All Related Articles

How Burdensome Are Your State’s Nonresident Income Tax Filing Laws?

One relatively easy but meaningful step policymakers can take to make future tax seasons less burdensome is to modernize their state’s nonresident income tax filing, withholding, and reciprocity laws.

7 min read

The Impact of BEPS 1.0

The global landscape of international corporate taxation is undergoing significant transformations as jurisdictions grapple with the difficulty of defining and apportioning corporate income for the purposes of tax.

22 min read

Unstable Taxes and an Unpredictable Future

When the tax code is stable and predictable, individuals, families, and businesses can set goals for the future and make plans to achieve them.

New National Tax Literacy Poll Highlights Need for Better Tax Education

Despite taxes playing a significant role in personal finances and being levied on a sizable portion of the U.S. population, most Americans are not just unhappy with the current tax code but also do not understand it.

4 min read

Facts & Figures 2024: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Considering Tax Reform Options for 2025 (and Beyond)

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

Maryland’s Worldwide Combined Reporting: To Be or Not to Be?

By violating the principles of simplicity, neutrality, and stability, and failing to raise significant revenue, worldwide combined reporting at the state level is doomed to fail.

6 min read

Sources of Government Revenue in the OECD, 2024 Update

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

3 min read

Unpacking the Impact of TCJA, IRA, and CHIPS on the U.S. Economy

We’re examining the differences between the broad incentives provided by the Tax Cuts and Jobs Act and the targeted approach of the Inflation Reduction Act and the CHIPS and Science Act.

U.S. Must Fix R&D Treatment to Compete with China

Though providing permanent R&D expensing alone would not be a China-competition magic bullet, it is a no-brainer place to start. In this technological race, we should first make sure we have not tied our own shoes together.

4 min read

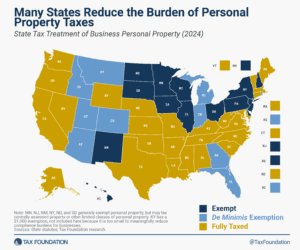

Tangible Personal Property De Minimis Exemptions by State, 2024

Does your state have a small business exemption for machinery and equipment?

3 min read

Launching Tax Foundation Europe

As the world of tax policy becomes more interconnected, the Tax Foundation is stepping up, recognizing the pressing need for informed and principled tax policy education in an ever-evolving landscape.

How Are Remote and Hybrid Workers Taxed?

Working from home is great. The tax complications? Not so much.

4 min read

Costly Inputs: Unraveling Sales Tax’s Impact on Businesses

Sales taxes go beyond a few extra bucks at the register. It’s not just about what you pay, but who pays. What are the implications of state sales tax bases across the U.S.?

Five Facts to Know about the Bipartisan Tax Deal

The U.S. House of Representatives has passed a highly anticipated bipartisan tax deal. The Tax Relief for American Workers and Families Act now awaits action in the Senate.

6 min read

Maryland Considers Raising Local Income Taxes

Local income taxes in Maryland constitute about 35 percent of local tax collections and more than 17 percent of local revenue, giving Maryland’s localities the highest dependence on income taxes in the nation.

5 min read

Mind the Gap, Please! How Portugal Could Reform Its VAT System

Portugal’s value-added tax (VAT) policy is a treasure trove of tax oddities. Thankfully, VAT base broadening is an ideal instrument to give the Portuguese government the fiscal room to implement pro-growth tax reforms

5 min read

The Impact of GILTI, FDII, and BEAT

The Tax Cuts and Jobs Act of 2017 (TCJA) reformed the U.S. system for taxing international corporate income. Understanding the impact of TCJA’s international provisions thus far can help lawmakers consider how to approach international tax policy in the coming years.

30 min read

Exploring the Impact of the 2024 Tax Relief Act

We’re exploring the intricacies of the latest congressional act stirring up Washington—The Tax Relief for American Families and Workers Act of 2024.