY 2018.

2 min read

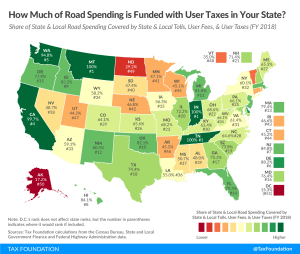

Traditionally, revenue dedicated to infrastructure spending has been raised through taxes on motor fuel, license fees, and tolls, but revenue from motor fuel has proven less effective over the last few decades.

4 min read

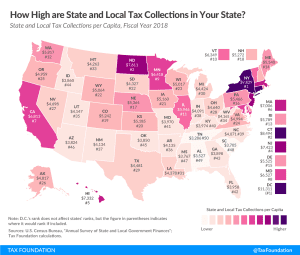

Although Tax Day has been pushed back this year, mid-April is still a good occasion to take a look at tax collections in the United States. Because differing state populations can make overall comparisons difficult, today’s state tax map shows state and local tax collections per capita in each of the 50 states and the District of Columbia.

2 min read

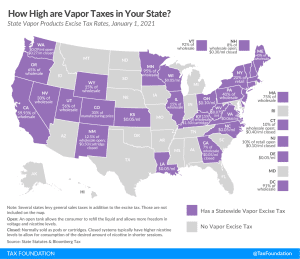

Several states are considering introducing or increasing taxes on vapor products to make up declining tax revenue from traditional tobacco products or to fill budget holes in the wake of the coronavirus pandemic. However, lawmakers should approach the issue carefully because flawed excise tax design on vapor products could drive consumers back to more harmful combustible products like cigarettes.

3 min read

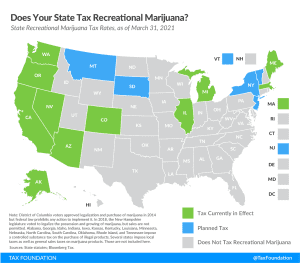

The legalization and taxation of recreational marijuana remains one of the hottest trends in state taxation.

6 min read

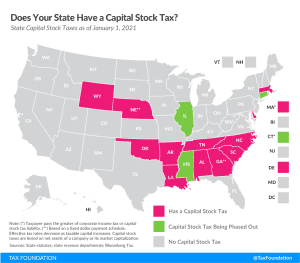

Capital stock taxes are imposed on a business’s net worth (or accumulated wealth). As such, the tax tends to penalize investment and requires businesses to pay regardless of whether they make a profit in a given year, or ever.

4 min read

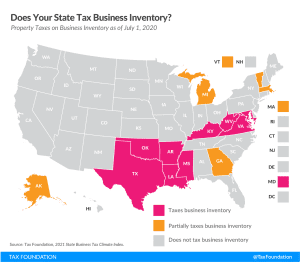

Inventory taxes are levied regardless of whether a business makes a profit, adding to the burden of businesses already struggling to stay afloat.

2 min read

Moving away from state gross receipts taxes would represent a pro-growth change to make the tax code friendlier to businesses and consumers alike, which is especially necessary in the wake of the coronavirus pandemic.

3 min read

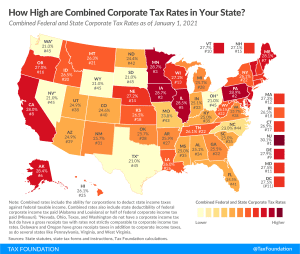

The state with the highest combined corporate income tax rate is New Jersey, with a combined rate of 30.1 percent. Corporations in Alaska, California, Illinois, Iowa, Maine, Minnesota, and Pennsylvania face combined corporate income tax rates at or above 28 percent.

3 min read

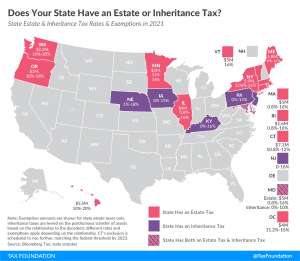

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax. Twelve states and Washington, D.C. impose estate taxes and six impose inheritance taxes. Maryland is the only state to impose both. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as estate taxes without the federal exemption hurt a state’s competitiveness.

3 min read

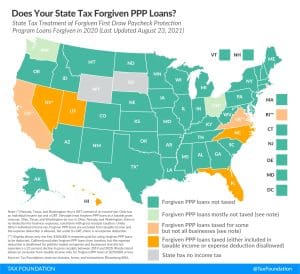

Congress chose to exempt forgiven Paycheck Protection Program (PPP) loans from federal income taxation. Many states, however, remain on track to tax them by either treating forgiven loans as taxable income, denying the deduction for expenses paid for using forgiven loans, or both.

11 min read

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

22 min read

Sources of state revenue have come under closer scrutiny in light of the impact of the coronavirus pandemic, as different tax types have differing volatility and economic impact—although even beyond these unique circumstances, it is important for policymakers to understand the trade-offs associated with different sources of tax revenue.

4 min read

North Carolina’s 2.5 percent corporate tax rate is the lowest in the country, followed by Missouri (4 percent) and North Dakota (4.31 percent). Seven other states impose top rates at or below 5 percent: Florida (4.458 percent), Colorado (4.55 percent), Arizona (4.9 percent), Utah (4.95 percent), and Kentucky, Mississippi, and South Carolina (5 percent).

7 min read

Consumption taxes (like sales taxes) are more economically neutral than taxes on capital and income because they target only current consumption. Consumption taxes are generally more stable than income taxes in economic downturns as well.

3 min read

New Hampshire and Alaska rely most heavily on property taxes. Neither have individual income taxes, and in New Hampshire, significant government authority often vested in state government is devolved to the local level, where services are overwhelmingly funded by property taxes.

4 min read