All Related Articles

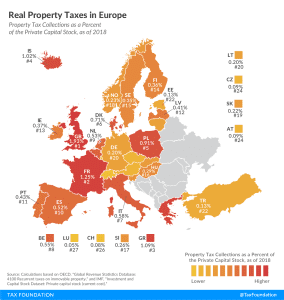

Real Property Taxes in Europe, 2020

High property taxes levied not only on land but also on buildings and structures can discourage investment because they disincentivise investing in infrastructure, which businesses would have to pay additional tax on. For this reason, it may also influence business location decisions away from places with high property tax.

3 min read

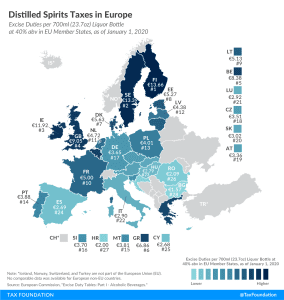

Distilled Spirits Taxes in Europe

2 min read

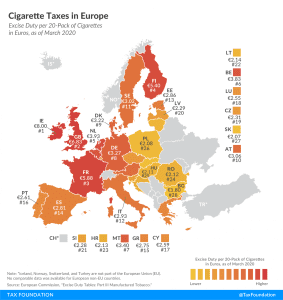

Cigarette Taxes in Europe, 2020

Ireland and the United Kingdom levy the highest excise duties on cigarettes in the European Union (EU), at €8.00 ($8.95) and €6.83 ($7.64) per 20-cigarette pack, respectively. This compares to an EU average of €3.22 ($3.61). Bulgaria (€1.80 or $2.01) and Slovakia (€2.07 or $2.32) levy the lowest excise duties.

3 min read

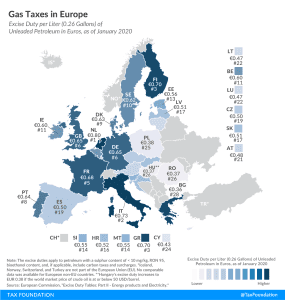

Gas Taxes in Europe, 2020

4 min read

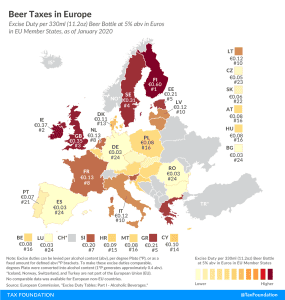

Beer Taxes in Europe, 2020

3 min read

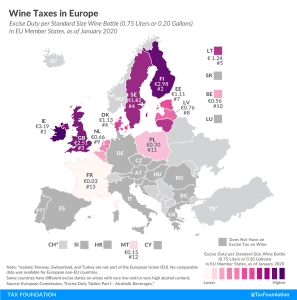

Wine Taxes in Europe

2 min read

Capital Gains Tax Rates in Europe, 2020

2 min read

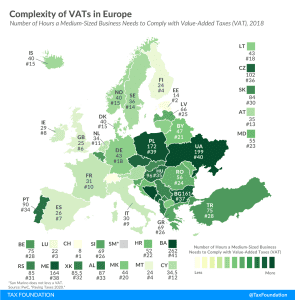

Complexity of VATs in Europe

2 min read

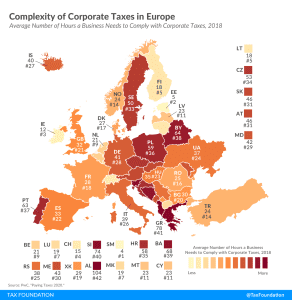

Complexity of Corporate Taxes in Europe

3 min read

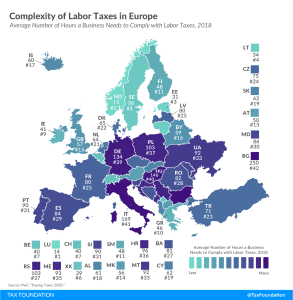

Complexity of Labor Taxes in Europe

2 min read

Tax Relief for Families in Europe

Most countries provide tax relief to families with children—typically through targeted tax breaks that lower income taxes. While all European OECD countries provide tax relief for families, its extent varies substantially across countries.

2 min read

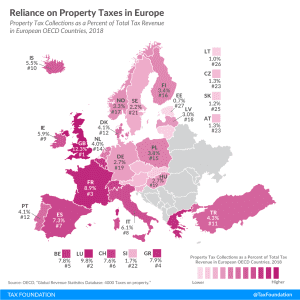

Reliance on Property Taxes in Europe

1 min read

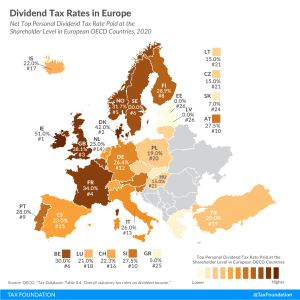

Dividend Tax Rates in Europe, 2020

2 min read

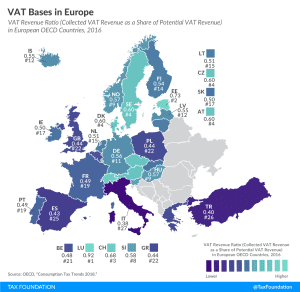

VAT Bases in Europe

The extent to which businesses and consumers will benefit from coronavirus relief measures like temporary VAT changes will depend on the VAT base.

2 min read

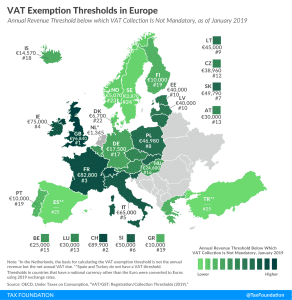

VAT Exemption Thresholds in Europe

Due to certain VAT exemption thresholds, many small businesses will not be able to benefit from the VAT changes being introduced throughout Europe to provide relief during the COVID-19 crisis.

2 min read