Providing journalists, taxpayers, and policymakers with basic data on taxes and spending is a cornerstone of Tax Foundation Europe’s educational mission.

As a nonpartisan, educational organization, the Tax Foundation has earned a reputation for independence and credibility.

Our policy team regularly provides accessible, data-driven insights from sources such as the European Commission, the Organisation for Economic Co-Operation and Development (OECD), and others.

Featured Data

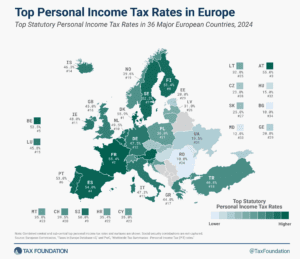

Top Personal Income Tax Rates in Europe, 2024

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

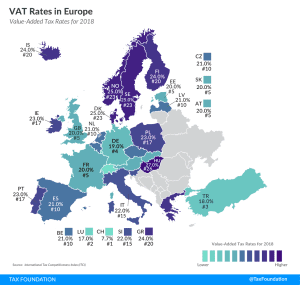

VAT Rates in Europe, 2024

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

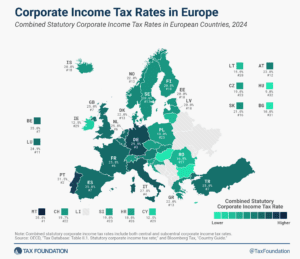

Corporate Income Tax Rates in Europe, 2024

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years.

2 min read

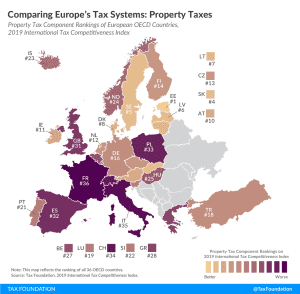

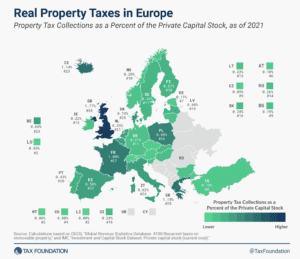

Real Property Taxes in Europe, 2023

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

2 min read

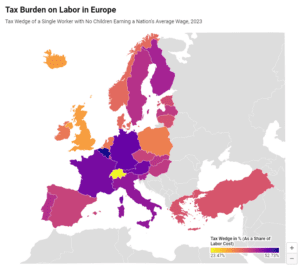

Tax Burden on Labor in Europe, 2024

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

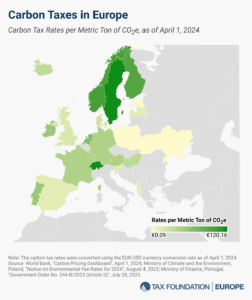

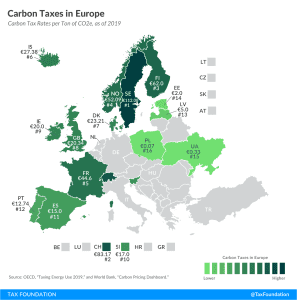

Carbon Taxes in Europe, 2024

23 European countries have implemented carbon taxes, ranging from less than €1 per metric ton of carbon emissions in Ukraine to more than €100 in Sweden, Liechtenstein, and Switzerland.

3 min readAll European Tax Data

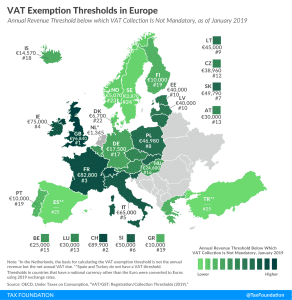

VAT Exemption Thresholds in Europe

Due to certain VAT exemption thresholds, many small businesses will not be able to benefit from the VAT changes being introduced throughout Europe to provide relief during the COVID-19 crisis.

