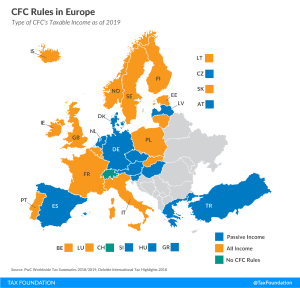

Top Personal Income Tax Rates in Europe, 2024

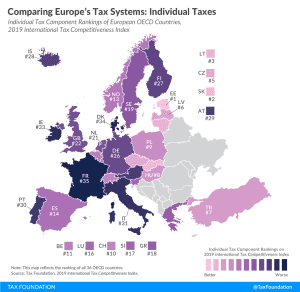

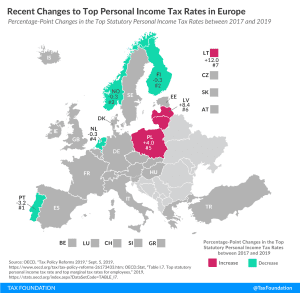

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min readProviding journalists, taxpayers and policymakers with basic data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission. We’ve found that one of the best, most engaging ways to do that is by visualizing tax data in the form of maps.

How does your country collect revenue? Every week, we release a new tax map that illustrates one important measure of tax rates, collections, burdens and more.

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

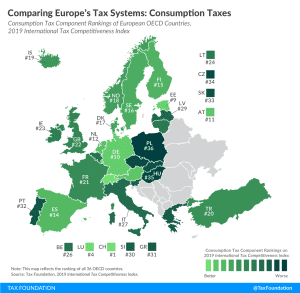

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

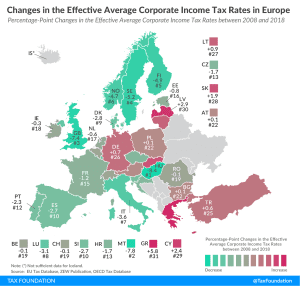

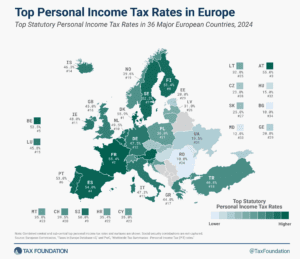

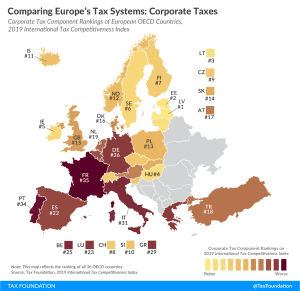

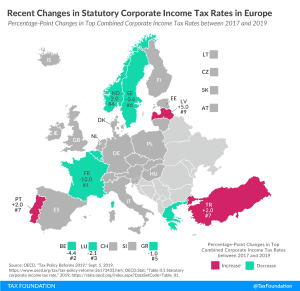

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years.

2 min read

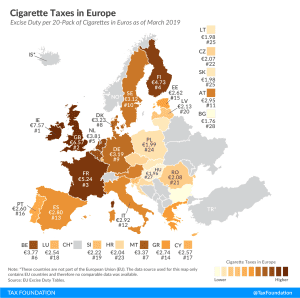

Today, Ireland and the United Kingdom levy the highest excise duties on cigarettes in the European Union (EU), at €7.57 (US $8.93) and €6.57 ($7.75) per 20-cigarette pack, respectively. This compares to an EU average of €3.09 ($3.64). In contrast, Bulgaria (€1.76 or $2.07) and Hungary (€1.96 or $2.31) levy the lowest excise duties.

3 min read