2022 Spanish Regional Tax Competitiveness Index

The 2022 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

8 min read

The 2022 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

8 min read

President Biden proposed a 7-point hike in the corporate tax rate to 28 percent, a new minimum book tax on corporate profits, and higher taxes on international activity. We estimated these proposals would reduce the size of the economy (GDP) by 1.6 percent over the long run and eliminate 542,000 jobs.

6 min read

When NFL star wide receiver Tyreek Hill weighed offers from the New York Jets and the Miami Dolphins, no doubt there was a lot on his mind. But one consideration towered over the rest, at least according to Hill himself: signing with the Jets “was very close to happening,” but “those state taxes man. I had to make a grown-up decision.”

7 min read

Alaska policymakers are understandably concerned about the long-term viability of the state’s overwhelming reliance on the oil and gas industry for revenue, but the state’s unique economy and geography, and low population density make some of the “traditional” taxes less efficient than they might be elsewhere.

55 min read

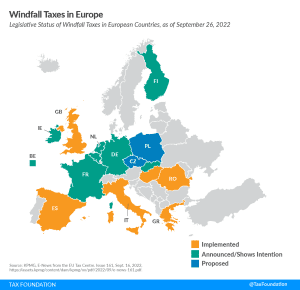

It’s unlikely these implemented and proposed windfall taxes will achieve their goals of addressing high gas and energy prices and raising additional revenues. They would more likely raise prices, penalize domestic production, and punitively target certain industries without a sound tax base.

9 min read

While there is more we can do to encourage lower- and middle-class households to save more and build wealth, a closer, more comprehensive look at the data and trends in other countries suggests that America’s wealth gap is not as alarming as some may think.

5 min read

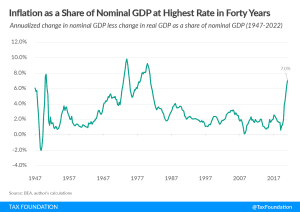

A new CBO report reveals that lower- and middle-income households are disproportionately shouldering the burden of this current inflation wave. And historical analysis suggests there is much more to come.

5 min read

In the EU, Italy plays an important role in economic policy. If the EU wants to further develop own resources, it will need the backing of the Italian government—which seems unlikely at the moment.

4 min read

Some tax ballot initiatives will be straightforward, some will be complex, and—let’s be honest—some will be a drafting nightmare.

5 min read

The Inflation Reduction Act primarily uses carrots, not sticks, to incentivize reductions in carbon emissions. It creates or expands tax credits for various low- or no-emission technologies, rather than imposing a generalized penalty for emissions, such as a carbon tax.

5 min read

Maine has blueberry taxes. Alabama has mosquito taxes. Each state and county has its tax quirks. But when state and local governments want to raise revenues, there are four key taxes they turn to.

The Inflation Reduction Act created numerous tax subsidy programs intended to accelerate the transition to a greener economy.

8 min read

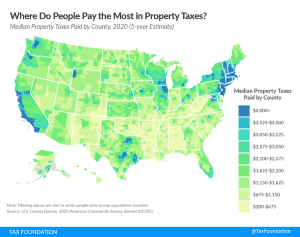

Property taxes are the primary tool for financing local government and generating state-level revenue in some states as well.

5 min read

Massachusetts’ competitive tax advantage in New England is driven primarily by its competitive individual income tax rate and its sales and use tax structure. If the Commonwealth changes its tax code in ways that narrow the base or increase the rate, it cedes greater tax competitiveness to other states, regionally and nationally.

34 min read

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

6 min read

Will states consider student loan forgiveness a taxable event? In some states, the answer could be yes.

5 min read