The Commonwealth’s Case for Corporate Tax Reforms

The Pennsylvania Senate Finance Committee recently advanced two bills, SB 345 and SB 346, that would build on last year’s historic corporate net income tax (CNIT) reform.

7 min readAcademic studies show that higher corporate tax rates depress worker wages and lead to fewer jobs. An Organisation for Co-operation and Development (OECD) study has found that the corporate tax is the least efficient and most harmful way for governments to raise revenue.

The Pennsylvania Senate Finance Committee recently advanced two bills, SB 345 and SB 346, that would build on last year’s historic corporate net income tax (CNIT) reform.

7 min read

Rather than continue down the path of growing debt, lawmakers should craft a comprehensive solution. International experience cautions against tax-based fiscal consolidations, but modest tax increases may be part of a successful debt reduction package.

6 min read

As Minnesota lawmakers consider making theirs the first state to mandate worldwide combined reporting, they are relying on a revenue estimate that is—this may not be the technical term—completely bogus.

7 min read

Permanent full expensing is an efficient and neutral tax policy that will allow markets to allocate private investment effectively while moving the economy towards the climate goals of the EU.

33 min read

By letting the corporate surtax expire, eliminating taxes on GILTI, and embracing full expensing, New Jersey would take important steps toward creating a more welcoming and competitive tax environment.

6 min read

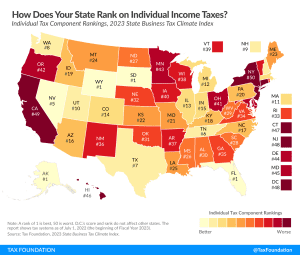

Individual income tax rates can influence location decision-making, especially in an era of enhanced mobility, where it is easier for individuals to move without jeopardizing their current job, or without limiting the scope of their search for a new one.

5 min read

When a country has a broad base with a simple and transparent tax code, small rate changes have little influence. Therefore, policymakers shouldn’t only focus on rate changes when it comes to increasing tax competitiveness.

4 min read

As policymakers in St. Paul finalize this year’s tax bill, they should avoid policies that incentivize the diversion or relocation of capital. Importantly, states do not institute tax policy in a vacuum. The evidence from states’ experiences and the academic literature supports the conclusion that tax competitiveness matters not just to businesses but to human flourishing.

15 min read

While some temporary policies can help in a crisis, policymakers should focus their efforts on sustainable policies that support growth and the resilience of businesses (and government coffers) over the long term.

6 min read

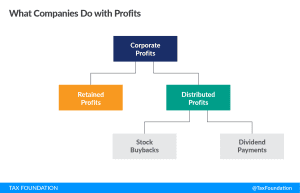

The distributed profits tax is a sounder approach to concerns about investment and stock buybacks than the existing policy approach.

6 min read

Scandinavian countries are well known for their broad social safety net and their public funding of services such as universal health care, higher education, parental leave, and child and elderly care. So how do Scandinavian countries raise their tax revenues?

7 min read

Consistent principles ought to apply across the tax code. In the case of intangible drilling costs, companies should be able to claim full deductions for the costs they incur.

4 min read

Accelerating its current individual income tax triggers and setting up the corporate income tax for eventual elimination would increase Missouri’s attractiveness among states at a time when businesses are increasingly mobile and tax competition matters more than ever.

4 min read

To recover from the pandemic and put the global economy on a trajectory for growth, policymakers need to aim for more generous and permanent capital allowances. This will spur real investment and can also contribute to more environmentally friendly production across the globe.

33 min read

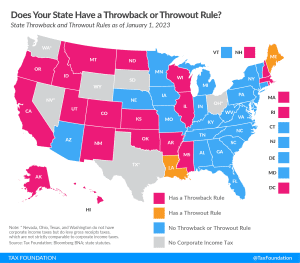

While throwback and throwout rules in states’ corporate tax codes may not be widely understood, they have a notable impact on business location and investment decisions and reduce economic efficiency.

4 min read

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

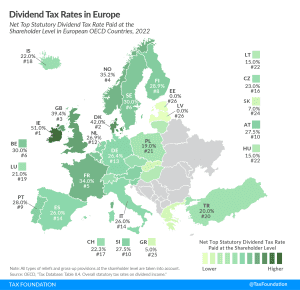

In many countries, corporate profits are subject to two layers of taxation: the corporate income tax at the entity level when the corporation earns income, and the dividend tax or capital gains tax at the individual level when that income is passed to its shareholders as either dividends or capital gains.

3 min read

According to our analysis, President Biden’s budget would reduce long-run economic output by about 1.3 percent and eliminate 335,000 FTE jobs. See what tax policies the president is proposing.

17 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

The UK’s adoption of full expensing is a welcome step that may generate short-run economic benefits. However, for the reform to have a meaningful effect on the UK’s international competitiveness and long-run economic performance, it must be made permanent—which the British government has said it hopes to do.

6 min read