State Tax Changes Taking Effect January 1, 2024

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

With Secure 2.0, lawmakers recognized and addressed several flaws in the tax code’s treatment of saving and retirement, but there is continued work to be done simplifying and expanding savings and retirement options for taxpayers.

5 min read

Americans are saving less. While the U.S. saving rate has regularly lagged behind its peers, it has yet to return to pre-pandemic levels. Increasingly, people are turning to credit cards to fill the gaps in their budgets.

What historical lessons of wartime finance can Ukrainian and EU policymakers learn to put Ukraine’s economy on a path to success during, and especially after, the war?

5 min read

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

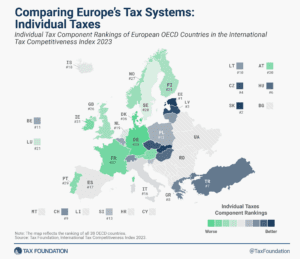

Estonia has the most competitive individual tax system in the OECD for the 10th consecutive year.

2 min read

Explore the IRS inflation-adjusted 2024 tax brackets, for which taxpayers will file tax returns in early 2025.

4 min read

The 2023 version of the International Tax Competitiveness Index is the 10th edition of the report. Let’s take a look back and see how country ranks have changed over time.

5 min read

Lawmakers will have to weigh the economic, revenue, and distributional trade-offs of extending or making permanent the various provisions of the TCJA as they decide how to approach the upcoming expirations. A commitment to growth, opportunity, and fiscal responsibility should guide the approach.

18 min read

The current patchwork of state laws taxing marketplace facilitators is complex, burdensome, and inefficient. States should work to resolve these issues and standardize the otherwise disparate requirements—with or without an inducement from Congress or the courts.

29 min read

The latest tax gap report from the IRS has generated much media attention—and much misunderstanding.

6 min read

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

In recognition of the fact that there are better and worse ways to raise revenue, our Index focuses on how state tax revenue is raised, not how much. The rankings, therefore, reflect how well states structure their tax systems.

111 min read

While there are many factors that affect a country’s economic performance, taxes play an important role. A well-structured tax code is easy for taxpayers to comply with and can promote economic development while raising sufficient revenue for a government’s priorities.

88 min read

If tax increases are included in a package, international experience points toward raising consumption taxes, rationalizing tax expenditures, and broadening the tax base—not hiking income taxes.

6 min read

Outside of the pandemic years, this year’s federal deficit is the highest in U.S. history. While tax revenue has increased about 28 percent since the pre-pandemic year 2019, spending has increased about 46 percent. Annual deficits are headed towards $3 trillion over the next few years.

3 min read

Income taxes impose steeper economic costs, and often steeper administrative and compliance costs, than consumption taxes. Moving to a consumption tax would end the tax bias against saving and investment and provide an opportunity to greatly simplify anti-poverty programs embedded in the tax code.

45 min read

Can an organization rightfully be called a “nonprofit” if it almost always makes money? And what if most of that organization’s income comes from “business income,” should it legitimately be considered a “charity”?

7 min read

Simplicity in the tax code means taxes should be easy for taxpayers to pay and easy for governments to administer and collect.

The Spanish election results are moving the country away from pro-growth tax reforms while launching the government’s tax agenda, and the agenda of the Spanish presidency of the Council of the European Union, into uncertainty.

7 min read