All Related Articles

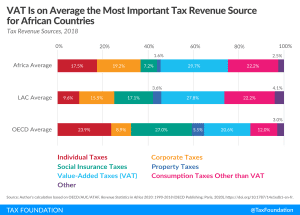

OECD Report: Tax Revenue in African Countries

Taxes on goods and services were on average the greatest source of tax revenue for African countries, at over 50 percent of total tax revenues. VAT contributed on average 30 percent, making it the most important tax on goods and services.

6 min read

Election Analysis: California and Colorado Voters Resist Temptation to Shift More of Property Tax Burden to Businesses

In Tuesday’s election, voters in two states—California and Colorado—were tasked with deciding whether to amend their states’ constitution to change how the property tax burden is distributed. In many ways, the ballot measures were mirror images of each other, but the outcomes were similar.

3 min read

Results of 2020 State and Local Tax Ballot Measures

See the results of the most notable state and local tax ballot measures during Election 2020 with our curated resource page.

11 min read

A Framework for the Future: Reforming the UK Tax System

Our new guide identifies key areas for improvement in UK tax policy and provides recommendations that would support long-term growth without putting a dent in government revenues.

24 min read

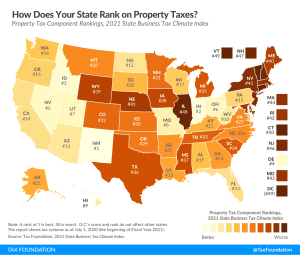

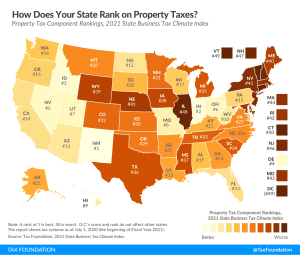

2021 State Business Tax Climate Index

166 min read

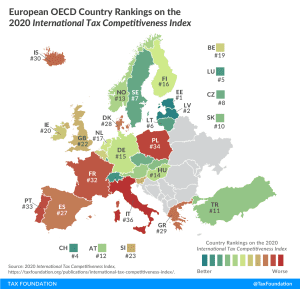

International Tax Competitiveness Index 2020

Our International Index compares OECD countries on over 40 variables that measure how well each country’s tax system promotes sustainable economic growth and investment.

13 min read

Tax Modernization: A Key to Economic Recovery and Growth in Nebraska

A competitive tax code has never been more important, and these tax policy improvements can both strengthen the short-term economic recovery and promote long-term economic growth in Nebraska.

26 min read

Split Roll Initiative in California Threatens Property Tax Limitations on Commercial Real Estate

On Election Day this year, California voters will vote on Proposition 15, a ballot measure that would create a “split roll” property tax system in the Golden State, increasing taxes on just commercial property by $8 billion to $12.5 billion.

15 min read

New Census Data Shows States Beat Revenue Expectations in FY 2020

State tax revenue collections were down 5.5 percent in FY 2020, driven by a dismal final quarter (April through June) as states began to feel the impact of the COVID-19 pandemic. While these early losses are certainly not desirable, they are manageable and far better than many feared.

16 min read

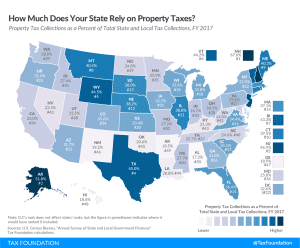

More Countries Target the Property Tax

A recent OECD report reveals a tendency towards higher property taxes, often in the form of base broadening, tax rate increases, or both.

5 min read

Nevada Hoping to Extract Revenue with Mining Tax Increase Amendment

Nevada is not alone in its need to find revenue, but it should take care not to embrace bad tax policy in the process. Significant rate increases, a shift in the tax base, and provisions which make it easier to hike taxes than to cut them would heavily burden the mining industry in the state.

3 min read

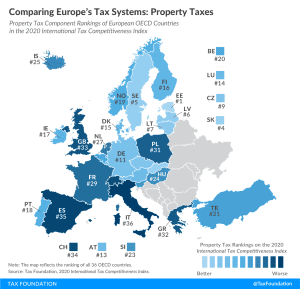

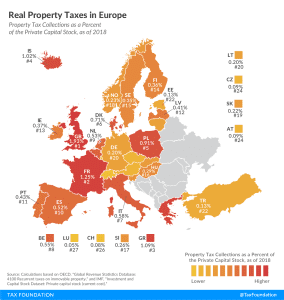

Real Property Taxes in Europe, 2020

High property taxes levied not only on land but also on buildings and structures can discourage investment because they disincentivise investing in infrastructure, which businesses would have to pay additional tax on. For this reason, it may also influence business location decisions away from places with high property tax.

3 min read

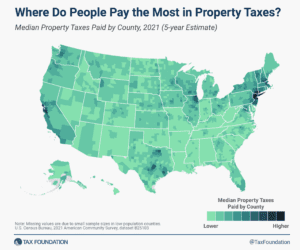

What Can Connecticut Learn from its Neighbors About Property Tax Limitations?

Property tax burdens in Connecticut continue to increase even as property values decline, whereas other states—including neighboring Massachusetts and New York—have managed to keep the growth of property tax burdens in check.

42 min read

CARES Act Conformity Would Promote Economic Recovery in Nebraska

Nebraska lawmakers may ultimately opt for a package that includes both property tax relief and the renewal of business incentives, but they should avoid doing so at the expense of decoupling from the CARES Act’s liquidity-enhancing provisions.

6 min read

New Jersey Considers Bonds Paid for by Statewide Property Tax

As New Jersey lawmakers grapple with reduced revenues due to the coronavirus pandemic, they have turned to an unusual solution: the issuance of bonds that would be repaid, if necessary, through temporarily higher sales and property taxes.

2 min read