The Biden Administration’s Misguided Approach to Defining “American” Companies

What does it mean to be an American company?

4 min readStay informed with quick and accessible analysis of today's top tax policy topics. Read Tax Foundation's Tax Policy Blog for insight from our experts on tax policies across the U.S. and abroad.

To find our most recent research papers and data, click the links below.

What does it mean to be an American company?

4 min read

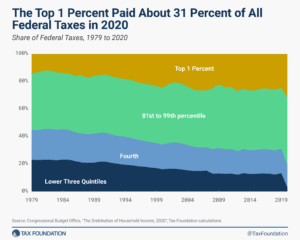

The pandemic led to one of the largest fiscal responses in U.S. history, impacting households across the income distribution.

4 min read

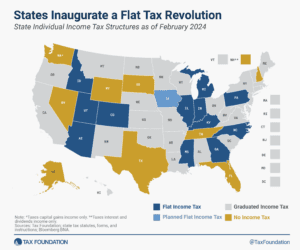

In 2021 and 2022 alone, more states enacted laws converting graduated-rate individual income tax structures into single-rate income tax structures than did so in the whole 108-year history of state income taxation up until that point.

10 min read

Working from home is great. The tax complications? Not so much.

4 min read

The landscape of tax policy is changing—and we at the Tax Foundation are changing with it.

3 min read

The CBO projects deficits will be higher than historical levels, largely due to growth in mandatory spending programs While some recent legislation has reduced the deficit, the Inflation Reduction Act is proving to be more expensive than originally promised.

5 min read

For most Americans, saving is a taxing experience. Our neighbors to the north have found a better solution—and U.S. lawmakers should take note.

5 min read

One particular provision of the Biden administration’s proposal to ban so-called “junk fees” would have unintended consequences.

5 min read

Limiting interest deductibility continues to be a worthwhile policy goal, but given the current climate, policymakers should opt to pair any further limitations with other pro-growth policies such as full expensing to ensure firms’ incentives to invest are preserved.

3 min read

From a revenue standpoint, about $9 billion of the $11.7 billion in lost revenue would accrue to joint filers earning more than $200,000.

5 min read

The U.S. House of Representatives has passed a highly anticipated bipartisan tax deal. The Tax Relief for American Workers and Families Act now awaits action in the Senate.

6 min read

Local income taxes in Maryland constitute about 35 percent of local tax collections and more than 17 percent of local revenue, giving Maryland’s localities the highest dependence on income taxes in the nation.

5 min read

Historical evidence and recent studies have shown that retaliatory tax and trade proposals raise prices and reduce the quantity of goods and services available to U.S. businesses and consumers, resulting in lower incomes, reduced employment, and lower economic output.

5 min read

Portugal’s value-added tax (VAT) policy is a treasure trove of tax oddities. Thankfully, VAT base broadening is an ideal instrument to give the Portuguese government the fiscal room to implement pro-growth tax reforms

5 min read

After years of strong revenue growth, Kansas has substantial cash reserves on hand, and policymakers on both sides of the aisle have expressed a desire to return some of the extra revenue to taxpayers.

5 min read

The Trump campaign is mulling a massive tax increase on American purchases from China. If reelected, he might quintuple the tax, imposing tariffs of 60 percent on imports from China. The economic ramifications would be significant and unwelcome.

5 min read

Examining the revenue, economic, and distributional effects of a hypothetical deal with permanent tax policy changes shows the longer-run trade-offs policymakers would face.

5 min read

The House Ways and Means Committee has advanced a tax deal to the House floor that would temporarily—and retroactively—restore two major business deductions for cost recovery and expand the child tax credit through 2025.

10 min read

Two pieces of tobacco legislation in Michigan have the potential to decrease state tax collections by $320 million per year, deter smokers from switching to less harmful products, and increase illicit trade and crime.

4 min read

Lawmakers should prioritize creating a tax system that supports investment more broadly rather than subsidizing specific industries and allowing broad, neutral pro-investment provisions to expire.

3 min read