All Related Articles

After the UK Super-Deduction: Assessing Proposals for the Reform of Capital Allowances

For many years, the UK has adopted a strikingly ungenerous approach to capital cost recovery – the ability of firms to write off investment against tax. This has coincided with consistently low levels of business investment. The super-deduction, which has temporarily made the UK tax system much more supportive of capital investment in plant and machinery is set to expire.

34 min read

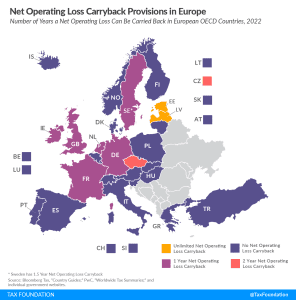

Net Operating Loss Carryforward and Carryback Provisions in Europe, 2022

Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

4 min read

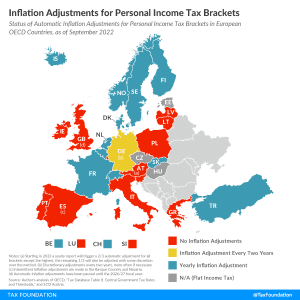

Inflation and Europe’s Personal Income Taxes

With continued concerns over inflation, individuals may be wondering how their tax bills will be impacted. Less than half of OECD countries in Europe automatically adjust income tax brackets for inflation every year.

3 min read

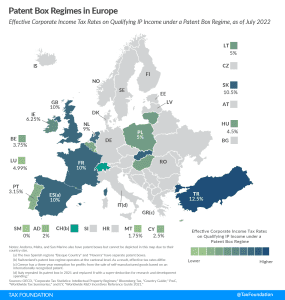

Patent Box Regimes in Europe, 2022

Patent box regimes (also referred to as intellectual property, or IP, regimes) provide lower effective tax rates on income derived from IP. Most commonly, eligible types of IP are patents and software copyrights. Currently, 13 of the 27 EU member states have a patent box regime.

4 min read

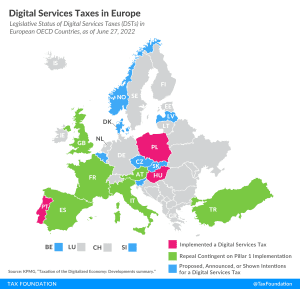

Digital Services Taxes in Europe, 2022

About half of all European OECD countries have either announced, proposed, or implemented a digital services tax.

7 min read

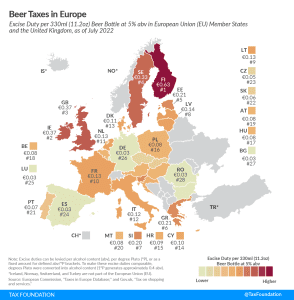

Beer Taxes in Europe, 2022

’Tis the season to crack open a cold one. Ahead of International Beer Day on August 5th, let’s take a minute to discover how much of your cash is actually going toward the cost of a brew with this week’s tax map, which explores excise duties on beer.

3 min read

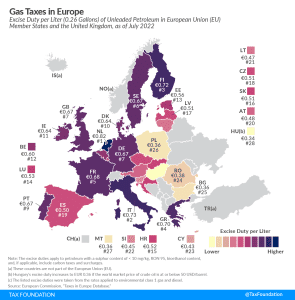

Gas Taxes in Europe, 2022

The Netherlands has the highest gas tax in the European Union, at €0.82 per liter ($3.69 per gallon). Italy applies the second highest rate at €0.73 per liter ($3.26 per gallon), followed by Finland at €0.72 per liter ($3.24 per gallon).

5 min read

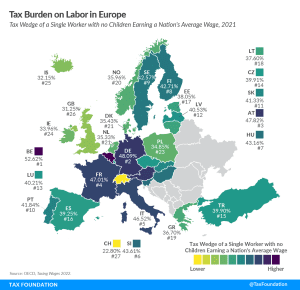

Tax Burden on Labor in Europe, 2022

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

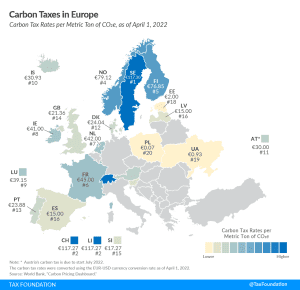

Carbon Taxes in Europe, 2022

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

3 min read

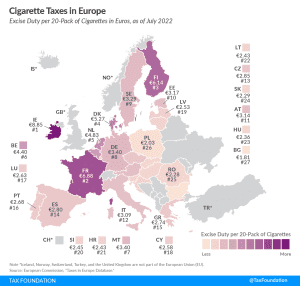

Cigarette Taxes in Europe, 2022

Ireland and France levy the highest excise duties on cigarettes in the EU, at €8.85 ($10.47) and €6.88 ($8.13) per 20-cigarette pack, respectively.

