Summary of the Latest Federal Income Tax Data, 2023 Update

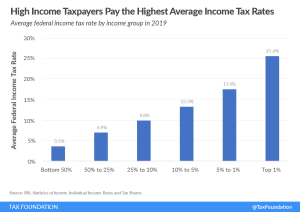

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

When we discuss tax policy, the conversation inevitably turns to who pays, who should pay, and how much they should pay. Unfortunately, the tax burdens debate is often missing a key point: how income transfer programs—like Social Security or Medicaid—affect households’ tax burdens.

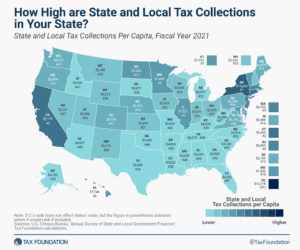

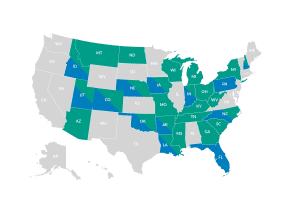

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read

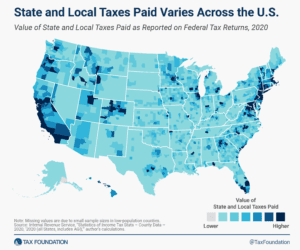

The fate of the $10,000 cap on state and local tax (SALT) deductions remains uncertain, with some policymakers pushing for an increase or repeal of the cap before its scheduled expiration in 2026.

6 min read

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

4 min read

The 2023 version of the International Tax Competitiveness Index is the 10th edition of the report. Let’s take a look back and see how country ranks have changed over time.

5 min read

Lawmakers will have to weigh the economic, revenue, and distributional trade-offs of extending or making permanent the various provisions of the TCJA as they decide how to approach the upcoming expirations. A commitment to growth, opportunity, and fiscal responsibility should guide the approach.

18 min read

What do The Rolling Stones, NFL star Tyreek Hill, and Maryland millionaires have in common? They all moved because of taxes.

4 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

88 min read

Income taxes impose steeper economic costs, and often steeper administrative and compliance costs, than consumption taxes. Moving to a consumption tax would end the tax bias against saving and investment and provide an opportunity to greatly simplify anti-poverty programs embedded in the tax code.

45 min read

The 2023 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

6 min read

In recent years, European countries have undertaken a series of tax reforms designed to maintain tax revenue levels while protecting households and businesses from high inflation.

8 min read

As increased political attention focuses on the state of the American worker, expect to see a resurgence of the argument that the labor share of income is in decline.

5 min read

Any move to repeal the cap or enhance the deduction would disproportionately benefit higher earners, making the tax code more regressive.

5 min read

Now is the time for lawmakers to focus on long-term fiscal sustainability, as further delay will only make an eventual fiscal reckoning that much harder and more painful. Congressional leaders should follow through on convening a fiscal commission to deal with the long-term budgetary challenges facing the country.

35 min read

Given that wealth taxes collect little revenue and have the potential to disincentivize entrepreneurship and investment, perhaps European countries should repeal them rather than implement one across the continent.

4 min read

This tax reform plan would boost long-run GDP by 2.5%, grow wages by 1.4%, and add 1.3M jobs, all while collecting a similar amount of tax revenue as the current code and reducing the long-run debt burden.

39 min read

The price tag of the Inflation Reduction Act’s green energy tax credits is much higher than originally thought. Among other things, the updated analysis indicates the Inflation Reduction Act does not reduce deficits after all.

6 min read

When we discuss tax policy, the conversation inevitably turns to who pays, who should pay, and how much they should pay. Unfortunately, the tax burdens debate is often missing a key point: how income transfer programs—like Social Security or Medicaid—affect households’ tax burdens.

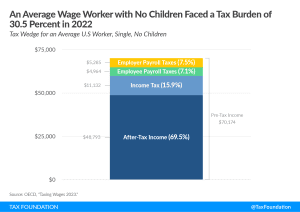

Although the U.S. has a progressive tax system and a relatively low tax burden compared to the OECD average, average-wage workers still pay more than 30 percent of their wages in taxes.

4 min read

Rather than continue down the path of growing debt, lawmakers should craft a comprehensive solution. International experience cautions against tax-based fiscal consolidations, but modest tax increases may be part of a successful debt reduction package.

6 min read