How Have Federal Revenues Evolved since the Tax Cuts and Jobs Act?

As members of Congress prepare to address the expiration of the TCJA, they should appreciate how revenues have evolved since 2017.

4 min read

As members of Congress prepare to address the expiration of the TCJA, they should appreciate how revenues have evolved since 2017.

4 min read

Tax cuts vs. tax reform: what’s the real difference, and why does it matter?

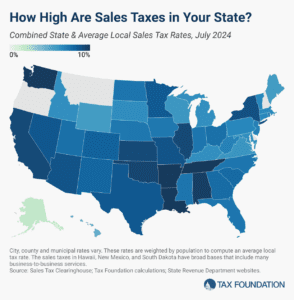

Retail sales taxes are an essential part of most states’ revenue toolkits, responsible for 32 percent of state tax collections and 13 percent of local tax collections (24 percent of combined collections).

8 min read

Retail delivery fees are an inefficient and ineffective way to close budget gaps, and lawmakers should consider other, more sound, policy options.

5 min read

As Hungary takes over the six-month rotating presidency of the Council of the European Union in the aftermath of the European elections, the relationship between tax policy and Europe’s competitiveness will be closely linked.

6 min read

While neither full expiration nor a deficit-financed full extension of the TCJA would be appropriate, lawmakers should consider the incentive effects of whichever tax reform they pursue. Because taxes affect the economy, they also affect the sustainability of debt reduction.

3 min read

Governor Sarah Huckabee Sanders (R) recently called a brief special legislative session to enact the fourth round of reductions to the Natural State’s individual and corporate income taxes. Legislators also passed a modest property tax reform proposal.

4 min read

The European Union’s experience with high inflation highlights the critical need for adaptive fiscal policies. Best practices drawn from the academic literature recommend implementing automatic adjustment mechanisms with a certain periodicity and based on price increases.

31 min read

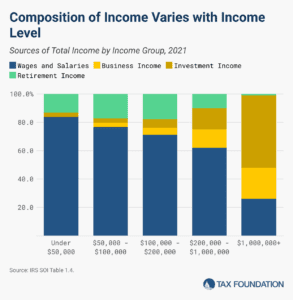

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

9 min read

Taxing wealth has become a hot-button issue in today’s political discourse, promising to reshape economic equality. But what are the real-world implications of such policies?

Many developed countries have repealed their wealth taxes in recent years for a variety of reasons. They raise little revenue, create high administrative costs, and induce an outflow of wealthy individuals and their money. Many policymakers have also recognized that high taxes on capital and wealth damage economic growth.

30 min read

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

13 min read

Both candidates should provide clear and honest answers about their plans (or lack thereof) to address the nation’s urgent tax policy issues.

8 min read

Portland residents face some of the country’s highest taxes on just about every class of income. In an era of dramatically increased mobility for individuals and businesses alike, that’s not a recipe for success.

11 min read

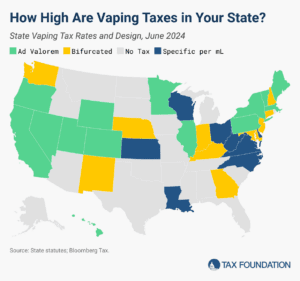

The vaping industry has grown rapidly in recent decades, becoming a well-established product category and a viable alternative to cigarettes for those trying to quit smoking. US states levy a variety of tax structures on vaping products.

4 min read

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

19 min read

The government won in Moore. However, given the narrow opinion of the court and the reasoning in the Barrett concurrence and the Thomas dissent, it seems likely that future rulings under other facts and circumstances could favor taxpayers instead.

7 min read

Adopting tax policy based on sound principles like neutrality rather than political expediency is essential for the European Union’s fiscal future.

5 min read

The Tax Cuts and Jobs Act (TCJA) significantly lowered the effective tax rates on business income, but the impact was not the same for C corporations and pass-through businesses.

6 min read

Neutral tax codes don’t play favorites or try to influence personal or business decisions but stick to what they’re best at – raising sufficient revenue through low rates and a broad base.