Tax Calculator: How the TCJA’s Expiration Will Affect You

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

At the end of 2025, the individual tax provisions in the Tax Cuts and Jobs Act (TCJA) expire all at once. Without congressional action, most taxpayers will see a notable tax increase relative to current policy in 2026.

4 min read

Policymakers should have two priorities in the upcoming economic policy debates: a larger economy and fiscal responsibility. Principled, pro-growth tax policy can help accomplish both.

21 min read

Lawmakers should see 2025 as an opportunity to consider more fundamental tax reforms. While the TCJA addressed some of the deficiencies of the tax code, it by no means addressed them all.

8 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

The TCJA improved the U.S. tax code, but the meandering voyage of its passing and the compromises made to get it into law show the challenges of the legislative process.

6 min read

The Tax Cuts and Jobs Act’s changes to family tax policy serve as a reminder to avoid looking at tax reform provisions in a vacuum.

5 min read

The Tax Cuts and Jobs Act (TCJA) significantly lowered the effective tax rates on business income, but the impact was not the same for C corporations and pass-through businesses.

6 min read

As lawmakers consider which policies to prioritize in the upcoming tax policy debates, better cost recovery for all investment should be top of mind.

7 min read

Pro-growth tax reform that does not add to the deficit will require tough choices, but whether to raise the corporate tax rate is not one of them. If lawmakers want to craft fiscally responsible and pro-growth tax reform, a higher corporate tax rate simply does not fit into the puzzle.

3 min read

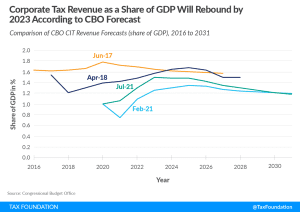

The 2017 Tax Cuts and Jobs Act (TCJA) was the largest corporate tax reform in a generation, lowering the corporate tax rate from 35 percent to 21 percent, temporarily allowing full expensing for short-lived assets (referred to as bonus depreciation), and overhauling the international tax code.

6 min read

As members of Congress prepare to address the expiration of the TCJA, they should appreciate how revenues have evolved since 2017.

4 min read

While the approaches differ, they share a reliance on similar linkages: new capital investment drives productivity growth, which grows the economy and raises wages for workers.

37 min read

The Tax Cuts and Jobs Act of 2017 (TCJA) reformed the U.S. system for taxing international corporate income. Understanding the impact of TCJA’s international provisions thus far can help lawmakers consider how to approach international tax policy in the coming years.

30 min read

Two major provisions in the federal tax code have been limited since the Tax Cuts and Jobs Act (TCJA) of 2017: the state and local tax (SALT) deduction and the home mortgage interest deduction (MID).

3 min read

This year’s robust corporate tax collections calls into question efforts by the administration and congressional Democrats to increase the corporate tax rate and raise other corporate taxes based on claims of relatively low tax collections following the Tax Cuts and Jobs Act (TCJA) in 2017.

2 min read

In general, the effective tax rates on the foreign profits of U.S. multinationals are not that low relative to the U.S. tax rate, contrary to popular rhetoric.

7 min read

Congressional lawmakers are putting together a reconciliation bill to enact much of President Biden’s Build Back Better agenda. Many lawmakers including Senate Finance Committee Chair Ron Wyden (D-OR), however, want to make their own mark on the legislation.

5 min read

Over the next ten years, the structure of the Child Tax Credit (CTC) is scheduled to change, complicating efforts to extend enhanced CTC benefits or reform the CTC for the long-term. Rather than take an all-or-nothing approach or kick the can down the road by relying on temporary expansions, lawmakers could consider alternative options that better target low-income households, retain work incentives, reduce the impact on federal revenue, and provide taxpayers with a stable, consistent tax code.

8 min read

As lawmakers are reviewing international tax rules and determining what to change and update, they should pay attention to the way GILTI interacts with profitable and loss-making companies.

5 min read

Temporary policy creates uncertainty for taxpayers and scheduling more expirations will add to the already-expiring provisions under the Tax Cuts and Jobs Act (TCJA) of 2017.

3 min read

While arcane, expense allocation rules are relevant to current debates because they result in a heavier tax burden for U.S. companies under current law than the recently negotiated global minimum tax proposal.

10 min read

There are many ways the U.S.’s international tax rules could be changed, reformed, improved, or worsened. Reflexively jacking up taxes on U.S. multinationals does not necessarily accomplish the goal of reducing or eliminating profit shifting, and it would in fact worsen it.

6 min read

Sen. Wyden recently introduced the Small Business Tax Fairness Act—the impact of which we modeled—to reform the Section 199A pass-through business deduction created in the Tax Cuts and Jobs Act (TCJA) of 2017. The provision currently allows taxpayers to deduct up to 20 percent of their qualified business income from their taxable income, subject to certain limitations.

2 min read

The Biden administration’s international tax proposals would impose a 7.7 percent surtax on the foreign profits of U.S. multinationals, resulting in a net increase in profit shifting out of the U.S.

60 min read

CBO data shows that the TCJA reduced federal tax rates for households across every income level while increasing the share of tax paid by the top 1 percent.

4 min read

In light of these forecasts, which could be revised upwards further given the pace of growth in the economy and corporate profits, it seems clear that the 2017 tax reform did not substantially reduce the revenue potential of the corporate tax.

3 min read

Three upcoming tax law changes scheduled by the 2017 Tax Cuts and Jobs Act (TCJA) to help offset its revenue losses would be canceled by proposed legislation that would prevent the tax treatment of investment from worsening over the coming years.

4 min read

The Biden administration has suggested several tax increases for his infrastructure plan. Public infrastructure can help increase economic growth, but by raising taxes on private investment, the net effect on growth may be negative. However, tax options like retaining expensing for private R&D investment or making 100 percent bonus depreciation for equipment permanent would be complementary to the goals of infrastructure spending.

5 min read

As tempting as inheritance, estate, and gift taxes might look especially when the OECD notes them as a way to reduce wealth inequality, their limited capacity to collect revenue and their negative impact on entrepreneurial activity, savings, and work should make policymakers consider their repeal instead of boosting them.

5 min read

While strong economic growth—fueled by higher levels of investment, productivity, and jobs—will lift after-tax incomes over time, policies that provide relief by immediately boosting after-tax incomes of lower-income households are also available. As lawmakers consider such policies, they should keep in mind the trade-offs among them.

4 min read

In his first 100 days as president, Joe Biden has proposed more than a dozen significant changes to the U.S. tax code that would raise upwards of $3 trillion in revenue and reduce incentives to invest, save, and work in the United States.

4 min read

Kansas has the revenue cushion it needs to provide tax relief to individuals and businesses and improve the structure of its tax code in the process. These pro-growth reforms would not only help taxpayers amid the pandemic but would also promote economic recovery and growth in a state that is lagging behind its competitors.

7 min read

Excluding Global Intangible Low-Taxed Income (GILTI) from taxation and reducing the state’s top marginal corporate rate would improve the state’s economic competitiveness and are among the top income tax modernization priorities Nebraska policymakers ought to consider.

4 min read