Tax Calculator: How the TCJA’s Expiration Will Affect You

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

Unless Congress acts, Americans are in for a tax hike in 2026.

3 min read

At the end of 2025, the individual tax provisions in the Tax Cuts and Jobs Act (TCJA) expire all at once. Without congressional action, most taxpayers will see a notable tax increase relative to current policy in 2026.

4 min read

Policymakers should have two priorities in the upcoming economic policy debates: a larger economy and fiscal responsibility. Principled, pro-growth tax policy can help accomplish both.

21 min read

Lawmakers should see 2025 as an opportunity to consider more fundamental tax reforms. While the TCJA addressed some of the deficiencies of the tax code, it by no means addressed them all.

8 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

While federal tax collections—especially corporate taxes—have reached historically high levels, these gains have not kept pace with escalating spending, particularly on debt interest, leading to a substantial and concerning budget deficit in FY24.

6 min read

The TCJA improved the U.S. tax code, but the meandering voyage of its passing and the compromises made to get it into law show the challenges of the legislative process.

6 min read

The Tax Cuts and Jobs Act’s changes to family tax policy serve as a reminder to avoid looking at tax reform provisions in a vacuum.

5 min read

The Tax Cuts and Jobs Act (TCJA) significantly lowered the effective tax rates on business income, but the impact was not the same for C corporations and pass-through businesses.

6 min read

As lawmakers consider which policies to prioritize in the upcoming tax policy debates, better cost recovery for all investment should be top of mind.

7 min read

Pro-growth tax reform that does not add to the deficit will require tough choices, but whether to raise the corporate tax rate is not one of them. If lawmakers want to craft fiscally responsible and pro-growth tax reform, a higher corporate tax rate simply does not fit into the puzzle.

3 min read

The 2017 Tax Cuts and Jobs Act (TCJA) was the largest corporate tax reform in a generation, lowering the corporate tax rate from 35 percent to 21 percent, temporarily allowing full expensing for short-lived assets (referred to as bonus depreciation), and overhauling the international tax code.

6 min read

As members of Congress prepare to address the expiration of the TCJA, they should appreciate how revenues have evolved since 2017.

4 min read

While the approaches differ, they share a reliance on similar linkages: new capital investment drives productivity growth, which grows the economy and raises wages for workers.

37 min read

The Tax Cuts and Jobs Act of 2017 (TCJA) reformed the U.S. system for taxing international corporate income. Understanding the impact of TCJA’s international provisions thus far can help lawmakers consider how to approach international tax policy in the coming years.

30 min read

The Biden administration has argued for raising the corporate tax rate to offset the drop in federal corporate revenues following the Tax Cuts and Jobs Act (TCJA) of 2017, claiming it did not lead to more corporate investment as advertised. Although corporate revenues did drop following this tax reform, the ensuing increase in corporate investment far exceeds these revenue losses.

1 min read

While proponents of the Section 199A pass-through deduction claimed it would boost investment and critics claimed it would encourage tax avoidance and income shifting, new research casts doubt on both claims.

3 min read

The tax treatment of intangible assets has come into the spotlight recently with the Biden administration proposing to undo a policy adopted in 2017 to encourage intellectual property (IP) to be located in the U.S.

6 min read

Many members of Congress have taken issue with the 2017 tax reform. However, the reasoning that has led some to believe that GILTI provides a path to offshoring investment and jobs is flawed.

6 min read

Both the Biden campaign and some Democratic members of Congress have recommended changes to GILTI, but before doing that, policymakers should consider how GILTI’s design can have ramifications for many U.S. companies and their tax burdens.

6 min read

The Biden administration has signaled its openness to raising the corporate tax rate, potentially by phasing in an increase over several years. While phasing in a tax increase, as opposed to hiking immediately, may seem like a reasonable middle ground, it would be the worst of both worlds because it provides old investment with a lower rate while penalizing new investment.

2 min read

President Biden and congressional policymakers have proposed several changes to the corporate income tax, including raising the rate from 21 percent to 28 percent and imposing a 15 percent minimum tax on the book income of large corporations, to raise revenue for new spending programs. Our new modeling analyzes the economic, revenue, and distributional impact of these proposals.

