All Related Articles

A Carbon Tax, Explained

Every policy has trade-offs, but a well-designed carbon tax has the potential to protect the environment without harming consumers, jobs, or businesses.

A Journey Through Germany’s Tax Laws

Get ready to hit the autobahn and explore the world of German taxes! We’ll navigate the complexities of Germany’s tax structure.

All I Want for Christmas is EU: Understanding Tax Policy in Brussels

When it comes to international economic competition, people often frame the argument as the U.S. versus China. But across the Atlantic, nation-states in the European Union have been working hard to show the world that they deserve to be considered an economic force. Rising up to this challenge for the EU is easier said than done.

An Introduction to the History of Taxes

Taxes have played a major role throughout history, and even date back to around 5,000 years ago. Taxes will continue to affect our lives and shape our societies just like they have for thousands of years.

Bob Stack Unpacks US Challenges in Global Tax

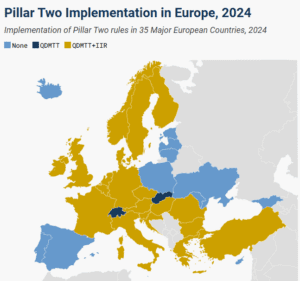

Bob Stack, an international tax expert, explores the implications of the EU’s adoption of Pillar Two and the potential for streamlining overlapping policies. He also addresses the issues that the US faces in global tax policy with the upcoming elections.

Do Americans Abroad Still Pay US Taxes?

How does living abroad impact the taxes an American has to pay? Unlike most countries that tax based on residency, the US employs citizenship-based taxation, meaning Americans are taxed on their global income regardless of where they reside.

GILTI: Foreign Tax, Local Impact

Since only U.S. businesses pay the GILTI tax, not foreign businesses, it makes U.S.-based brands less competitive abroad. Whatever its intentions, GILTI is a flawed policy, and doubling down on it will hurt us abroad, and at home.

It Pays to Keep It Simple

Simplicity in the tax code means taxes should be easy for taxpayers to pay and easy for governments to administer and collect.

Launching Tax Foundation Europe

As the world of tax policy becomes more interconnected, the Tax Foundation is stepping up, recognizing the pressing need for informed and principled tax policy education in an ever-evolving landscape.