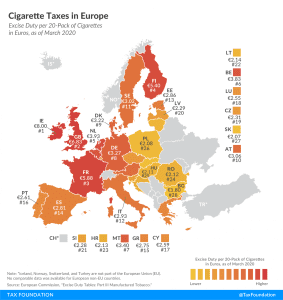

Cigarette Taxes in Europe, 2020

Ireland and the United Kingdom levy the highest excise duties on cigarettes in the European Union (EU), at €8.00 ($8.95) and €6.83 ($7.64) per 20-cigarette pack, respectively. This compares to an EU average of €3.22 ($3.61). Bulgaria (€1.80 or $2.01) and Slovakia (€2.07 or $2.32) levy the lowest excise duties.

3 min read