Facts and Figures 2021: How Does Your State Compare?

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

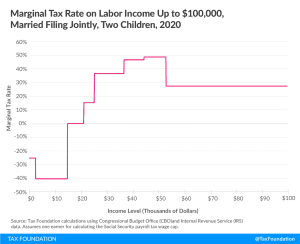

Under the budget introduced by Gov. Tom Wolf, Pennsylvania’s flat personal income tax rate would increase by 46 percent, partially offset by an outsized increase in the poverty credit, which would see a family of four eligible for partial relief due to poverty until they reached $100,000 in taxable income—four times the poverty line.

6 min read

Unless the legislature acts, businesses that have received PPP loans and related federal assistance will face $457 million in state taxes through 2024—with more than half of those taxes coming due this spring—despite Wisconsin being on track to see continued general fund revenue growth even amid the pandemic.

4 min read

As Congress works to provide another round of emergency economic relief, it is a good time to step back and consider how tax policy affects entrepreneurs and small businesses.

3 min read

On Monday, members of the bipartisan Gang of Eight negotiating an end-of-year pandemic relief package announced that they had settled on language and had divided the package into two bills: a pandemic aid package and a $160 billion state and local support package.

6 min read

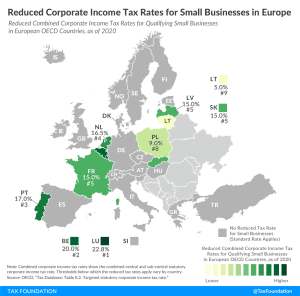

Corporate income taxes are commonly levied as a flat rate on business profits. However, some countries provide reduced corporate income tax rates for small businesses

2 min read

It’s important for Poland to understand the main lesson of the Estonian approach: taxes should be designed with an overarching approach to maximize neutrality and minimize complexity and distortions. Instead of simply adopting a preference for small businesses, the Polish government should instead overhaul its corporate tax rules and truly adopt the Estonian approach to taxation.

2 min read

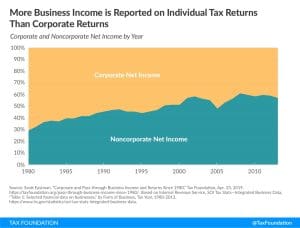

Economists have proposed taxing corporate income more uniformly through corporate integration, which can be done in a variety of ways. Biden’s plan goes in the opposite direction by making worse the double taxation of corporate income.

5 min read

We sat down with the owners of Black Narrows Brewing Company, a family-owned craft brewery situated in a small island-town on Virginia’s scenic Eastern Shore, to discuss the challenges they face as a small business during COVID-19 and what they would like to see legislators do to reduce short- and long-term barriers for entrepreneurs.

The sooner federal policymakers or regulators clarify tax questions about the Paycheck Protection Program (PPP), the more certainty firms will have when they accept the economic relief to keep their businesses afloat.

3 min read

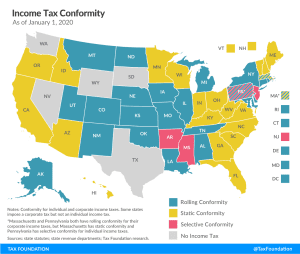

If states fail to update their income tax conformity, they will wind up taxing the federal lifeline to small businesses in the CARES Act: the Paycheck Protection Program (PPP) loans.

3 min read

Some policymakers are proposing a payroll tax holiday for businesses and individuals for 2020 and a complete delay in filing deadlines for tax year 2019 and 2020 to April 2021. What are the pros and cons of doing so?

4 min read

The small business provisions in the CARES Act support small businesses and nonprofits seeking economic relief during this downturn. However, creating multiple programs with overlapping purposes and differing qualification requirements makes relief more complicated, vague, and not neutral.

6 min read