All Related Articles

Illustrating Senator Warren’s Taxes on Capital Income

Taken together, these proposed tax changes would significantly raise marginal and effective tax rates and increase the cost of capital, all of which would lead to a reduced level of output and less revenue than anticipated.

5 min read

2020 Tax Brackets

The IRS recently released the new 2020 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

5 min read

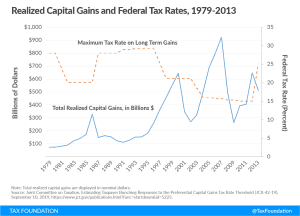

JCT Report Shows Capital Gains are Sensitive to Taxation

JCT’s report on capital gains elasticities reminds us that capital gains realizations, at least under a tax system that allows deferral, are sensitive to tax rates. Moving to mark-to-market taxation of all capital gains would remove this sensitivity by taxing capital gains annually.

4 min read

Evaluating Senator Wyden’s “Mark-to-Market” Capital Gains Tax

Wyden’s “mark-to-market” proposal strives to subject capital gains to the same treatment as ordinary income. While the plan resolves the “lock in effect” issue and would make the tax code more progressive, it would increase the tax burden on savers and increase tax code complexity.

2 min read

Senator Van Hollen Introduces Proposal to Raise Taxes on High-Income Households

Van Hollen’s proposals add to the long list of Democratic Party tax proposals that attempt to both raise additional revenue from corporations and high-income households and make the tax code more progressive and “equitable.”

3 min read

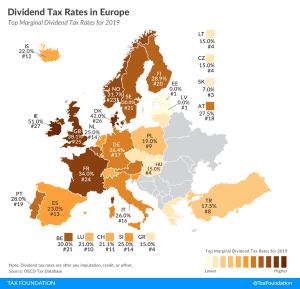

Dividend Tax Rates in Europe, 2019

2 min read

Measuring Opportunity Zone Success

16 min read

What’s Going on With the Kiddie Tax?

2 min read

Sources of Government Revenue in the OECD, 2019 Update

OECD countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

10 min read