It Pays to Keep It Simple

Simplicity in the tax code means taxes should be easy for taxpayers to pay and easy for governments to administer and collect.

Simplicity in the tax code means taxes should be easy for taxpayers to pay and easy for governments to administer and collect.

Any move to repeal the cap or enhance the deduction would disproportionately benefit higher earners, making the tax code more regressive.

5 min read

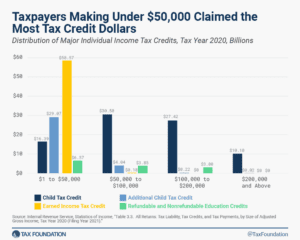

In tax year 2020, taxpayers claimed more than 159 million tax credits on their individual income tax returns worth a total of more than $277 billion. That was an increase of $35.3 billion from tax year 2019, largely due to an influx of pandemic relief administered through the tax code in 2020.

6 min read

Details and analysis of the latest House GOP tax plan, the American Families and Jobs Act. Learn more about the House Republican tax plan.

7 min read

Explore IRS clean energy tax credits, including Direct Pay, the IRA and CHIPS Act tax provisions, and Section 1603 grant program. See more.

7 min read

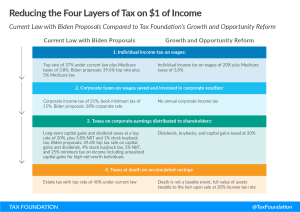

This tax reform plan would boost long-run GDP by 2.5%, grow wages by 1.4%, and add 1.3M jobs, all while collecting a similar amount of tax revenue as the current code and reducing the long-run debt burden.

39 min read

Reviewing reported income helps to understand the composition of the federal government’s revenue base and how Americans earn their taxable income. The individual income tax, the federal government’s largest source of revenue, is largely a tax on labor.

10 min read

What does the tax reform package do well? What does it do poorly? How would it affect me?

4 min read

The current tax treatment of R&D expenses is irrational, complicated, and counterproductive. Fortunately, fixing this problem is a bipartisan issue.

4 min read

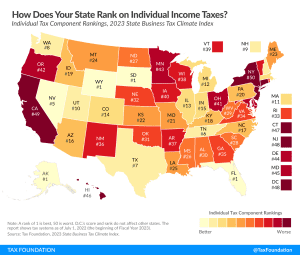

Individual income tax rates can influence location decision-making, especially in an era of enhanced mobility, where it is easier for individuals to move without jeopardizing their current job, or without limiting the scope of their search for a new one.

5 min read

Scandinavian countries are well known for their broad social safety net and their public funding of services such as universal health care, higher education, parental leave, and child and elderly care. So how do Scandinavian countries raise their tax revenues?

7 min read

Michiganders will pay a lower individual income tax rate next year thanks to high general fund revenues, but these savings may be short-lived following an opinion released by the state’s attorney general.

7 min read

While the IRS hopes to increase revenue collection and minimize additional burdens on taxpayers, uncertainty remains regarding its ability to deliver, particularly on the latter. Furthermore, some concerns about the original funding package are already surfacing, specifically around insufficient funding for taxpayer services.

6 min read

When designed well, excise taxes discourage the consumption of products that create external harm and generate revenue for funding services that ameliorate social costs. The effectiveness of excise tax policy depends on the appropriate selection of the tax base and tax rate, as well as the efficient use of revenues.

83 min read

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

According to our analysis, President Biden’s budget would reduce long-run economic output by about 1.3 percent and eliminate 335,000 FTE jobs. See what tax policies the president is proposing.

17 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

The changes put forth in a new package of bills would represent significant pro-growth change for Oklahoma that would set the state up for success in an increasingly competitive tax landscape.

7 min read

Tax reform should be about increasing fairness. And the way to get there is by reducing complexity and double taxation, not by doubling down on them.

6 min read

President Biden’s new budget proposal outlines several major tax increases targeted at businesses and high-income individuals that would bring U.S. income tax rates far out of step with international norms.

7 min read