Summary of the Latest Federal Income Tax Data, 2023 Update

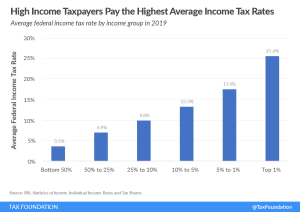

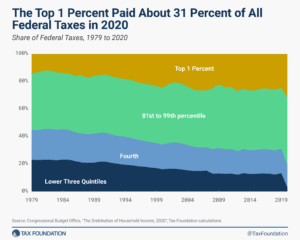

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

When we discuss tax policy, the conversation inevitably turns to who pays, who should pay, and how much they should pay. Unfortunately, the tax burdens debate is often missing a key point: how income transfer programs—like Social Security or Medicaid—affect households’ tax burdens.

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

Despite taxes playing a significant role in personal finances and being levied on a sizable portion of the U.S. population, most Americans are not just unhappy with the current tax code but also do not understand it.

4 min read

With proposals to adopt the nation’s highest corporate income tax, second-highest individual income tax, and most aggressive treatment of foreign earnings, as well as to implement an unusually high tax on property transfers, Vermont lawmakers have no shortage of options for raising taxes dramatically.

7 min read

Portugal’s personal income tax system levies high tax rates on an unusually narrow set of high earners, striking a poor balance between earnings incentives and revenue contributions.

4 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

The federal income tax drives the tax code’s progressivity. In 2021, taxpayers with higher incomes paid much higher average income tax rates than taxpayers with lower incomes.

4 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

In the context of the 2024 election year, what does President Biden’s 2025 budget proposal signify regarding his strategies and priorities as he seeks reelection? And how could these proposals shape the overall landscape of this election cycle?

The 2021 tax year was the fourth since the Tax Cuts and Jobs Act (TCJA) made many significant, but temporary, changes to the individual income tax code to lower tax rates, widen brackets, increase the standard deduction and child tax credit, and more.

9 min read

Do taxes affect individuals’ decisions regarding where to live and work? Can high taxes cause the outmigration of wealthy individuals?

5 min read

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

Vermont lawmakers are considering the adoption of two new taxes on high earners, which proponents have branded “wealth taxes.”

4 min read

Creative options including changes in Social Security benefits growth for higher earners and reforms to how Medicare compensates for health services should be on the table, along with broad-based and well-structured tax reforms.

6 min read

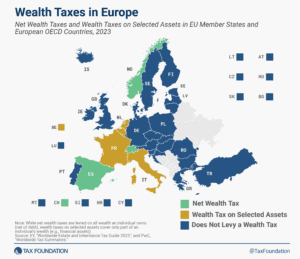

Only three European countries levy a net wealth tax—Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets.

4 min read

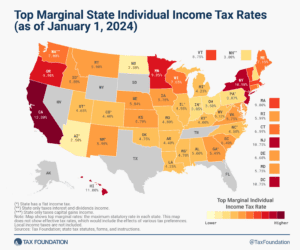

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

The pandemic led to one of the largest fiscal responses in U.S. history, impacting households across the income distribution.

4 min read

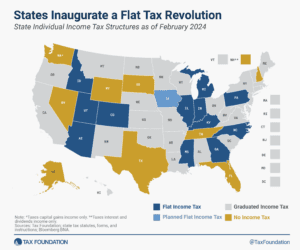

In 2021 and 2022 alone, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read

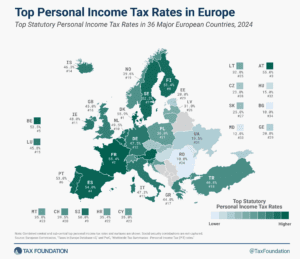

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

From a revenue standpoint, about $9 billion of the $11.7 billion in lost revenue would accrue to joint filers earning more than $200,000.

5 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

What historical lessons of wartime finance can Ukrainian and EU policymakers learn to put Ukraine’s economy on a path to success during, and especially after, the war?

5 min read