Featured Articles

All Related Articles

OECD Report: Tax Revenue as a Percent of GDP in Latin American and Caribbean Countries Is below the OECD Average

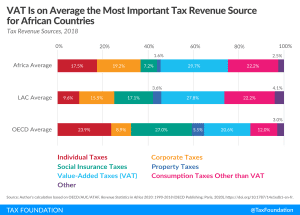

Taxes on goods and services were on average the greatest source of tax revenue for Latin American and Caribbean countries

5 min read

More Tax Hikes Than Investment Projects?

Tax hikes implemented in the near term might undermine Spain’s economic recovery. Spain should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting private investment and employment while increasing its internal and international tax competitiveness.

5 min read

IMF Tax Proposals: Shrink Inequality or Sink Post-Pandemic Recovery?

To help countries face the pandemic-related financing needs while reducing inequality, the International Monetary Fund (IMF) has released a series of policy recommendations based on a temporary COVID-19 tax, levied on high incomes or wealth.

4 min read

Washington State Lawmakers Consider 1,000% Tax Increase on Tobacco Businesses

Limiting addiction to nicotine is a laudable goal, but lawmakers should exercise caution with the methods employed. Using gross receipts taxes on businesses to effectively levy an excise tax introduces complexity to an already flawed tax design. It is better to let the excise tax internalize externalities and the business tax raise general revenue.

3 min read

Facts and Figures 2021: How Does Your State Compare?

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

New Hampshire Bill Aims to Reduce Tax Burden on Businesses

A year ago, it seemed possible that New Hampshire was headed toward a triggered tax increase. Instead, lawmakers may trim business tax rates and begin the phaseout of the state’s tax on interest and dividend income, which would take away the asterisk and make New Hampshire the ninth state to forgo an individual income tax altogether.

4 min read

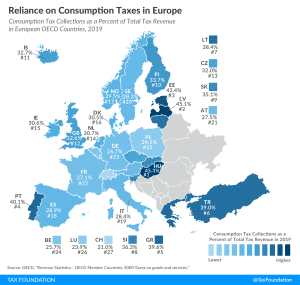

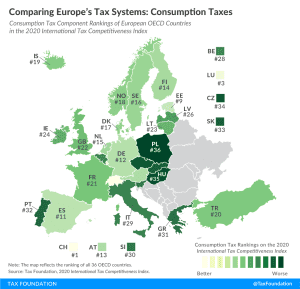

Reliance on Consumption Taxes in Europe

Hungary relies the most on consumption tax revenue, at 45.3 percent of total tax revenue, followed by Latvia and Estonia at 45.1 percent and 42.4 percent, respectively.

2 min read

An Investment Boost in the UK’s 2021 Budget

The UK’s Chancellor of the Exchequer Rishi Sunak released the 2021 budget, and most important for near-term growth is the significant boost to capital allowances.

5 min read

Renewed Calls for Severance Taxes on Bottled Spring Water

Amid a debate over water extraction from Florida’s springs, Florida Sen. Annette Taddeo (D) has introduced a bill (SB 562) which, if enacted, would establish an excise tax on water extraction beginning July 1.

4 min read

Brits to Prepare for Tax Reforms

Tax hikes or spending cuts implemented early in the year might undermine the desirable rapid recovery of the economy. The UK should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting business investment and employment while increasing its international tax competitiveness.

4 min read

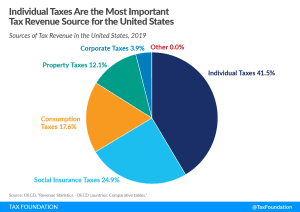

Sources of U.S. Tax Revenue by Tax Type, 2021 Update

In the United States, individual income taxes (federal, state, and local) are the primary source of tax revenue, at 41.5 percent of total tax revenue. Social insurance taxes make up the second-largest share, at 24.9 percent, followed by consumption taxes, at 17.6 percent, and property taxes, at 12.1 percent.

4 min read

Join Us for a Free “State Tax Policy Boot Camp”

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

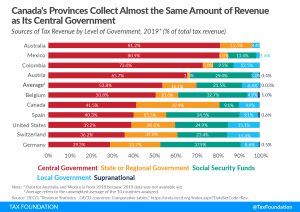

Sources of Government Revenue in the OECD, 2021 Update

Developed countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less distortionary effects than taxes on income.

16 min read

The European Commission and the Taxation of the Digital Economy

The consultation on the EU’s digital levy provides an opportunity for policymakers and taxpayers to reflect on the underlying issues of digital taxation and potential consequences from a digital levy. Unless the EU digital levy is designed with an OECD agreement in mind, it is likely to cause more uncertainty in cross-border tax policy.

12 min read

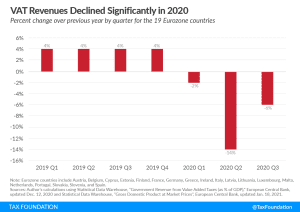

Value-added Taxes in the Pandemic

Many governments have chosen to use VAT as a tool to provide tax relief for consumption in various sectors throughout the pandemic, but in the long term, VAT should not be used as a tool for relief.

3 min read

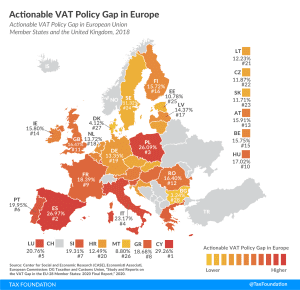

Actionable VAT Policy Gap in Europe, 2021

Value-added taxes (VAT) make up approximately one-fifth of total tax revenues in Europe. However, European countries differ significantly in how efficiently they raise VAT revenues. One way to measure a country’s VAT efficiency is the VAT Gap.

4 min read

Consumption Tax Policies in OECD Countries

Despite the potential of consumption taxes as a neutral and efficient source of tax revenues, many governments have implemented policies that are unduly complex and have poorly designed tax bases that exclude many goods or services from taxation, or tax them at reduced rates.

40 min read

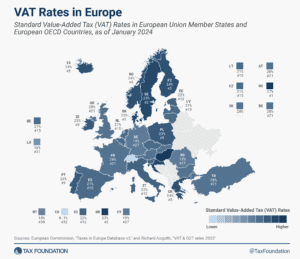

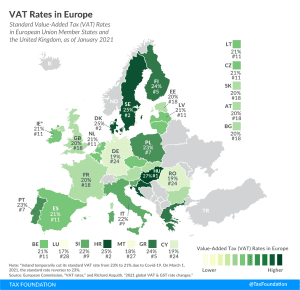

VAT Rates in Europe, 2021

More than 140 countries worldwide—including all European countries—levy a Value-Added Tax (VAT) on goods and services.

4 min read

OECD Report: Tax Revenue in African Countries

Taxes on goods and services were on average the greatest source of tax revenue for African countries, at over 50 percent of total tax revenues. VAT contributed on average 30 percent, making it the most important tax on goods and services.

6 min read

Comparing Europe’s Tax Systems: Consumption Taxes

How do consumption tax codes compare among European OECD countries? Explore our new map to see how consumption tax systems in Europe compare.

2 min read