46 min read

The Biden campaign and Senate Democrats identified changes to GILTI that would increase the taxes U.S. companies pay on their foreign earnings. Rather than tacking on changes to a system that is currently neither fully territorial nor worldwide, policymakers should evaluate the structure of the current system with a goal of it becoming more, not less, coherent.

51 min read

Some lawmakers have expressed interest in repealing the SALT cap, which was originally imposed as part of the Tax Cuts and Jobs Act (TCJA) in late 2017. It is important to understand who benefits from the SALT deduction as it currently exists, and who would benefit from the deduction if the cap were repealed.

6 min read

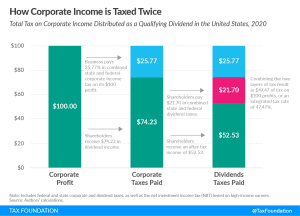

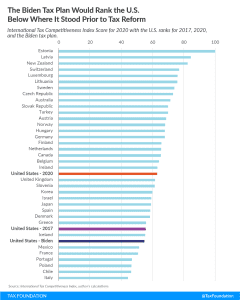

Biden’s proposal to increase the corporate income tax rate and to tax long-term capital gains and qualified dividends at ordinary income tax rates would increase the top integrated tax rate above pre-TCJA levels, making it the highest in the OECD and undercutting American economic competitiveness.

17 min read

Tax extenders are no stranger to hitching a last-minute ride on year-end legislation. This year they made another last-minute appearance, finding a hold in their own division of the 5,593-page bill to fund the government through the fiscal year and provide additional coronavirus relief through March.

2 min read

While a sweeping tax policy bill is unlikely in the near future, lawmakers may be able to come together on a smaller scale. Pairing better cost recovery on a permanent basis with support for vulnerable households as well as additional pandemic-related relief would help promote a more rapid return to growth and help businesses and households weather the ongoing crisis.

4 min read

At the end of 2020, 33 temporary tax provisions are scheduled to expire at the federal level. These provisions generally fall under four categories: cost recovery, energy, individual, and other business provisions.

20 min read

President Biden may make greater use of regulatory changes to modify how tax law is interpreted and administered. There are several areas where a Biden Treasury Department, likely led by former Federal Reserve Chair Janet Yellen, may focus.

3 min read

While there are many tax changes built into the tax code over the coming years for individuals and businesses, the recent claim that lower- and middle-income Americans may see a “stealth tax increase” in 2021 due to the Tax Cuts and Jobs Act (TCJA) is untrue.

3 min read

President Biden and Congress should concentrate on areas of common ground, finding incremental places to improve the tax code. A bipartisan bill recently introduced to help retirement savings is a good model for what incremental reform may look like.

4 min read

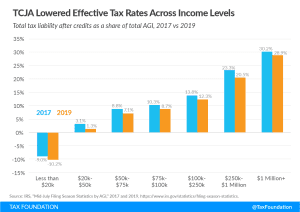

The latest IRS data continues to illustrate that the net effect of the Tax Cuts and Jobs Act was to reduce effective tax rates across income groups. In 2019, the TCJA again expanded the use of several deductions and credits, made the standard deduction more favorable than itemizing, and lowered taxes for most taxpayers.

4 min read

While the Biden campaign is certainly focused on increasing taxes on U.S. businesses and high-income earners, it is important that policymakers also understand what that reversal might do to U.S. competitiveness, and the competitive global environment in which U.S. companies and U.S. workers operate.

3 min read

While there is still plenty of work to be done to get unemployed Americans back to work, the U.S. economy as a whole is now recovering strongly from the pandemic-induced economic downturn, outperforming forecasts from earlier in the year and outperforming most other developed countries.

4 min read

House Republicans recently introduced HR 11, the Commitment to American GROWTH Act, outlining an alternative to Democratic presidential nominee Joe Biden’s tax vision. The proposal would address upcoming expirations of the 2017 Tax Cuts and Jobs Act (TCJA) and create or expand other tax provisions designed to boost domestic investment.

5 min read