The U.S. Tax Burden on Labor, 2023

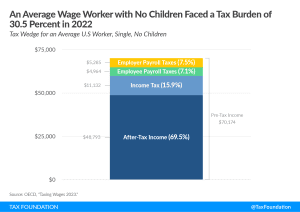

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay more than 30 percent of their wages in taxes.

4 min read

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay more than 30 percent of their wages in taxes.

4 min read

According to the International Monetary Fund (IMF), the U.S. federal government is among the most indebted governments in the world.

6 min read

As policymakers look to tackle America’s debt and deficit crisis, they should consider international experiences on successful fiscal consolidations.

6 min read

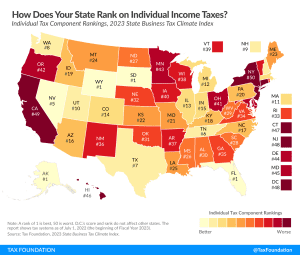

Individual income tax rates can influence location decision-making, especially in an era of enhanced mobility, where it is easier for individuals to move without jeopardizing their current job, or without limiting the scope of their search for a new one.

5 min read

When a country has a broad base with a simple and transparent tax code, small rate changes have little influence. Therefore, policymakers shouldn’t only focus on rate changes when it comes to increasing tax competitiveness.

4 min read

Scandinavian countries are well known for their broad social safety net and their public funding of services such as universal health care, higher education, parental leave, and child and elderly care. So how do Scandinavian countries raise their tax revenues?

7 min read

While the IRS hopes to increase revenue collection and minimize additional burdens on taxpayers, uncertainty remains regarding its ability to deliver, particularly on the latter. Furthermore, some concerns about the original funding package are already surfacing, specifically around insufficient funding for taxpayer services.

6 min read

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

According to our analysis, President Biden’s budget would reduce long-run economic output by about 1.3 percent and eliminate 335,000 FTE jobs. See what tax policies the president is proposing.

17 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

The proposed reforms would be welcome changes to the Commonwealth’s tax code, but the economic principles behind the reforms also have important implications for the Bay State’s income tax system writ large.

6 min read

President Biden’s new budget proposal outlines several major tax increases targeted at businesses and high-income individuals that would bring U.S. income tax rates far out of step with international norms.

7 min read

Affordable housing is an issue that has had long-standing bipartisan interest in D.C. But the path to increase the supply of affordable housing, though often well-intentioned, has created a bureaucratic nightmare.

In a day and age when businesses and individuals alike are increasingly mobile, West Virginians can be relieved that their state is getting off the sideline and into the action.

4 min read

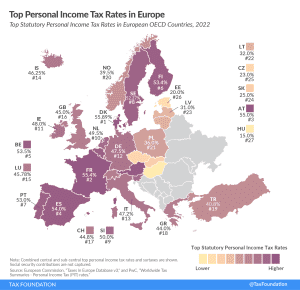

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read

Immediately balancing the $20 trillion budget shortfall would take drastic, unwanted policy changes. Instead, lawmakers should target a more achievable goal, such as stabilizing debt and deficits with an eye toward comprehensive tax reform that can produce sufficient revenue with minimal economic harm.

4 min read

While hoping for inflation’s continued decline, policymakers should finish the job and index the tax code to prepare for future bouts of high inflation and as a contingency in case it takes longer to defeat elevated inflation than expected.

4 min read

When peeling back layers of the JCT report, it becomes clear that many tax expenditures are not “loopholes” or benefits for narrow special interests, but important structural elements of the tax code.

6 min read

President Biden shared his policy aspirations during the State of the Union address, outlining three tax proposals in his remarks: quadrupling the brand-new excise tax on stock buybacks, instituting a “billionaire minimum tax,” and extending the now-lapsed expanded Child Tax Credit. We discuss the prospects of major tax changes becoming law in a divided government and what these proposals signal about how President Biden thinks about tax policy as he enters the latter half of his first term.

A new tax expenditures report by the Joint Committee on Taxation (JCT) reveals two problematic developments: 1) policymakers have increasingly relied on the tax code to deliver benefits to individuals, and 2) the broad, neutral tax treatment of investment has shifted to targeted subsidies for businesses.

4 min read