State Tax Changes Taking Effect July 1, 2024

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

13 min read

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

13 min read

Both candidates should provide clear and honest answers about their plans (or lack thereof) to address the nation’s urgent tax policy issues.

8 min read

Portland residents face some of the country’s highest taxes on just about every class of income. In an era of dramatically increased mobility for individuals and businesses alike, that’s not a recipe for success.

11 min read

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the US in a distinctly uncompetitive international position and threaten the health of the US economy.

19 min read

The government won in Moore. However, given the narrow opinion of the court and the reasoning in the Barrett concurrence and the Thomas dissent, it seems likely that future rulings under other facts and circumstances could favor taxpayers instead.

7 min read

The Tax Cuts and Jobs Act (TCJA) significantly lowered the effective tax rates on business income, but the impact was not the same for C corporations and pass-through businesses.

6 min read

Neutral tax codes don’t play favorites or try to influence personal or business decisions but stick to what they’re best at – raising sufficient revenue through low rates and a broad base.

Former President Trump floated the possibility of entirely replacing the federal income tax with new tariffs. He also raised other ideas like eliminating taxes on tipped income and lowering the corporate tax rate by one percentage point.

8 min read

To stay competitive in an increasingly mobile post-pandemic world, states and localities must learn from the tax policy successes and failures of their neighbors and communities across the nation.

27 min read

The Tax Cuts and Jobs Act’s changes to family tax policy serve as a reminder to avoid looking at tax reform provisions in a vacuum.

5 min read

Lawmakers should see 2025 as an opportunity to consider more fundamental tax reforms. While the TCJA addressed some of the deficiencies of the tax code, it by no means addressed them all.

8 min read

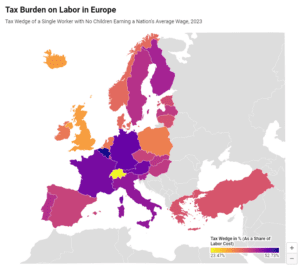

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

Governments often justify higher tax burdens with more extensive public services. However, the cost of these services can be more than half of an average worker’s salary.

16 min read

To make sound financial decisions and support better tax policy, taxpayers should understand the taxes they face. Unfortunately, most U.S. taxpayers do not know or are unsure of basic tax concepts.

6 min read

Universal savings accounts would boost savings for low-income households, allowing them to better withstand economic shocks, such as pandemics and recessions, and plan for major expenses, such as an expanded family, education, and housing needs.

36 min read

The recent push to increase taxes on the wealthy has gained significant traction across Europe. This report highlights the obstacles and complex interplay between tax policy and economic behavior, suggesting that simply raising tax rates on the wealthy might not yield the intended social benefits.

42 min read

With a robust surplus and plenty saved for a rainy day, Kansas can afford substantial tax relief, but not all tax relief is created equal.

7 min read

The Moore case could have important impacts on tax policy.

5 min read

For U.S. policymakers looking to encourage greater saving and financial security, particularly among low- and moderate-income households facing serious affordability challenges, the experiences in both the UK and Canada indicate that universal savings accounts are an effective policy tool to help reach that goal.

4 min read

When Caitlin Clark and Angel Reese made their WNBA preseason debuts, basketball fans across the country tuned in. But there’s another audience that also follows along: state revenue officials, who will expect their piece of the pie each time these star athletes—and their teammates—come to town.

3 min read