3 min read

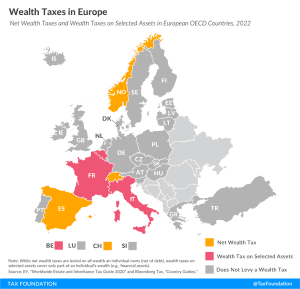

Wealth Taxes in Europe, 2022

Only three European OECD countries levy a net wealth tax, namely Norway, Spain, and Switzerland.

3 min read

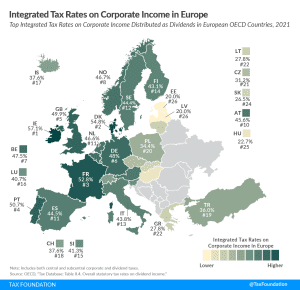

Integrated Tax Rates on Corporate Income in Europe, 2022

In most European OECD countries, corporate income is taxed twice, once at the entity level and once at the shareholder level.

4 min read

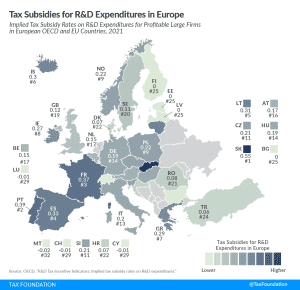

Tax Subsidies for R&D Expenditures in Europe, 2022

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offers R&D tax incentives.

3 min read

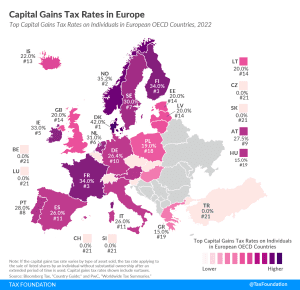

Capital Gains Tax Rates in Europe, 2022

In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Denmark levies the highest top capital gains tax among European OECD countries, followed by Norway, Finland, and France.

4 min read

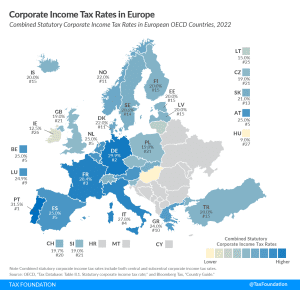

Corporate Income Tax Rates in Europe, 2022

Portugal, Germany and France have the highest corporate tax rates in Europe. How does your country compare?

2 min read

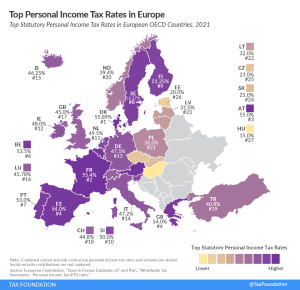

Top Personal Income Tax Rates in Europe, 2022

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

2 min read

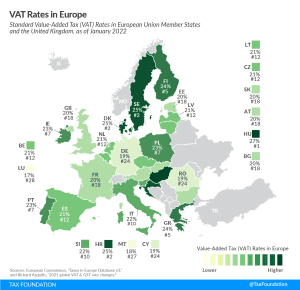

VAT Rates in Europe, 2022

The VAT is a consumption tax assessed on the value added in each production stage of a good or service. Every business along the value chain receives a tax credit for the VAT already paid. The end consumer does not, making it a tax on final consumption.

4 min read

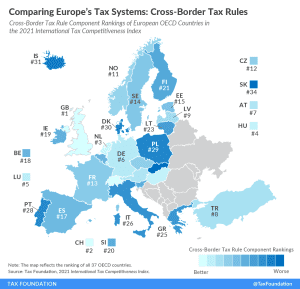

Comparing Europe’s Tax Systems: Cross-Border Tax Rules

Cross-border tax rules define how income earned abroad and by foreign entities are taxed domestically, making them an important element of each country’s tax code.

3 min read

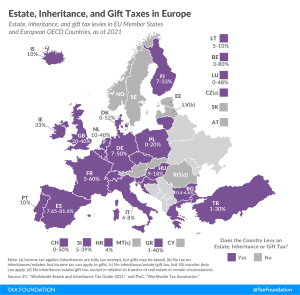

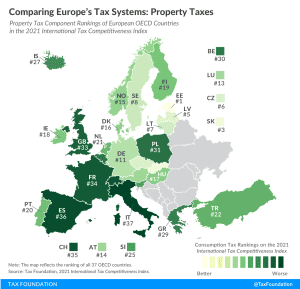

Comparing Europe’s Tax Systems: Property Taxes

According to the 2021 International Tax Competitiveness Index, Switzerland has the best-structured consumption tax among OECD countries while Poland has the worst-structured consumption tax code.

2 min read