Reviewing the Tax Changes in Senator Bennet’s Real Deal

The “Real Deal” would increase the tax burden on saving, investing, and working in the United States, and reduce the global competitiveness of the U.S. economy.

3 min read

The “Real Deal” would increase the tax burden on saving, investing, and working in the United States, and reduce the global competitiveness of the U.S. economy.

3 min read

The IRS recently released the new 2020 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

5 min read

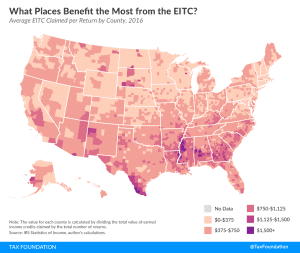

We estimate that a new proposal to expand the EITC would reduce federal revenue by $1.8 trillion and decrease long-run GDP by 0.29 percent, while boosting labor force participation for low-income tax filers by 822,788 full-time equivalent jobs.

10 min read

The IRS recently released its 2019 individual income tax brackets and rates. Check out the new standard deduction, child tax credit, earned income tax credit, rates and brackets, and more.

5 min read