Bumpy Tax Filing Season Ahead Due to IRS Backlog and Pandemic Tax Relief

The National Taxpayer Advocate argued the IRS telephone service “was the worst it has ever been” in 2021, with an answer rate of about 11 percent.

4 min read

The National Taxpayer Advocate argued the IRS telephone service “was the worst it has ever been” in 2021, with an answer rate of about 11 percent.

4 min read

When looking at the tax burden on businesses over time, it is important to provide a complete picture by accounting for the different types of businesses in the U.S. and the timing effects of the 2017 tax law. Doing so provides important context on existing tax burdens and for considering the impact of raising taxes on corporations and pass-through firms.

3 min read

Reducing the tax gap is a good idea, but the reporting requirements for financial institutions could be better-targeted at the problem at hand.

4 min read

Increasing tax compliance is a major part of the Biden administration proposal to raise revenue for physical and social infrastructure. Reducing the tax gap—the difference between taxes owed and taxes paid—is a good way to raise revenue, but it doesn’t come without trade-offs, and it’s important to go about it in the right way.

3 min read

Recent Biden administration proposals rely heavily on revenue from better IRS tax collections to fund spending initiatives. The American Families Plan uses several avenues to reduce the tax gap (or the difference between taxes paid and taxes owed), from increasing the IRS’s tax enforcement budget to improving information technology and expanding reporting requirements.

4 min read

Learn about the tax gap, what it is, how the U.S. compares to other countries, and recent proposals aimed at closing it. We also explore how much revenue could actually be raised through increased tax enforcement, the current challenges the IRS faces, and how stronger enforcement could impact taxpayers at large.

Reducing the tax gap is, on the margin, a good way to raise revenue, but is not without costs. Policymakers should consider compliance costs for law-abiding taxpayers as well as administrative costs for the IRS when evaluating measures to reduce the tax gap.

33 min read

New Treasury Department data released on the advance Child Tax Credit payments shows the distribution by state, including how much, on average, households in each state received. The expansion will only be in effect for the 2021 tax year—if policymakers wish to continue providing the increased benefits, they must address the administrative and revenue costs of the policy.

4 min read

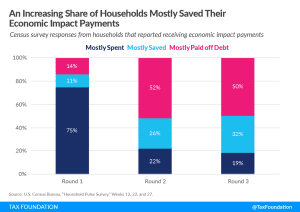

In 2020 and 2021, Congress enacted three rounds of economic impact payments (EIPs) for direct relief to households amidst the pandemic-induced downturn. Survey data from the U.S. Census Bureau indicates that households increasingly saved their EIPs or used them to pay down debt rather than spend them.

5 min read

Explore President Biden budget proposals, including tax and spending in American Jobs Plan and American Families Plan. See Biden tax and spending proposals.

12 min read

The Biden administration will have to balance the desire to increase social spending through the tax code with the need to collect revenue and have a tax system that is transparent and easy to understand.

5 min read

During the pandemic, economic relief administered through the tax code exploded as Congress passed nearly $6 trillion of legislation into law. That left the 2021 tax filing season, which ended May 17, with complications that still linger.

4 min read

If Biden wants to reduce tax evasion, raising the corporate rate, increasing the incentives to engage in tax evasion, and creating a larger tax advantage to becoming a pass-through business is counterproductive.

3 min read

In his first 100 days as president, Joe Biden has proposed more than a dozen significant changes to the U.S. tax code that would raise upwards of $3 trillion in revenue and reduce incentives to invest, save, and work in the United States.

4 min read

Since 1987, unemployment compensation benefits have been subject to federal income tax and, in most states, to state income tax. According to the Congressional Research Service, such treatment—including unemployment compensation benefits in taxable income—is common across industrial nations.

4 min read

The IRS recently announced the extension of tax filing and payment deadlines from April 15th to May 17th to help taxpayers navigating the many tax changes amid the pandemic and give the IRS opportunity to clear its backlog of tax returns and correspondence.

7 min read

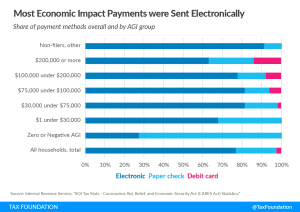

Newly published data from the Internal Revenue Service (IRS) shows that the first round of economic impact payments primarily benefited households earning less than $100,000.

3 min read

President Biden may make greater use of regulatory changes to modify how tax law is interpreted and administered. There are several areas where a Biden Treasury Department, likely led by former Federal Reserve Chair Janet Yellen, may focus.

3 min read

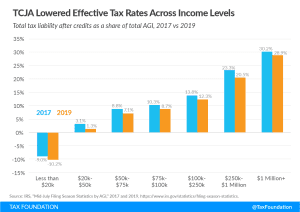

The latest IRS data continues to illustrate that the net effect of the Tax Cuts and Jobs Act was to reduce effective tax rates across income groups. In 2019, the TCJA again expanded the use of several deductions and credits, made the standard deduction more favorable than itemizing, and lowered taxes for most taxpayers.

4 min read