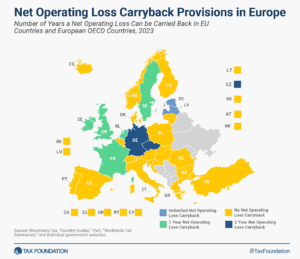

Net Operating Loss Carryforward and Carryback Provisions in Europe, 2023

Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

Moving from one athletic conference to another can mean millions in additional revenue sharing from lucrative broadcasting contracts and other revenue streams, all tax-free.

6 min read

The United Nations (UN) is preparing to flex its muscles on international tax policy. Several developing countries say the OECD’s approach favors richer countries at their expense, and the UN hopes to fix this.

5 min read

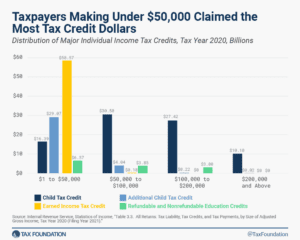

In tax year 2020, taxpayers claimed more than 159 million tax credits on their individual income tax returns worth a total of more than $277 billion. That was an increase of $35.3 billion from tax year 2019, largely due to an influx of pandemic relief administered through the tax code in 2020.

6 min read

Congress should reconsider key elements of the IRA, including the book minimum tax and the green energy credits, with an eye towards simplification and fiscal responsibility.

46 min read

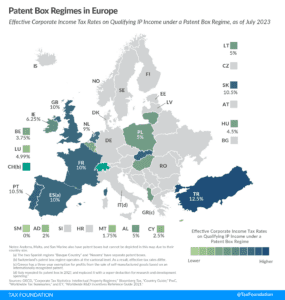

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

3 min read

Simplifying international tax rules will not solve all the challenges that stand in the way of healthy cross-border investment, but eliminating unnecessary provisions would be a positive pivot relative to the trajectory of recent years. It’s high time that policymakers stopped pursuing ever more complex rules and started the hard work of simplification.

6 min read

Explore IRS clean energy tax credits, including Direct Pay, the IRA and CHIPS Act tax provisions, and Section 1603 grant program. See more.

7 min read

It is hard to imagine the IRS Direct e-File Program operating seamlessly with the complexity of the current U.S. tax system. Instead, lawmakers should first address the more fundamental problem that causes taxpayer frustration: our highly complicated tax code.

4 min read

This tax reform plan would boost long-run GDP by 2.5%, grow wages by 1.4%, and add 1.3M jobs, all while collecting a similar amount of tax revenue as the current code and reducing the long-run debt burden.

39 min read

Sens. Kevin Cramer (R-ND) and Christopher Coons (D-DE) have recently introduced a bill laying the groundwork for a possible solution to the problem: a tax on the carbon content of imports. But it falls short of the optimal approach in several ways.

4 min read

By extending bonus depreciation and introducing neutral cost recovery, the RSC budget would significantly improve the treatment of investment leading to increased growth, expanded employment, and higher wages.

3 min read

The price tag of the Inflation Reduction Act’s green energy tax credits is much higher than originally thought. Among other things, the updated analysis indicates the Inflation Reduction Act does not reduce deficits after all.

6 min read

Lawmakers should avoid delivering social and economic benefits through the tax code whenever possible and work to simplify or repeal the tax expenditures already in the tax code.

7 min read

The current tax treatment of R&D expenses is irrational, complicated, and counterproductive. Fortunately, fixing this problem is a bipartisan issue.

4 min read

As the UTPR is a new concept, it is worth explaining what it is and why Rep. Smith cares about it. In a sentence, the Undertaxed Profits Rule (UTPR) is a looming extraterritorial enforcement mechanism for a tax base the U.S. has not adopted.

6 min read

Making expensing permanent is especially important now, when the economy is threatened with a recession and inflation remains high.

7 min read

Legislation currently advancing in Louisiana—related to the franchise tax, inventory tax, and corporate rebate and exemption programs—would make the state’s tax code simpler and more competitive.

4 min read

The Pennsylvania Senate Finance Committee recently advanced two bills, SB 345 and SB 346, that would build on last year’s historic corporate net income tax (CNIT) reform.

7 min read