All Related Articles

221 Results

Comparison of Cross-Border Effective Average Tax Rates in Europe and G7 Countries

As policymakers consider ways to facilitate investment, effective average tax rates provide a valuable perspective on where burdens on those activities are high and where they are low.

16 min read

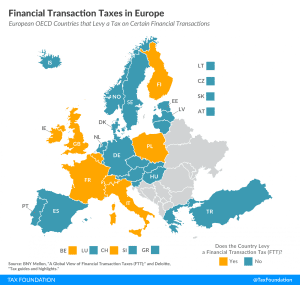

Financial Transaction Taxes in Europe

2 min read

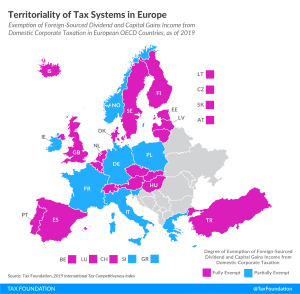

Territoriality of Tax Systems in Europe

3 min read

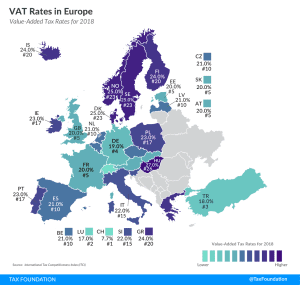

VAT Rates in Europe, 2020

3 min read

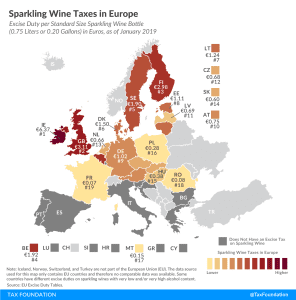

Sparkling Wine Taxes in Europe

1 min read

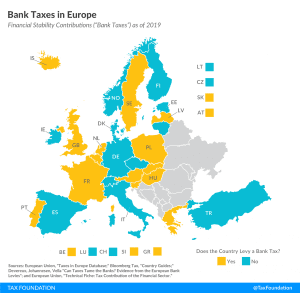

Bank Taxes in Europe

2 min read

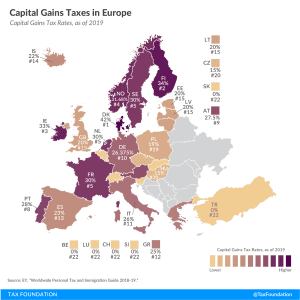

Capital Gains Taxes in Europe, 2019

2 min read

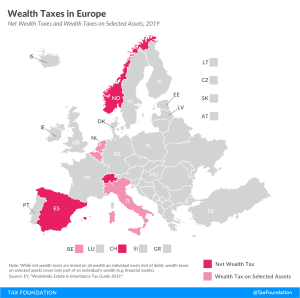

Wealth Taxes in Europe, 2019

Only three European countries levy a net wealth tax, namely Norway, Spain, and Switzerland. Belgium, Italy, and the Netherlands levy wealth taxes on selected assets, but not on an individual’s net wealth per se.

3 min read

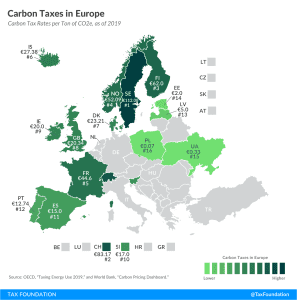

Carbon Taxes in Europe, 2019

3 min read