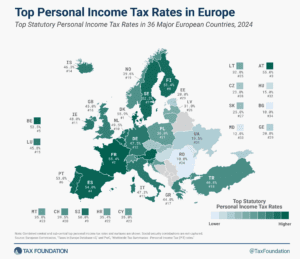

Top Personal Income Tax Rates in Europe, 2024

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

From a revenue standpoint, about $9 billion of the $11.7 billion in lost revenue would accrue to joint filers earning more than $200,000.

5 min read

The U.S. House of Representatives has passed a highly anticipated bipartisan tax deal. The Tax Relief for American Workers and Families Act now awaits action in the Senate.

6 min read

Historical evidence and recent studies have shown that retaliatory tax and trade proposals raise prices and reduce the quantity of goods and services available to U.S. businesses and consumers, resulting in lower incomes, reduced employment, and lower economic output.

5 min read

Portugal’s value-added tax (VAT) policy is a treasure trove of tax oddities. Thankfully, VAT base broadening is an ideal instrument to give the Portuguese government the fiscal room to implement pro-growth tax reforms

5 min read

After years of strong revenue growth, Kansas has substantial cash reserves on hand, and policymakers on both sides of the aisle have expressed a desire to return some of the extra revenue to taxpayers.

5 min read

The House Ways and Means Committee has advanced a tax deal to the House floor that would temporarily—and retroactively—restore two major business deductions for cost recovery and expand the child tax credit through 2025.

10 min read

Lawmakers should use the year ahead to thoroughly review and debate lasting, fundamental tax reform and prioritize policies that best boost work and investment incentives in a fiscally responsible manner.

4 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

The fate of the $10,000 cap on state and local tax (SALT) deductions remains uncertain, with some policymakers pushing for an increase or repeal of the cap before its scheduled expiration in 2026.

6 min read

In Congress, both parties have expressed widespread support for improving the treatment of R&D and potentially extending some or all of the major business provisions, while the White House and congressional Democrats have indicated interest in an expanded child tax credit, suggesting potential for a deal.

6 min read

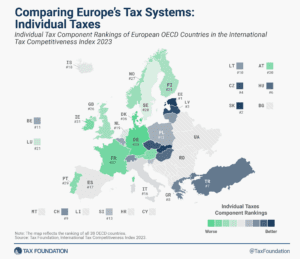

Estonia has the most competitive individual tax system in the OECD for the 10th consecutive year.

2 min read

Explore the IRS inflation-adjusted 2024 tax brackets, for which taxpayers will file tax returns in early 2025.

4 min read

The 2023 version of the International Tax Competitiveness Index is the 10th edition of the report. Let’s take a look back and see how country ranks have changed over time.

5 min read

Lawmakers will have to weigh the economic, revenue, and distributional trade-offs of extending or making permanent the various provisions of the TCJA as they decide how to approach the upcoming expirations. A commitment to growth, opportunity, and fiscal responsibility should guide the approach.

18 min read

The latest tax gap report from the IRS has generated much media attention—and much misunderstanding.

6 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

88 min read

If tax increases are included in a package, international experience points toward raising consumption taxes, rationalizing tax expenditures, and broadening the tax base—not hiking income taxes.

6 min read