Don’t Ignore the Long Run When Evaluating Corporate Tax Cuts

Do corporate tax cuts boost workers’ wages? The answer depends on your time frame.

4 min readAcademic studies show that higher corporate tax rates depress worker wages and lead to fewer jobs. An Organisation for Co-operation and Development (OECD) study has found that the corporate tax is the least efficient and most harmful way for governments to raise revenue.

Do corporate tax cuts boost workers’ wages? The answer depends on your time frame.

4 min read

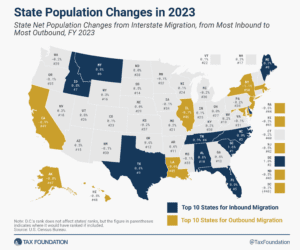

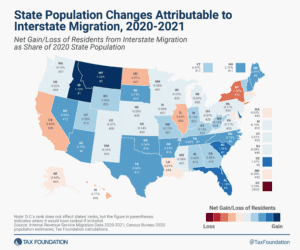

The pandemic has accelerated changes to the way we live and work, making it far easier for people to move—and they have. As states work to maintain their competitive advantage, they should pay attention to where people are moving, and try to understand why.

5 min read

Spain’s central government could learn some valuable lessons from its regional governments about sound tax policy.

7 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

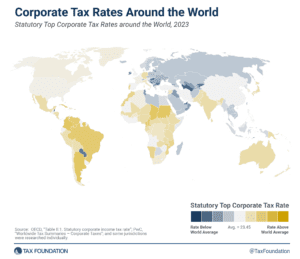

Of the 225 jurisdictions around the world, only six have increased their top corporate income tax rate in 2023, a trend that might be reversed in the coming years as more countries agree to implement the global minimum tax.

16 min read

At first glance, a ruling for the plaintiffs in Moore might seem to solve some of the timing problems with the U.S. tax system. Unfortunately, upon greater inspection, such a ruling might create new timing problems. And the more rigid the ruling, the harder it would be to fix the timing problems it would create.

5 min read

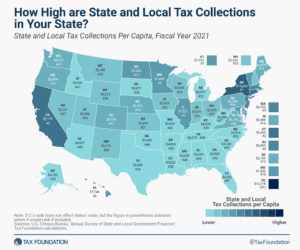

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

4 min read

The rules of tax competition are changing with the recent agreement on a global minimum tax and other changes to tax rules around the world, but that does not mean the contest is over.

5 min read

The 2023 version of the International Tax Competitiveness Index is the 10th edition of the report. Let’s take a look back and see how country ranks have changed over time.

5 min read

Lawmakers will have to weigh the economic, revenue, and distributional trade-offs of extending or making permanent the various provisions of the TCJA as they decide how to approach the upcoming expirations. A commitment to growth, opportunity, and fiscal responsibility should guide the approach.

18 min read

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

The 2017 Tax Cuts and Jobs Act (TCJA) was the largest corporate tax reform in a generation, lowering the corporate tax rate from 35 percent to 21 percent, temporarily allowing full expensing for short-lived assets (referred to as bonus depreciation), and overhauling the international tax code.

6 min read

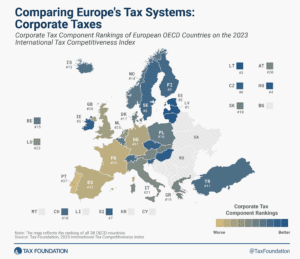

According to the corporate tax component of the 2023 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

2 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

If the EU is going to harmonize its tax base, it should do so in a way that increases the efficiency and competitiveness of tax policy for the EU as a whole, and not just seek out the lowest common denominator.

5 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

88 min read

The OECD recently released a trove of new documents on a draft multilateral tax treaty. The U.S. Treasury has opened a 60-day consultation period for the proposal and is requesting public review and input.

7 min read

Pillar Two implementation is underway in many jurisdictions, and many governments are aiming to get their proposals approved before the end of 2023. However, estimating Pillar Two’s impact on government revenue is proving difficult. As a result, only a few countries have publicly presented their findings.

7 min read