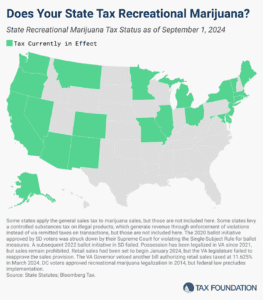

Recreational Marijuana Taxes by State, 2024

Many states regulate and tax legal marijuana sales and consumption, despite the ongoing federal prohibition. Explore the data here.

6 min read

Many states regulate and tax legal marijuana sales and consumption, despite the ongoing federal prohibition. Explore the data here.

6 min read

Estimating the economic effects of different types of taxes informs policymakers about the trade-offs of raising revenue in a given way.

5 min read

CBO data shows that the federal fiscal system—both taxes and direct federal benefits—is getting more progressive and redistributive in 2024.

7 min read

Growing levels of waste and pollution, paired with increasing burdens on taxpayers to address environmental problems, have spurned policymakers in the US and abroad to encourage producers to be responsible, either financially or operationally, for the end-life of their products.

34 min read

What do the contrasting tax proposals of Vice President Kamala Harris and former President Donald Trump mean for Americans as the 2024 election approaches?

Under the tax created by Measure 118, Oregon businesses would be significantly disadvantaged against their larger and out-of-state rivals.

6 min read

Social Security is by far the largest federal government spending program. The latest trustees report shows the program is on a fiscally unsustainable path that will exacerbate the US debt crisis if its imbalances are not addressed in the near term.

33 min read

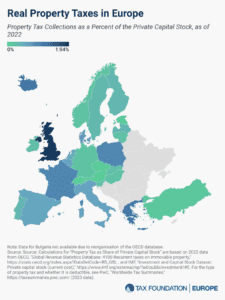

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

3 min read

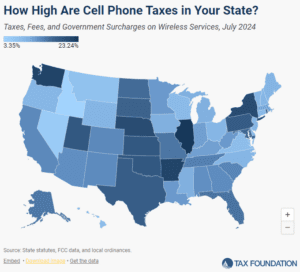

Wireless taxes and fees set a new record high in 2024.

23 min read

As part of the 2024 presidential campaign, Vice President Kamala Harris is proposing to tax long-term capital gains at a top rate of 33 percent for high earners, taking the top federal rate to highs not seen since the 1970s.

3 min read

Bob Stack, an international tax expert, explores the implications of the EU’s adoption of Pillar Two and the potential for streamlining overlapping policies. He also addresses the issues that the US faces in global tax policy with the upcoming elections.

The gap between statutory rates and average effective tax rates for personal income tax in the European Union varies significantly, affecting the efficiency and simplicity of the tax system.

32 min read

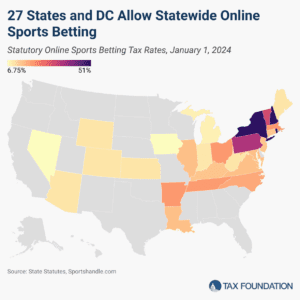

Legal sports betting has grown rapidly since the Supreme Court granted states the ability to establish online sports betting markets in Murphy vs. NCAA in 2018.

3 min read

Oregon’s Measure 118, though presented as a tax on big business, would function as an aggressive sales tax on consumers.

7 min read

Exempting overtime would unnecessarily complicate the tax code, increase compliance and administrative costs, and reduce neutrality by favoring certain work arrangements over others.

5 min read

Nationwide, property owners have experienced surges in valuations and are demanding tax relief. Lawmakers are right to find ways to provide it, but should do so with sound tax principles in mind.

5 min read

Taxes are on the ballot this November—not just in the sense that candidates at all levels are offering their visions for tax policy, but also in the literal sense that voters in some states will get to decide important questions about how their states raise revenue.

9 min read

While tax policy was almost nonexistent in the first debate between Vice President Kamala Harris and former President Donald Trump, this episode will explore each candidate’s latest proposals in greater depth.

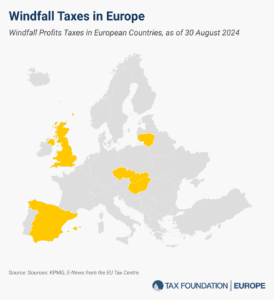

The flawed design of these windfall profits taxes has created problems in countries that implemented them.

4 min read

Rather than pursuing temporary policies, policymakers should implement long-term, pro-growth tax reforms that stimulate economic activity and incentivize energy diversification by supporting private investment through full expensing.

19 min read