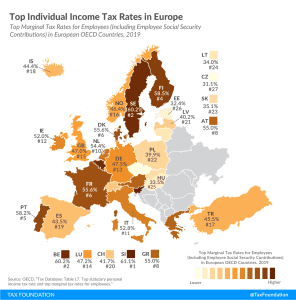

Top Personal Income Tax Rates in Europe, 2024

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min readProviding journalists, taxpayers and policymakers with basic data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission. We’ve found that one of the best, most engaging ways to do that is by visualizing tax data in the form of maps.

How does your country collect revenue? Every week, we release a new tax map that illustrates one important measure of tax rates, collections, burdens and more.

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

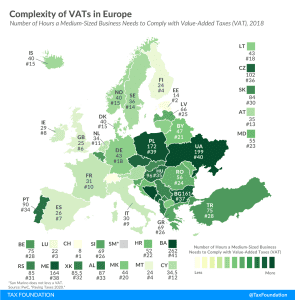

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

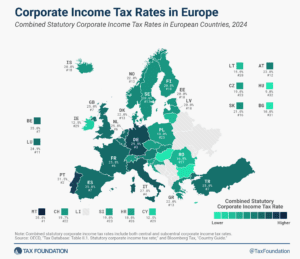

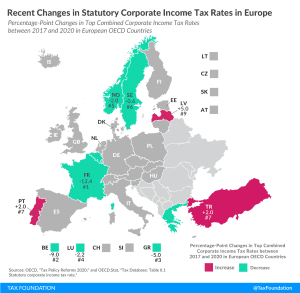

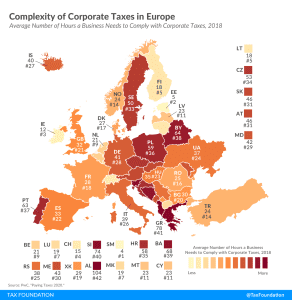

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years.

2 min read

Over the last two decades, corporate income tax rates have declined around the world. Our new map shows the most recent changes in corporate tax rates in European OECD countries, comparing how combined statutory corporate income tax rates have changed between 2017 and 2020.

3 min read

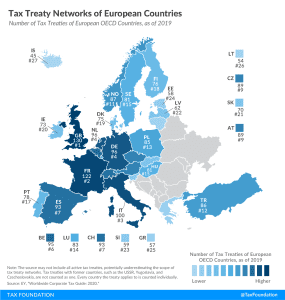

Tax treaties usually provide mechanisms to eliminate double taxation and can provide certainty and stability for taxpayers and encourage foreign investment and trade. A broad network of tax treaties contributes to the competitiveness of an economy.

1 min read

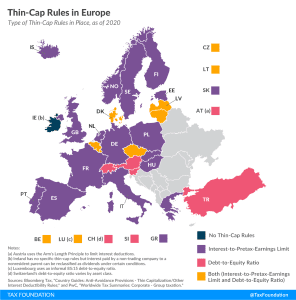

To discourage a certain form of international debt shifting, many countries have implemented so-called thin-capitalization rules (thin-cap rules), which limit the amount of interest a multinational business can deduct for tax purposes.

4 min read

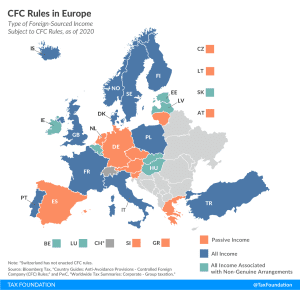

To prevent businesses from minimizing their tax liability by taking advantage of cross-country differences in taxation, countries have implemented various anti-tax avoidance measures, one known as Controlled Foreign Corporation (CFC) rules.

5 min read

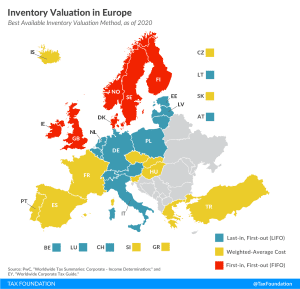

The method by which a country allows businesses to account for inventories can significantly impact a business’s taxable income. When prices are rising, as is usually the case due to factors like inflation, LIFO is the preferred method because it allows inventory costs to be closer to true costs at the time of sale.

2 min read

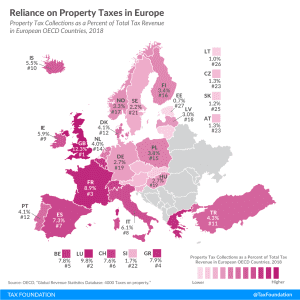

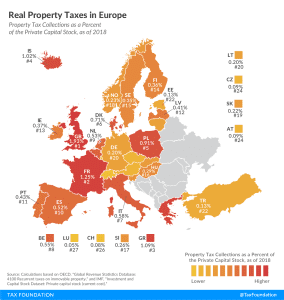

High property taxes levied not only on land but also on buildings and structures can discourage investment because they disincentivise investing in infrastructure, which businesses would have to pay additional tax on. For this reason, it may also influence business location decisions away from places with high property tax.

3 min read

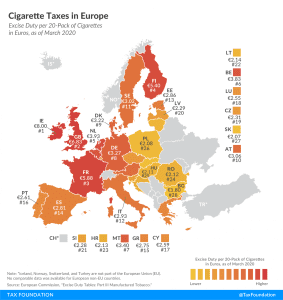

Ireland and the United Kingdom levy the highest excise duties on cigarettes in the European Union (EU), at €8.00 ($8.95) and €6.83 ($7.64) per 20-cigarette pack, respectively. This compares to an EU average of €3.22 ($3.61). Bulgaria (€1.80 or $2.01) and Slovakia (€2.07 or $2.32) levy the lowest excise duties.

3 min read

Most countries provide tax relief to families with children—typically through targeted tax breaks that lower income taxes. While all European OECD countries provide tax relief for families, its extent varies substantially across countries.

2 min read