The Latest on the Global Tax Agreement

The agreement represents a major change for tax competition, and many countries will be rethinking their tax policies for multinationals.

8 min read

The agreement represents a major change for tax competition, and many countries will be rethinking their tax policies for multinationals.

8 min read

The technical rules that were once solely the province of tax wonks in D.C. and Paris are being brought out into the public sphere.

5 min read

If a multilateral solution to remove digital services taxes (DSTs) is not agreed to, then DSTs will continue to spread and mutate with negative impacts on some of the most innovative companies in the world.

Pillar Two, the international global minimum tax agreement, has a considerable chance of failing and may ultimately allow the same problems it was designed to address.

6 min read

The Tax Cuts and Jobs Act of 2017 (TCJA) reformed the U.S. system for taxing international corporate income. Understanding the impact of TCJA’s international provisions thus far can help lawmakers consider how to approach international tax policy in the coming years.

30 min read

Simplifying international tax rules will not solve all the challenges that stand in the way of healthy cross-border investment, but eliminating unnecessary provisions would be a positive pivot relative to the trajectory of recent years. It’s high time that policymakers stopped pursuing ever more complex rules and started the hard work of simplification.

6 min read

The Biden administration has been supportive of the negotiations, but the changes should be reviewed in the context of recent policy changes in the U.S. and elsewhere, the general landscape of business taxation in the U.S., and potential challenges and risks arising from the global tax deal.

3 min read

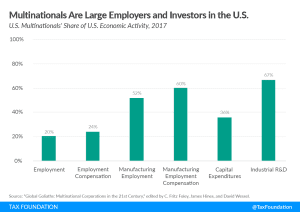

Contrary to the Biden administration’s claims, raising taxes on cross-border investment would hurt U.S. economic growth and jobs. Research shows that FDI creates jobs in the U.S. and raises workers’ wages and productivity.

5 min read

Treasury Secretary Janet Yellen offered estimates from the EU Tax Observatory as evidence that the Polish government would benefit from supporting the global tax deal. Unfortunately, evidence was, at best, out of date.

2 min read

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have been debated in recent months, there are clear divides between U.S. proposals and the global minimum tax rules.

5 min read

Late last year, over 130 countries agreed to a global minimum tax, a purported end-all and be-all to the “race to the bottom.” But this policy is complex, and countries are already struggling to implement these new rules. We talk through how this policy came to be, identify where problems are beginning to arise, and dispel some common myths about this emerging new tax system.

Double taxation impacts the ability of companies to invest valuable things like improving their supply chains, developing new products, and hiring workers, and it can be fixed if the minimum tax uses a country’s own tax rate.

8 min read

One goal for the Build Back Better Act has been to increase the amount of revenue the U.S. raises from U.S. companies at home or abroad. With the global minimum tax rules in play, it is likely that the expected gains to the U.S. Treasury from foreign profits of U.S. companies will diminish.

5 min read

Complex tax policies that work well “in theory” can often have a hard time when the rubber meets the road. One instance of this is the challenge that the OECD has created for itself with the global tax deal, also fondly known as Pillar 1 and Pillar 2.

7 min read

The current prospect for the global minimum tax requires the attention of U.S. lawmakers. Otherwise, a tax benefit at home will just mean a tax increase abroad.

6 min read

As 2021 comes to a close, countries are moving toward harmonizing tax rules for multinationals, but stalled talks on the Build Back Better Act in the United States means new uncertainties for a global agreement and for taxpayers.

5 min read

The new OECD global minimum tax rules are complex, and some countries may opt to put them in place on top of preexisting rules for taxing multinational companies. However, countries should also consider ways to reform their existing rules in response to the minimum tax.

7 min read

In general, the effective tax rates on the foreign profits of U.S. multinationals are not that low relative to the U.S. tax rate, contrary to popular rhetoric.

7 min read

Over the course of the last year, it has become clear that Democratic lawmakers want to change U.S. international tax rules. However, as proposals have surfaced in recent weeks, there are clear divides among various proposals.

5 min read

As Congress prepares to rewrite some portion of the current international tax rules, it’s hoped that they are able to achieve a more principled approach and one that is not so subject to obfuscation and misinterpretation.

7 min read

What is the OECD Global Tax Deal and what impact will it have on U.S. and foreign multinationals? Learn about the OECD’s efforts to prevent companies from shifting profits—including Pillar 1, which is focused on changing where companies pay taxes, and Pillar 2, which would establish a global minimum tax.

While arcane, expense allocation rules are relevant to current debates because they result in a heavier tax burden for U.S. companies under current law than the recently negotiated global minimum tax proposal.

10 min read