2 min read

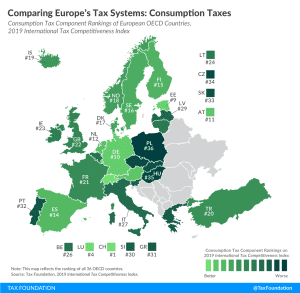

Reliance on Consumption Taxes in Europe

2 min read

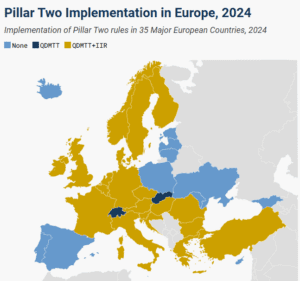

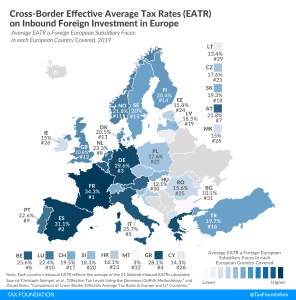

Comparison of Cross-Border Effective Average Tax Rates in Europe and G7 Countries

As policymakers consider ways to facilitate investment, effective average tax rates provide a valuable perspective on where burdens on those activities are high and where they are low.

16 min read

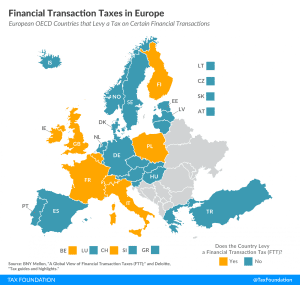

Financial Transaction Taxes in Europe

2 min read

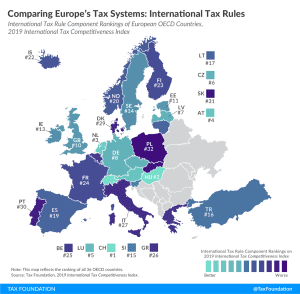

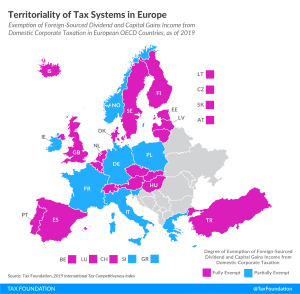

Territoriality of Tax Systems in Europe

3 min read

VAT Rates in Europe, 2020

3 min read

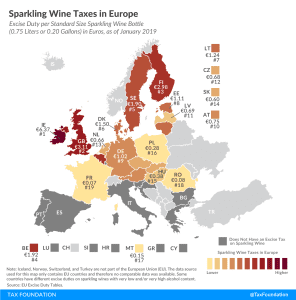

Sparkling Wine Taxes in Europe

1 min read

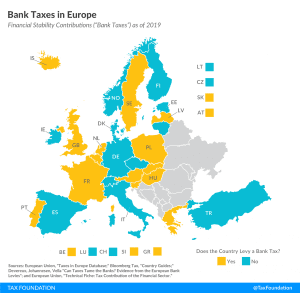

Bank Taxes in Europe

2 min read

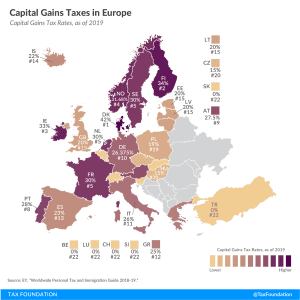

Capital Gains Taxes in Europe, 2019

2 min read

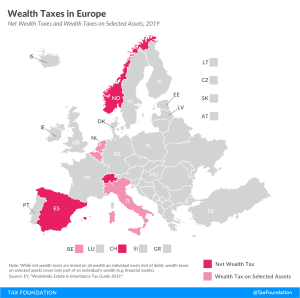

Wealth Taxes in Europe, 2019

Only three European countries levy a net wealth tax, namely Norway, Spain, and Switzerland. Belgium, Italy, and the Netherlands levy wealth taxes on selected assets, but not on an individual’s net wealth per se.

3 min read

Carbon Taxes in Europe, 2019

3 min read