Summary of the Latest Federal Income Tax Data, 2023 Update

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

When we discuss tax policy, the conversation inevitably turns to who pays, who should pay, and how much they should pay. Unfortunately, the tax burdens debate is often missing a key point: how income transfer programs—like Social Security or Medicaid—affect households’ tax burdens.

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

Recent discussions of a proposed wealth tax for the United States have included little information about trends in wealth taxation among other developed nations. However, those trends and the current state of wealth taxes in OECD countries can provide context for U.S. proposals.

3 min read

When examining how tax policy impacts the economy, researchers typically look at labor supply and investment responses. One other channel through which taxes impact the economy has been less studied: innovation.

3 min read

Congressional Democrats are reported to be weighing a special tax on the assets of billionaires to raise revenues to pay for their Build Back Better spending plan. There are two fundamental challenges to such a plan.

8 min read

One has to wonder how stable or sustainable the Democrats’ spending program can be if it must rely so heavily on the taxes paid by such a small number of taxpayers as in the top 1 percent.

5 min read

The White House Council of Economic Advisors (CEA)’s recent report estimates the average federal individual income tax rate for the top 400 wealthiest households in the U.S to be 8.2 percent, lower than typically estimated for top earners.

4 min read

As Congress considers several tax proposals designed to raise taxes on high-income earners, it’s worth considering the distribution of the existing tax code.

3 min read

How do current federal individual income tax rates and brackets compare historically?

1 min read

According to the Tax Policy Center, an estimated 60 percent of U.S. households paid no income tax in 2020, up from around 43 percent of households in 2019.

4 min read

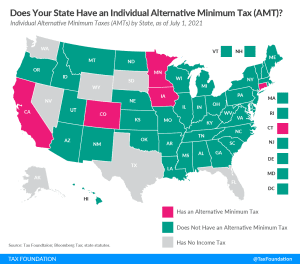

The original goal of AMTs—to prevent deductions from eliminating income tax liability altogether—can be accomplished best by simplifying the existing tax structure, not by creating an alternative tax which adds complexity and lacks transparency and neutrality.

2 min read

To fully follow the Scandinavian model would require additional taxes that place a higher burden on middle-income earners, but instead, Biden proposes higher taxes on corporations and households making more than $400,000.

3 min read

The Biden administration has targeted U.S. businesses, including corporations and passthrough entities, to raise revenue to fund new spending. However, individual taxpayers across America will end up footing the bill.

4 min read

The Biden administration has primarily focused on increasing taxes on top earners to generate revenue to fund its spending priorities. However, these proposals would hit many pass-through businesses and much of pass-through business income, including small businesses, family-owned businesses, and farms.

3 min read

The redistribution of income from the Biden administration’s tax proposals would involve many winners and losers, not only across different types of taxpayers but also geographically across the country. Launch our new interactive map to see average tax changes by state and congressional district over the budget window from 2022 to 2031.

8 min read

Expanding the generosity of tax credits for lower-income individuals can help make the tax code more progressive, but it also reduces federal revenue. Pairing a credit expansion with a tax offset may sustain federal revenue but can also hamper economic growth.

3 min read

Explore President Biden budget proposals, including tax and spending in American Jobs Plan and American Families Plan. See Biden tax and spending proposals.

12 min read

Taxes are once again at the forefront of the public policy debate as legislators grapple with how to fund new infrastructure spending, among other priorities. Our tax tracker helps you stay up-to-date as new tax plans emerge from the Biden administration and Congress.

1 min read

Rather than relying on damaging corporate tax hikes, policymakers should consider user fees and consumption taxes as options for financing new infrastructure to ensure that a compromise does not end up being a net negative for the U.S. economy.

2 min read