Income Tax Earmarking and Grocery Taxes on the Ballot in Utah

Utah is the only state to earmark the entirety of one of its major taxes, but a measure on the ballot this November might change that.

4 min read

Utah is the only state to earmark the entirety of one of its major taxes, but a measure on the ballot this November might change that.

4 min read

The sales tax is the second-largest source of state tax revenue and an important source of local tax revenue, but decades of base erosion threaten the tax’s share of overall revenue and have prompted years of countervailing rate increases.

72 min read

In her campaign for president, VP Kamala Harris has embraced all the tax increases President Biden proposed in the White House FY 2025 budget—including a new idea that would require taxpayers with net wealth above $100 million to pay a minimum tax on their unrealized capital gains from assets such as stocks, bonds, or privately held companies.

5 min read

Lawmakers should consider compliance costs—not just tax liabilities—when evaluating reforms to business income taxation.

22 min read

Eliminating the property tax will unfortunately set North Dakota back in significant ways, making the state a national outlier and eroding regional competitiveness.

6 min read

World War II shaped many aspects of the modern world, including the US tax code. But the dramatic changes to our system that military mobilization required didn’t subside when the fighting finished; they’ve persisted to today.

4 min read

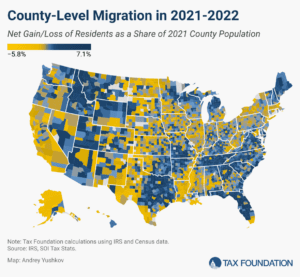

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

8 min read

States would do better to broaden the sales tax base to include currently exempt classes of final consumption than to impose disproportionate taxes on prepared foods.

6 min read

If lawmakers are convinced that new revenues must be part of any long-term effort to solve the budget crisis or offset the cost of extending the TCJA, they must choose the least harmful ways of raising new revenues or else risk undermining their efforts by slowing economic growth.

7 min read

Dive into the highlights from the DNC as we break down Vice President Kamala Harris’s tax proposals and their potential impact on everyday families. What do higher taxes on businesses and the wealthy mean for working Americans?

Explore the latest EU tobacco and cigarette tax rates, including EU excise duties on cigarettes. Compare cigarette taxes in Europe.

3 min read

The recently released FY 2025 budget for New York State signals a degree of optimism, with caveats. New York cannot tax itself toward a balanced budget.

6 min read

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts—especially as a large number of major cities have combined rates of 9 percent or more.

6 min read

How does living abroad impact the taxes an American has to pay? Unlike most countries that tax based on residency, the US employs citizenship-based taxation, meaning Americans are taxed on their global income regardless of where they reside.

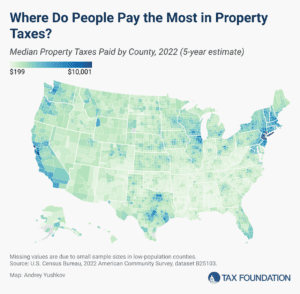

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues.

6 min read

To encourage greater saving, the US federal income tax provides tax-neutral treatment to some types of saving through a variety of accounts. The type of tax treatment, contribution limits, withdrawal rules, and use cases for contributions all vary by account, leading to a complicated system for households to navigate.

11 min read

With pandemic-era savings now fully depleted and the majority of Americans pointing to their finances as their biggest source of stress, one thing is clear: the US needs policies that help people save more.

4 min read

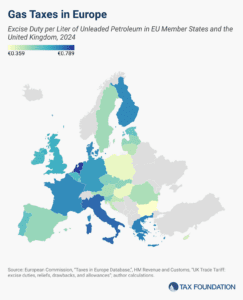

Gas and diesel taxes continue to be prominent policy issues throughout Europe. As the EU undergoes sweeping changes for its green transition, fuel taxes are likely to be a crucial aspect of policy discussions.

3 min read

The government provides various services at the federal, state, and local levels. How are they paid for? Taxes.

Not every change in the Tax Cuts and Jobs Act simplified the tax code. However, the TCJA reduced compliance costs overall for individual filers, and allowing fundamental structural improvements to expire would make the tax code worse.

5 min read